Understanding the capital stack prior to investing in a high yield property fund

Joe Christie

Fri 26 Jul 2024 5 minutesInvesting in high yield property funds can be an attractive proposition, with promises of high returns frequently exceeding 14% per annum.

Prior to make an investment, investors should ensure:

1.they are aware of all the risks and 2.they are being adequately compensated for the risks involved.

In many cases, investors find themselves short-changed on their returns and exposed to greater risk than they anticipated.

One key factor contributing to this issue is a misunderstanding of the capital stack and where their investment sits within it.

Understanding the Capital Stack

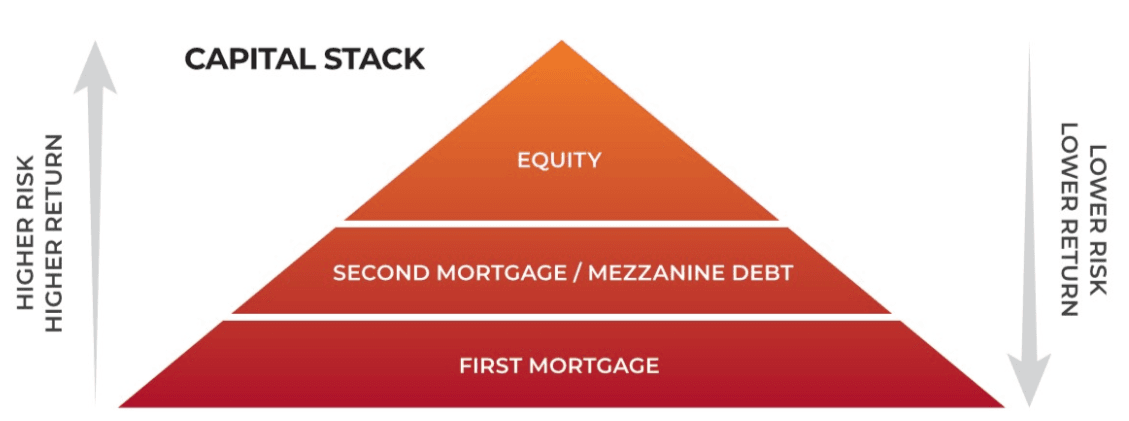

The capital stack is a term used to describe the hierarchy of financial claims or layers of capital that typically fund a property-based project.

Understanding the capital stack is important as it helps assess the risk and potential return associated with a position in the stack.

The capital stack is typically divided into the following layers:

First Mortgage:

Position: First ranking priority in the capital stack.

Security: Secured via a first mortgage on the underlying property security.

Risk: Lowest risk, as these investors are the first to be repaid in case of liquidation.

Return: Typically offers the lowest returns due to the lower risk.

Second Mortgage:

Position: Second ranking priority in the capital stack after first mortgage holders.

Security: Secured via a second mortgage on the underlying property security.

Risk: Higher risk than first mortgage, as these investors are repaid only after the first mortgage has been fully repaid.

Return: Offers higher returns to compensate for the increased risk.

Equity

Position: Third or last ranking priority in the capital stack after both first and second mortgage holders

Security: Not secured by any mortgage; purely dependent on the commercial success of the property project.

Risk: Highest risk, as these investors are the last to be repaid after both first and second mortgage holders have been repaid in full.

Return: Potentially the highest returns, reflecting the high risk and the success of the project.

Key Takeaways to Understanding the Capital Stack

Priority of Payments: First Mortgage gets paid first, Second Mortgage get paid second and Equity gets paid third in the event of liquidation or sale of the property.

Risk and Return: There is an inverse relationship between risk and return. Higher priority positions in the stack offer lower returns and lower risk, while lower priority positions (Equity) offer higher returns and higher risk.

Security: First Mortgage secured by a first mortgage, offers more protection to the investor. As one moves up the stack, the security diminishes, and the investment relies more on the success of the project.

Understanding where an investment sits within the capital stack helps investors align their risk tolerance with their investment goals and make more informed decisions.

How to Determine Position in the Capital Stack

Debt investments, particularly in property developments, are generally secured against the underlying property via a first mortgage. Equity investments, particularly in property developments, are investments in the commercial outcome of the project and are akin to being an owner of the project. For example:

If an investment is secured by a first mortgage, it should clearly state this fact.

If an investment does not clearly state it is secured by a first mortgage, then it is likely either a second or third ranking security.

If a portion of an investment return is dependent on the outcome of the project, then it is likely either a second or third ranking security.

Matching Position in the Capital Stack with Risk

Generally, property development opportunities will be secured via a first mortgage debt facility. If an investment does not clearly state it is secured via a first mortgage, then it is likely either a Second Mortgage or Equity investment. Second Mortgage and Equity investments contain higher risk than First Mortgage investments and, consequently, should provide a higher return.

Equity investments, particularly in property developments, are dependent upon the commercial outcome of the project and are akin to being an owner of the project. If a portion of an investment return is dependent upon the commercial outcome of the project, then the investment is starting to look like equity, and the investor needs to be satisfied that they are receiving a commensurate equity-like return.

Conclusion

In summary, there is nothing wrong with a good high yield property fund investment. However, it is crucial for investors to thoroughly examine the details and ensure they are not taking on more risk than they are comfortable with.

By understanding the capital stack and clearly identifying where an investment sits within it, investors can better align their risk tolerance with their investment goals. This diligence will help ensure that investments are not only lucrative but also secure.

Past performance is not a reliable indicator of future returns. Financial returns depend upon the performance of the underlying investments. The information provided in this document/seminar is general in nature and does not constitute investment advice or personal financial product advice. The content of this document/seminar does not constitute an offer or solicitation to subscribe for units or an offer to buy or sell any financial product. You should obtain and carefully consider the relevant offer documents before deciding to invest into any Fund offered by Capital Property Funds. Capital Property Funds Pty Ltd (ACN: 162 323 506) is a Corporate Authorised Representative No 457306 for General Advice only of Sequoia Wealth Management Pty Ltd (AFSL No: 472387).