Will the ‘Magnificent Seven’ keep their edge?

Ankita Rai

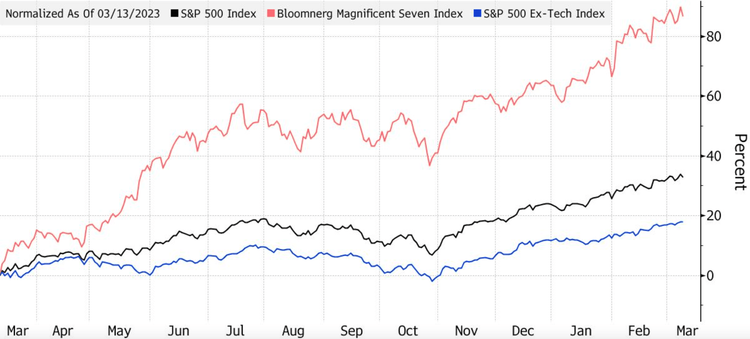

Thu 21 Mar 2024 6 minutesA year has passed since generative AI took the investment world by storm. The cohort of tech giants dubbed the Magnificent Seven led global equity markets higher in 2023, returning a staggering 107% and significantly outperforming the S&P 500’s 24% gain, as shown below.

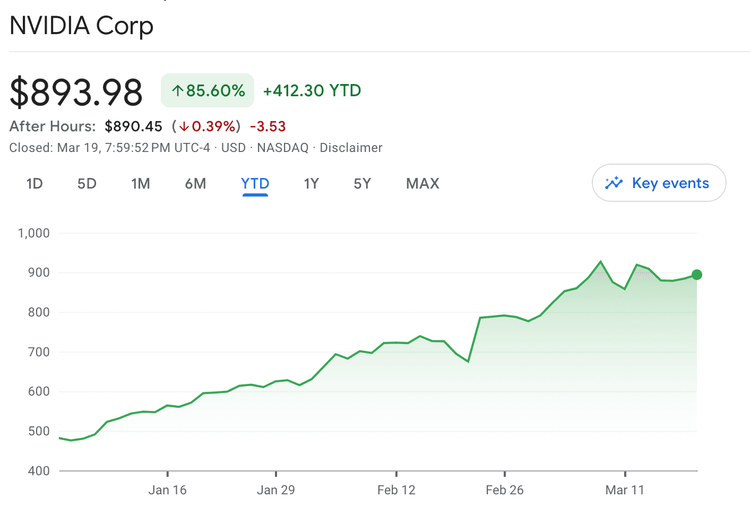

With around 30% of the S&P 500 index now held by these companies, the market seems to be viewing their superiority as beyond doubt. In fact, propelled by the surge in artificial intelligence and Nvidia's continued ascent, the S&P 500 reached another record high last week. Nvidia now constitutes 5% of the index.

However, recent earnings indications suggest a divergence in performance among the Magnificent Seven. While Nvidia, Meta, Amazon and Microsoft have maintained their dominance year-to-date, Apple, Tesla, and Alphabet have started to lag behind.

Big tech weaklings

While excitement over AI fuelled the big tech rally last year, 2024 is proving to be a more sobering market environment for some. Rising AI costs and persistent cost inflation have brought reality to the fore.

Consider Tesla, for example. While the rest of the Mag7 cohort is expected to benefit from AI-powered tailwinds, the decline in demand for electric vehicles (EVs) is hurting Tesla. It has become a "growth company with no growth," as noted by Wells Fargo analyst Colin Langan.

A big part of Tesla’s trouble is lower than expected EV demand. Add to that stiff competition in China, aggressive price cuts, and investments in cheaper new models, and the company has been facing margin pressure which has impacted profitability. The stock is down more than 34% year to date.

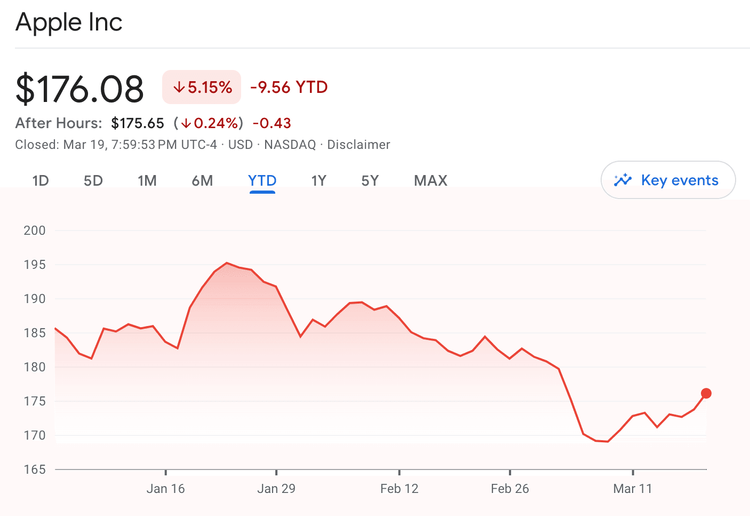

Apple stands out as another Magnificent 7 member at the back of the pack this year, as it has fallen behind in incorporating generative AI within its products.

Despite its pivot from electric cars to AI, the stock hasn't experienced the anticipated growth, as there have been no updates on its planned AI projects.

Additionally, iPhone sales have remained sluggish due to weak demand and tough competition in China, and Samsung launching AI-enabled smartphones.

These issues have led to a 12% slump in the stock this year, pushing its market value below that of Microsoft.

Tech giant Alphabet, Google's parent company, also faces the danger of falling behind after multiple setbacks with its AI initiatives.

It posted its fourth consecutive decline in profit in the December quarter as digital advertising slowed amid rising interest rates and inflation. Its cloud business also failed to grow as expected, putting it at risk of falling further behind Microsoft's Azure and Amazon’s AWS.

MAGNIFICENT 4: Leading the AI charge

Clearly, there is a shift occurring in the Mag 7 group, with the leadership becoming concentrated in four stocks—Meta Platforms, Microsoft, Nvidia, and Amazon—all of which are leading on the AI front.

Together, these four stocks have driven more than half of the S&P 500’s total return for the year thus far according to S&P Dow Jones Indexes.

Nvidia is the top performer among the magnificent four stocks, with a scorching return of 85% year-to-date. It is the first chipmaker to have a market capitalisation of more than $US2 trillion and trails behind Microsoft and Apple in market value.

Its line-up of AI accelerator chips has not only led to blockbuster earnings but also extended its AI dominance. Nvidia's success is closely related to cloud computing giants Amazon and Microsoft, which are its key consumers.

Both Amazon and Microsoft have experienced strong growth in the cloud, driven by the introduction of new AI features.

Amazon's earnings in the fourth quarter were propelled by both its cloud services unit and e-commerce businesses, thanks to the introduction of new AI features. It achieved a record cash flow of $36.8 billion in the quarter, propelled by cost-cutting measures and investments in generative AI.

Microsoft also posted its strongest revenue growth since 2022, spurred by demand for AI services that in turn are driving renewed spending on cloud computing. In fact, its robust cloud business led to a 33% surge in net profit in the December quarter.

Another top-performing stock of the group, Meta, saw its net income triple to $14 billion in the fourth quarter, driven by cost-cutting measures and AI-driven ad revenue growth. Meta announced the integration of artificial intelligence tools into its core products, such as advertising campaigns and AI chatbots.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Building new economic moats

The advancements in AI clearly have the potential to disrupt or weaken traditional competitive advantages.

For example, Apple's declining sales and lack of AI offerings, contrasted with competitors launching superior AI-enabled smartphones, indicating that AI-enabled features are increasingly becoming a key factor in purchasing decisions.

Similarly, Google's struggles with AI implementation suggest that even tech giants failing to adapt to the evolving AI landscape may face challenges in maintaining their competitive edge.

Moreover, the success of the Magnificent 4 in a challenging economic environment, characterized by high interest rates and inflation, has reinforced their strategy of building an economic moat through the adoption of AI.

Meta, Amazon, Microsoft, and Nvidia have led the way by implementing generative AI across business functions including digital advertising, e-commerce, cloud, and more.

Navigating AI disruptions

Given the rapidly evolving tech space, investors interested in the AI thematic may be well advised to focus on economic moats instead of just chasing stock market winners.

Companies with strong economic moats, like those with resilient brands, robust product offerings, ecosystem partnerships etc, are better equipped to navigate AI disruptions.

As the industry evolves, staying informed about market trends and technological advancements is key to making informed investment decisions.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What it means for investors

- The magnificent seven is experiencing varying fortunes in 2024 with Nvidia, Meta, Amazon, and Microsoft maintaining dominance, while Apple, Tesla, and Alphabet are lagging behind.

- Companies like Nvidia, Meta, Amazon, and Microsoft have leveraged AI to drive significant returns, with Nvidia particularly shining with an 85% year-to-date return, propelled by its leadership in AI chips.

- The success of the Magnificent 4 companies in a challenging economic environment has reinforced their strategy of building economic moats by widely implementing AI across their business functions.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.