The inverted yield dilemma

Simon Turner

Thu 17 Aug 2023 5 minutesYou may have heard the classic joke about economists… Economists were created to make weather forecasters and astrologers feel better about the accuracy of their predictions.

US economists have certainly lived up to this stereotype of late. There’s rarely been a period when economists have been more wrong-footed by a strengthening economy. Global financial markets bought into their impending US recession warnings which led to last year’s unwarranted global economic pessimism. As we all know, that pessimism has reversed this year with the US market climbing a wall of worry to a place of optimism, with the All Ords following in its footsteps.

But as US economists become more optimistic, it may well be time for global equity investors to be more cautious. There’s one particular warning sign which is flashing red all investors should be aware of.

Surprise! The US economy is doing much better than expected

If you’re a US economist, please close your eyes. The chart below may cause offense.

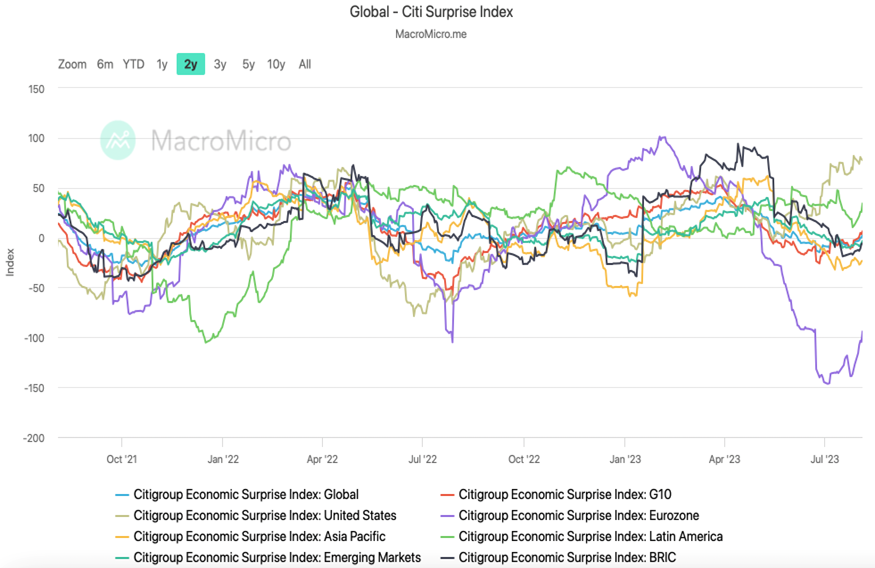

It’s Citi Economic Surprise Index and it shows the sum of the difference between US economic results and forecasts. Numbers over zero represent positive surprises and vice versa.

The current reading of 80 is extraordinary on many levels, not least of which is that this has occurred whilst the Fed has raised rates at the fastest pace in four decades. The vast majority of economists believed this rate rising cycle would lead to a weakening economy, but the US economy has proved far more resilient than most expected.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The global and Australian context

Economists haven’t as bad a job in most other regions of the world, apart from the Eurozone which has surprised to the downside even more than the US has surprised to the upside (as shown below).

Whilst the Citi Surprise Index is a regional index, the Asian Pacific line (yellow) partially reflects the Australian position thanks to our dependence upon the dominant Chinese economy. Whilst the Asian Pacific positive economic surprise momentum had been building up until May, since then there’s been a gradual fade into negative surprise territory.

The inverted yield dilemma

The question equity investors all around the world may be asking at this point is…given the recent strength in the US economy, can we trust the global economy not to disappoint?

The short answer is probably not despite how bullish US economists have become of late.

The reason is US yields are inverted—and Australia recently followed suit with the yield curve inverting in June for the first time since the GFC. Inverted yields occur when short term interest rates are higher than long term yields which causes the yield curve to slope downward.

The problem with inverted yields is that they’re relatively rare occurrences which run counter to the natural state of affairs in a healthy economy. This naturally upward sloping yield curve is based on the notion there’s more economic uncertainty looking out 10 years than 1 year, so bond investors should be compensated for future uncertainties in the form of higher yields.

So when yields are inverted, like now, that’s effectively the financial markets expressing extreme concern about future economic growth.

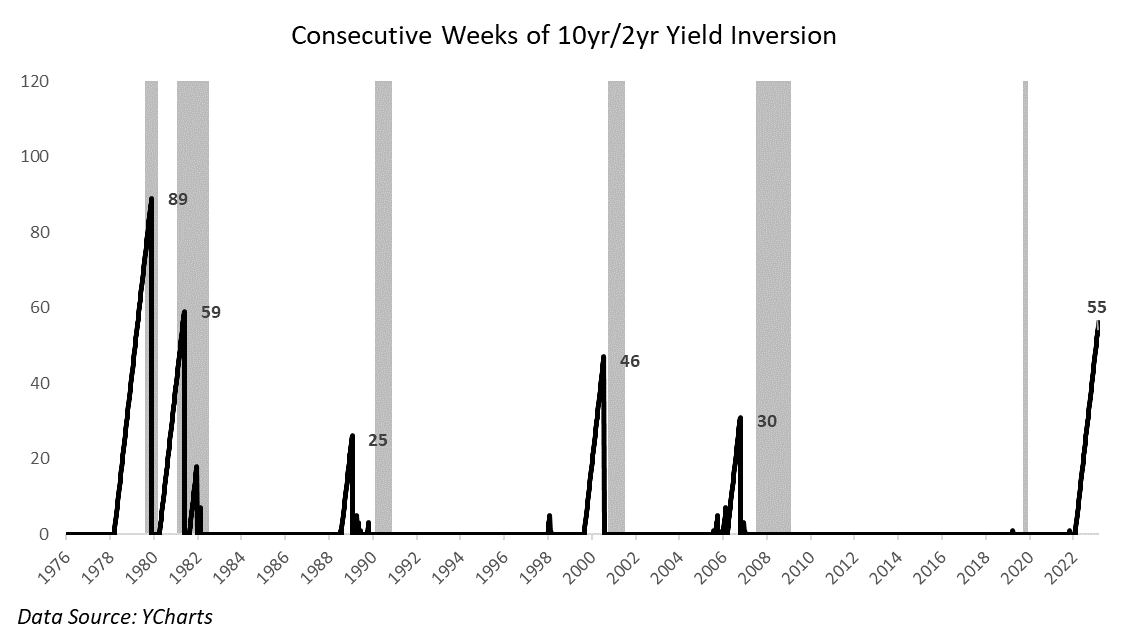

What’s most concerning is how reliable inverted yields are at predicting recessions. Check out the chart (using US data) below.

It won’t have escaped your notice that each of the previous periods of yield inversion occurred just ahead of recessions, including prior to the GFC in 2008. In fact, as a prediction tool, inverted yields have a perfect track record of predicting recessions.

So inverted yields are one of those ignore-it-at-your-peril types of indicators—and right now they’re flashing red.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What to do in the face of inverted yields

As with most investment advice, not panicking is a good starting point.

Navigating the inverted yield market backdrop is all about risk management rather than reacting to one particular economic outcome. After all, the world’s leading investors don’t tend to think about economic scenarios in binary terms. They make their plans based upon probabilities.

With the benefit of this mind-set, the inverted yield curves in the US and Australia are simply highlighting to us that global economic risk is elevated right now.

That doesn’t mean you should be selling everything you own based on this one indicator. But it does mean it may be prudent to ensure your portfolio is ready to navigate more volatile economic waters.

The answer of how to best to achieve this will be different for everyone, but if you’re fully invested in equities it may be wise to reduce your equity exposure in favour of cash or other defensive asset classes.

Invert market risks on their head by being ready for all scenarios

Jokes aside, making economic predictions is one of the toughest jobs in the world. There are so many moving parts at play and whilst history tends to rhyme, it rarely repeats.

That’s why paying attention to the inverted yield curve is so useful. In direct contrast with the patchy track record of most economists, the inverted yield curve has always been right about predicting recessions in the past.

One thing’s for sure…successful investors will be ready for the inverted yield curve being right again whilst hoping it’s wrong this time.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.