What’s behind the recent rush into corporate bonds?

Simon Turner

Wed 27 Mar 2024 5 minutesCorporate bonds are once again popular with Australian and global investors alike. With markets expecting the RBA and the Fed to start cutting rates in the coming months, investors have been increasing their corporate bond exposure to lock in the highest yields available in recent years. We investigate whether or not this is a wise strategy below.

Banking on higher yields

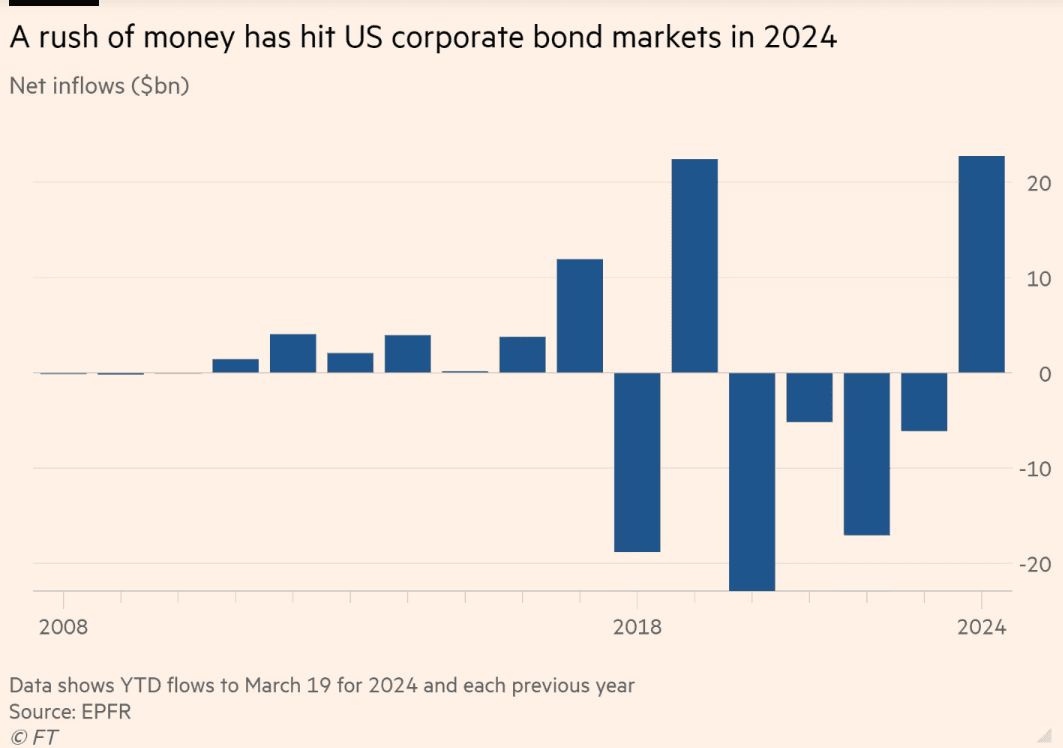

The strong inflows into the global corporate bond sector so far this year ends four painful years of outflows for the asset class. The impressive year-to-date US corporate bond flow data is shown below.

These corporate bond inflows are coming from retail and institutional investor alike, and are being driven by a desire to secure current yields ahead of expected rate cuts by central banks. It’s the perceived scarcity of current yields that’s been inspiring so much enthusiasm amongst investors. According to Andrzej Skiba, head of fixed income at RBC GAM, “investors are afraid to miss the opportunity to lock in these yields.”

In short, the recent surge in corporate bonds inflows has been driven by FOMO in all its glory.

Yield spreads have compressed

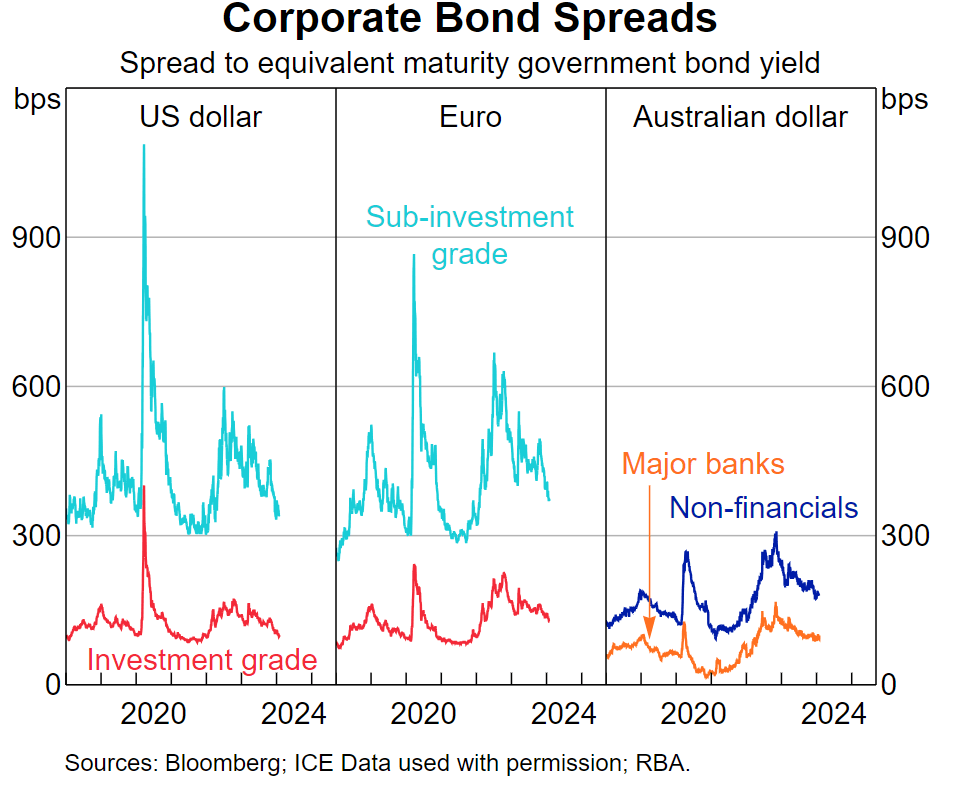

As tends to be the case during periods of corporate bond inflows like this, yield spreads between the RBA’s and the Fed’s cash rates and corporate bond yields in their respective countries have compressed in recent months.

Investment grade bonds have been particularly popular of late which has put pressure on their yields. For example, average yields on US investment grade debt have fallen from a 2023 high of 6.4% to 5.4%. Bond spreads have fallen as a result. According to Ice BofA, the US investment grade bond spread has fallen to 0.9%.

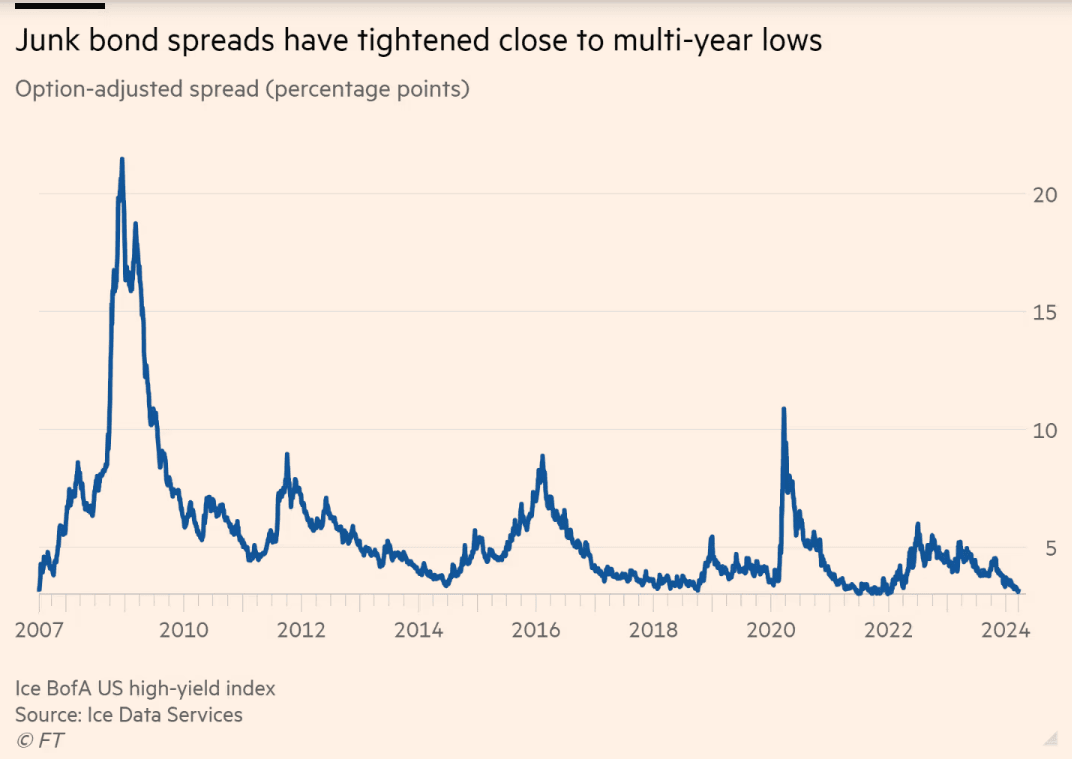

It’s a similar story with US junk debt with spreads at multi-year lows:

Corporate bond spreads have also fallen in Australia, although not to the same extent as in the US:

Borrowers making hay while the sun shines

It’s not just investors who are more focused on the corporate bond market this year. Corporate borrowers are also more active.

According to LSEG, investment grade corporates have issued a massive $US561 billion in bonds so far in 2024. To put that number into context, that’s the largest volume of corporate bond issuance since way back in 1990. Despite the size of the recent bond issuance, investors have been mopping it up while still pushing yields lower.

It’s fair to say this is an extreme situation which suggests that either corporates or investors will be proven prudent with the benefit of hindsight, but not both.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Investors blasé about risk?

Some investors believe that recent corporate bond inflows and the subsequent yield compression exposes the corporate bond sector to potential disappointments by central banks. If the RBA and the Fed don’t deliver the rate cuts bond markets have priced in, there’s likely to be a lot of disappointed corporate bond investors, some of whom are likely to run for the exits.

Another way to look at the current situation is that for corporate bonds to outperform from here, a few key things have to go right. Namely, the Fed and the RBA need to deliver the rate cuts markets have priced in, inflation needs to remain under control, and the global and Australian economies need to achieve a soft landing.

Markets certainly seem to believe that these scenarios are likely.

Others disagree. According to Christian Hansel, portfolio manager at Vontobel, the inadequate pricing of risk is a growing concern across the corporate bond world: “The risk premium of certain credits is not adequately priced anymore.”

Corporate bonds back in the game for now

The rush to secure attractive yields has led to an unusually strong surge in demand for corporate bonds year to date. It’s great news for bond issuers and bond fund managers after a difficult few years.

All being well, the corporate bond sector may be positioned to deliver on investors’ bullish expectations. However, that depends upon the RBA and the Fed cutting rates as markets expect, inflation remaining under control, and the Australian and global economies achieving a soft landing.

If you believe those scenarios are likely, then corporate bonds are likely to outperform throughout 2024. However, if you believe those scenarios are unlikely, a degree of caution may be warranted with spreads at such low levels.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.