Bond Markets Are Celebrating the Death of TINA

Simon Turner

Mon 1 Sep 2025 6 minutesGlobal bond markets are far from boring in 2025. The death of the ‘TINA’ era (‘There is No Alternative’ to Equities) is resulting in surging bond demand from institutional and superannuation investors, while the supply of primary local issuance is under strain.

Add into the mix falling yields, rising geopolitical risks, and the ‘flight to safety’ mentality that’s increasingly taking hold, and bond investors face a complex landscape…

An Undersupplied Local Bond Market

In Australia, the bond market has matured considerably over recent decades. In the first half of 2025, investment-grade domestic issuance soared to $271 billion, up 156% from 2019, reflecting robust demand growth.

At the same time, supply is lagging. BlackRock notes that local bond supply remains 17% below its five-year average.

The upshot is upward pressure on bond prices and downward pressure on yields. Expectations of one more RBA rate cut by the end of the year are reinforcing this dynamic.

A Booming Global Bond Market

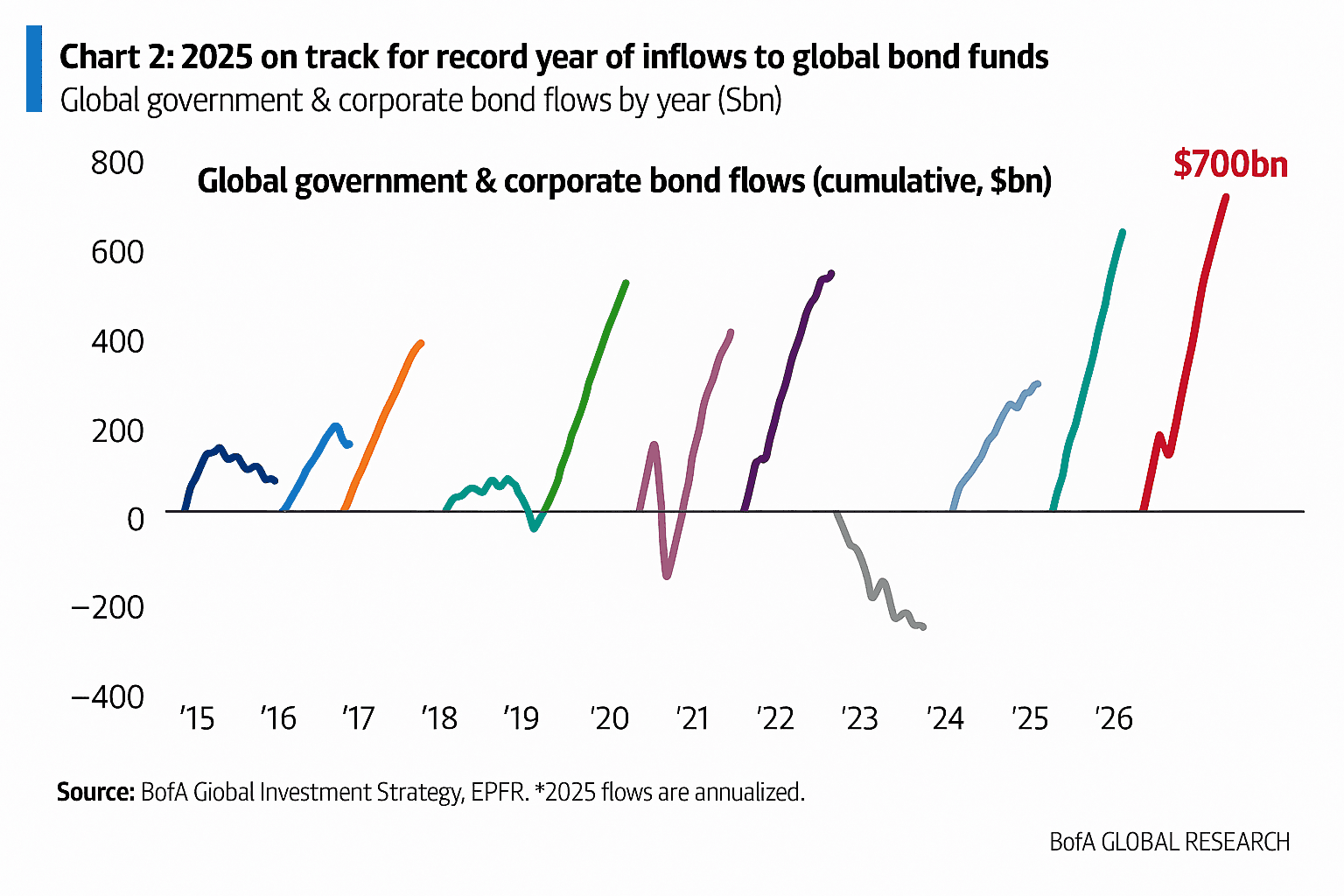

Global bond markets are in a similar boat with strong inflows this year.

In fact, the numbers have been historic.

Investors invested a record $US97 billion into global government and corporate bond funds over the last four weeks. Global government and corporate bond funds are set to attract $US700 billion in net inflows this year, an all-time high, and materially surpassing the previous record of $US620 billion. Similar inflows have only been witnessed during the 2020 pandemic recovery.

The fact that these historic inflows are occurring whilst long-term U.S. Treasury yields have climbed reflecting structural concerns over US Government fiscal deficits is instructive.

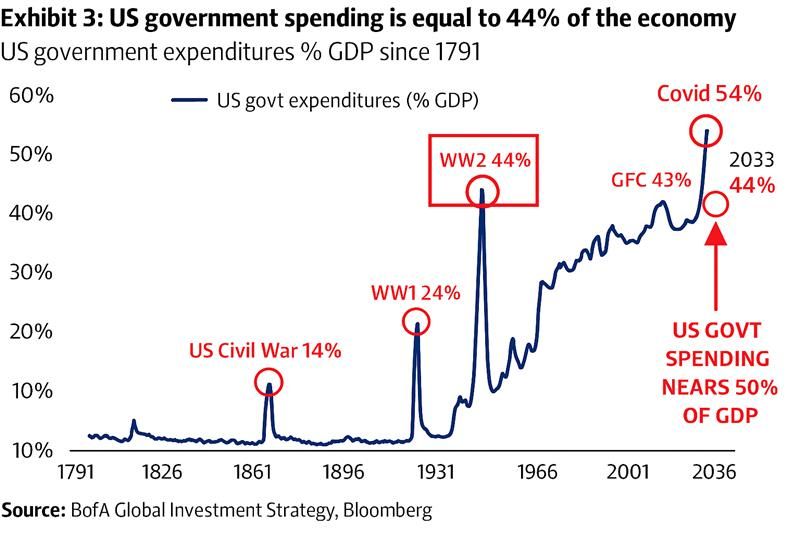

With US Federal debt growing at $US21 billion each day driven by unrestrained government spending, the sustainability of US Government finances has rarely been more questionable.

The implication is clear: for now, investor unease over Republican fiscal policies has been more than offset by the sheer weight of money looking for a home. Whether this continues is anyone’s guess, but at this stage liquidity is trumping fundamentals.

Similarly, across emerging markets, falling risk premiums are the name of the game this year. In the first seven months of 2025, emerging market corporates outside of China raised at least $US250 billion in international bond markets, paving the way for a full-year total north of $US370 billion.

The takeaway for investors is that when markets expect rate cuts and declining premiums, borrowing conditions open up despite escalating geopolitical tensions and tariff threats.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Normal Service Has Resumed

The global bond market is well-known for its more conservative and grounded perspective, which is at odds with the speculative frenzy driving the tech sector of equity markets to historic highs in recent months.

Societe Generale’s Albert Edwards thinks bond investors are right to be more cautious than their more emotional equity market peers. He recently warned that rising long-term US Treasury yields and the flattening of yield curves confirm that the ‘TINA’ era (‘There Is No Alternative’ to Equities) has indeed ended.

Furthermore, the IMF recently cautioned about the high level of leverage in U.S. equity markets as they believe rising yields could trigger destabilising margin calls and forced selling.

In short, global bonds have been reasserting their role as a reliable source of income, reminding investors that fixed income still warrants a place in most well-balanced portfolios.

J.P. Morgan concur: ‘the fixed income reset is largely complete, with global bonds once again behaving like they should within portfolios.

Five Money-Making Strategies for Bond Investors

Against this evolving bond market backdrop, have are five strategies to help optimise your returns while managing your risk:

1. Focus on Quality & Resilience.

Whilst most global bond markets have benefitted from record inflows in recent months, focusing on quality is likely to be prudent during future bouts of volatility when you’re hoping your bond allocation behaves defensively.

In particular, higher quality government and corporate bonds are more likely to provide stability during periods of global uncertainty.

👉 Key takeaway: Investing in bond funds and ETFs with a quality tilt is likely to help ensure your bond exposure remains resilient over the longer term.

2. Capitalise on Scarce Local Supply.

With domestic issuance set to remain constrained in the foreseeable future, Australian government and higher quality corporate bonds are likely to maintain tight yields in the secondary market.

👉 Key takeaway: Focusing on bonds in scarce supply, or bond funds which are investing in these types of deals, could provide profitable secondary market opportunities.

3. Diversify Globally Thoughtfully.

Emerging market bond issuance and select global government bonds may offer worthy yield-enhancing opportunities, but they always require credit and geopolitical vigilance.

👉 Key takeaway: Whilst global bond diversification often improves risk-adjusted returns, it’s important to diversify thoughtfully. One of the easiest ways to do this is to invest in a global bond fund or ETF which provides immediate diversification.

4. Monitor US Fiscal Policy & Political Risk.

The U.S. Treasury’s financial position is arguably the biggest risk to global bond markets right now. This is a big deal for investors because:

a) In an efficient market, rising risk should translate into higher yields; and

b) Most global bond markets are priced off the US Treasury Note yield.

👉 Key takeaway: Paying close attention to U.S. Republican-driven spending and debt developments has become more important for bond investors.

5. Use Bonds for Ballast, not just Yield.

In volatile markets, bond markets’ defensive characteristics in the form of stable income, liquidity, and capital preservation often justify an allocation within balanced portfolios. However, it’s important to understand that pursuing higher yields may offset how defensive a bond allocation is during future market selloffs.

👉 Key takeaway: If defensiveness is one of the main objectives for your bond allocation, make sure you don’t purely focus on yield. It’s the same with bond funds and ETFs. By sacrificing some of your shorter term income return, more of your capital is likely to be preserved during periods of volatility.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Navigating an Unusually Dynamic Bond Market

Global bond markets are currently defined by an imbalance between sky-high demand and constrained issuance. This undersupply is likely to remain a dominant theme looking forward. At the same time, rising US government debt levels and their knock-on effects remain sizeable risks which may affect bond markets in the coming years.

For informed investors, the opportunity lies in navigating these dynamics with appropriate foresight and readiness for future volatility.

Bond Funds Worth Checking Out

Click to watch IAM's episode of our Insights Series Podcast

Bond ETFs Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.