Are central bankers really in control of inflation?

Simon Turner

Thu 24 Aug 2023 7 minutesWhen US Fed chairman Jerome Powell admitted last year, ‘We now understand better how little we understand about inflation,’ it confirmed what many investors suspected… inflation is a more complex beast than most people, including central bankers, realise.

The confession raises an important question after such an aggressive rate raising cycle which hasn’t tamed inflation as intended… If the (previous) Fed Chairman doesn’t understand inflation with the help of over four hundred PhD qualified economists, how can we expect the world's central bankers to control inflation?

Central bankers’ one and only job

It’s long been accepted that governments pass responsibilities related to inflation (and unemployment) management onto their central bankers. The economic theory behind this strategy is that an independent and qualified central bank is better positioned to manage the complexities of inflation than a policy-driven government.

However, the reality is central banks effectively have one, and only one, tool in their toolbox to deal with inflation… interest rates.

So, we’ve been faced with a one-dimensional playbook for decades.

The world’s central bankers raise rates when inflation is high—and vice versa. That’s it.

Of course, they use lots of words to justify their actions and their role in system, but essentially central bankers move rates when inflation dictates they do. Then they hope for the best.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The curious relationship between interest rates and unemployment

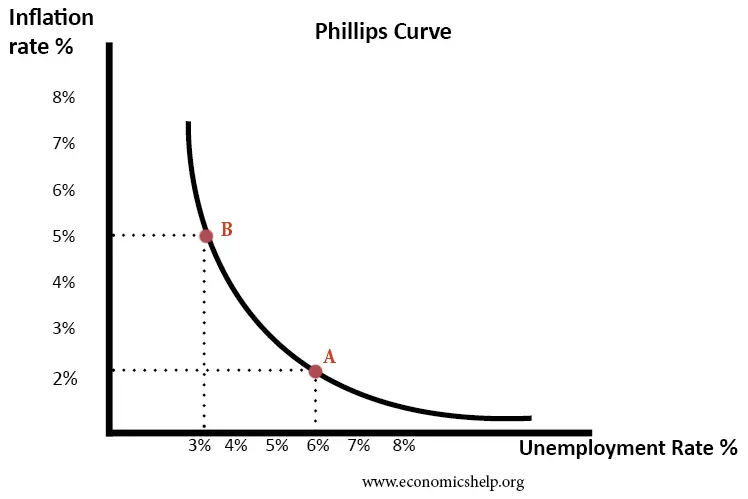

At the heart of central bankers’ belief in the power of interest rates to tame inflation is their insistence that the Phillips Curve works in the real world as opposed to within economic textbooks. As shown below, the Phillips Curve suggests there’s an inverse relationship between inflation and unemployment.

The reason central bankers are so wed to this theory is their underlying belief that workers tend to leverage their bargaining power by asking for higher wages when unemployment is low, which leads to higher inflation—and vice versa.

However, you’d think long-held economic theories would be updated to reflect modern economic realities, wouldn’t you?

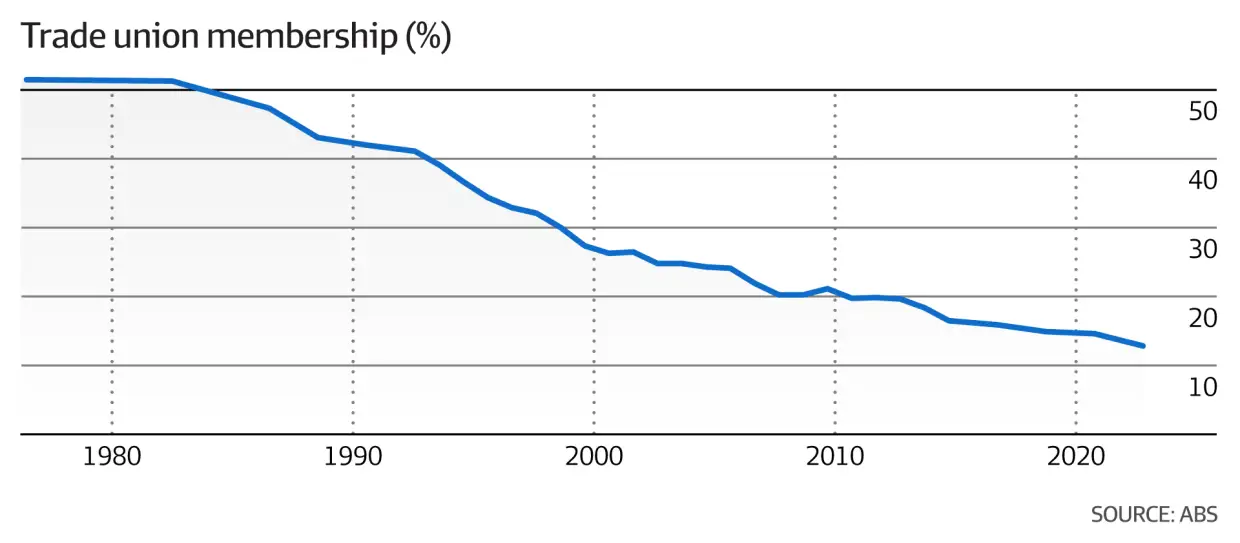

Looking backward, the Phillips Curve generally worked when unions negotiated wage increases for vast swathes of the Australian workforce.

But with only 12.5% of Australian workers currently belonging to a trade union, the potential for widespread reactive wage inflation has significantly dissipated. As shown in chart below, in the 1980s over 50% of the Australian workforce belonged to a trade union, so there’s been a drop of over 75% over the past four decades.

Recent wage inflation numbers confirm this shifting backdrop has had a significant impact.

Australian wage inflation has remained below CPI for nine consecutive quarters which means real earnings have been consistently declining in the face of a high CPI rate (6% in the June quarter). This real-world outcome is in direct contrast to the economic theory espoused by the RBA and the world’s central bankers in general.

And this is not a one-off deviation from a theory which generally works. Quay Global Investors analysed the US unemployment rate versus the US inflation rate between 1985 and 2022 and found there was no meaningful relationship between the two variables. Case closed.

So why do the Fed, the RBA, and other central banks continue to inundate their communications with references to the unemployment rate and the ongoing risk to inflation posed by the infamous price-wage spiral they believe is lurking in the background?

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Central bankers are ignoring the elephant in the room

The sceptic would highlight that central bankers’ self-interests are best defended if they continue to focus on the theories which have historically justified their presence and their effectiveness.

The same sceptic may highlight that like a magician distracting the audience from the magic trick, if central bankers keep showing the market enough data and charts which suggest their old economic theories still have a role to play in the modern world, they may succeed in making people believe they are indeed pulling the inflationary strings.

If this is indeed the case, the elephant in the room is likely to remain an inconvenient truth which remains unaddressed.

Where inflation really comes from

With central bankers’ fixation upon workers being responsible for driving up inflation being proved invalid, the question remains… what is driving high inflation at a global level?

Recent OECD research confirms what many other studies have shown…corporate profiteering is responsible for elevated inflation levels.

The term ‘escuseflation’ has emerged to describe how the corporate world has justified higher prices in recent years as an apparent strategy to pass on rising costs to consumers. Despite these excuses, there’s no hiding the fact that corporate margins keep rising. In fact, US corporate margins hit a 70-year high last year.

So, the answer to what’s driving inflation up isn’t the mystery you’d think it was given central bankers never mention the real culprit in their communications.

What it means for investors

Once you’ve understood that central bankers may be basing their monetary policy decisions on outdated economic theories for largely self-interested reasons, you have context for the range of scenarios which could play out from here.

The first point to accept is that central bankers aren’t directly controlling inflation because their toolbox doesn’t allow them to. But that won’t stop them from using their tools and claiming success along the way because they want to continue to play the role governments and markets expect of them.

The obvious implication is that inflation may run rampant at some point despite central bank action to contain it.

If that does happen, central bankers will face a difficult decision. They can go all-in and raise interest rates much higher despite the dire economic implications that’s likely to catalyse. Or, at some point, they can admit defeat and start cutting interest rates despite ongoing high inflation. To do so would be an implicit acknowledgement that their theories, assumptions, and goals were misguided.

Which path central bankers pick is likely to be determined by how they weigh up their self-interests versus the global and local economic outlook.

Having said that, the best magicians are able to distract their audiences from pretty much anything, so the world’s central bankers may attempt to argue their way into cutting interest rates without losing face in financial markets—difficult as that would be.

The key point for investors to understand is that both scenarios imply elevated risk from a market perspective.

A challenging outlook for central bankers

The world’s central bankers face growing challenges in the coming months and years. Unless inflation miraculously responds to their interest rate increases and remains low longer term, some hard truths may be revealed to financial markets.

Investors who are aware of the challenges central bankers face are likely to be least surprised by and most prepared for what’s coming next.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.