Will these losing investment themes keep losing?

Simon Turner

Thu 20 Jun 2024 7 minutesWith inflation and interest rates remaining higher for longer, the implications for which investment themes have been outperforming and underperforming in recent months has been profound.

If you’re exposed to the weakest performing investment themes, it’s worth sense-checking your conviction levels to ensure you aren’t exposed to market segments which are positioned for longer term underperformance. So we delve into the weakest investment themes of the past three months below and ask the question: will these themes keep underperforming?

Losing investment themes

Using Betashare’s ETF performance data as a guide, the following investment themes have been the worst performers over the past three months.

1. Cloud computing -13.2%

What’s going on? Cloud computing has long been one of the fastest growing technology segments due to the fact that much of the world’s digital data and software applications are still maintained outside of the cloud. This is sub-optimal from a security and cost management perspective so the impetus for transitioning to the cloud is strong and growing. Despite a solid start to the year, the cloud investment thematic has suffered from a prolonged selloff reflecting the normalisation of growth rates from pandemic highs.

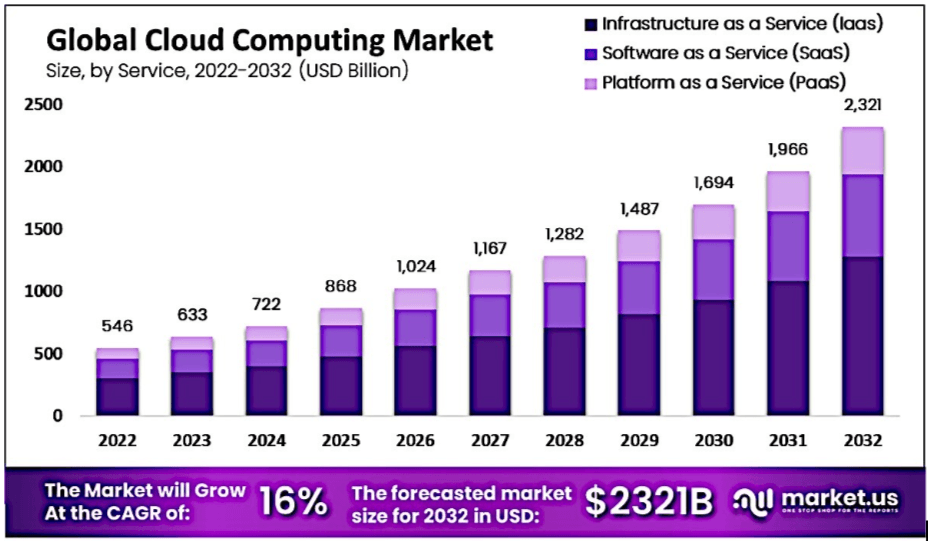

Will this theme keep losing? Probably not. Don’t write off the cloud just yet. Cloud-related revenues are expected to grow strongly as more companies pursue digital transformation through advancing technologies to keep up with their competitors. In 2024, global IT services revenues are expected to grow by 8.7% with a growing share going to the cloud. Market.us is projecting the cloud computing revenues will grow at 16% p.a. between 2023 and 2033. Leading cloud players such as Wix.com, C3.AI, and Digital Realty Trust are positioned to benefit.

Best ETFs to gain exposure: Betashares Cloud Computing ETF (ASX: CLDD), Global X Cloud Computing ETF (ASX: CLOU).

2. Global cybersecurity -9.3%

What’s going on? The global cybersecurity sector outperformed throughout the pandemic as digitalisation trends accelerated and security became a bigger focus for most organisations. Like the cloud, recent underperformance in the cybersecurity sector largely reflects the normalisation of growth rates from a higher base.

Will this theme keep losing? Probably not. Cybersecurity will become a more important issue for all organisations as the AI rollout gathers pace. It’s an issue that affects companies, governments, and individuals alike. As a result, investment into safeguarding all forms of digital data ranging from personal data to national security information is likely to continue growing strongly and indefinitely. Cybersecurity leaders such as Broadcom, Crowdstrike, Palo Alto Networks, Cisco Systems, and Infosys are positioned to benefit.

Best ETFs to gain exposure: Betashares Global Cybersecurity ETF (ASX: HACK), Global X Cybersecurity ETF (ASX: BUGG).

3. Future of payments – 5.8%

What’s going on? The future of payments has long been regarded as an investment theme which benefits from strong structural tailwinds. According to Custom Market Insights, the global mobile payments sector is expected to grow at 37.1% p.a. between 2022 and 2030 to reach a hefty market size of $US588 billion by 2030. In recognition of this significant opportunity, payments competition is intensifying. Previous market darling Paypal has suffered as a result, with rivals such as Stripe, Adyen, and Block threatening its global market share. It’s this increasingly competitive environment that largely explains why this investment theme has been underperforming in recent months.

Will this theme keep losing? Possibly, in the short term. Whilst the future of payments theme is well positioned for long term growth, the issues responsible for recent underperformance may continue for some time. Having said that, the growth opportunity is so significant that it’s likely a handful of companies will outperform in both the short and long term. Being selective in your exposure to this theme is likely to be prudent.

Best ETFs to gain exposure: Betashares Future of Payments ETF (ASX: IPAY).

4. Digital health and telemedicine -5.8%

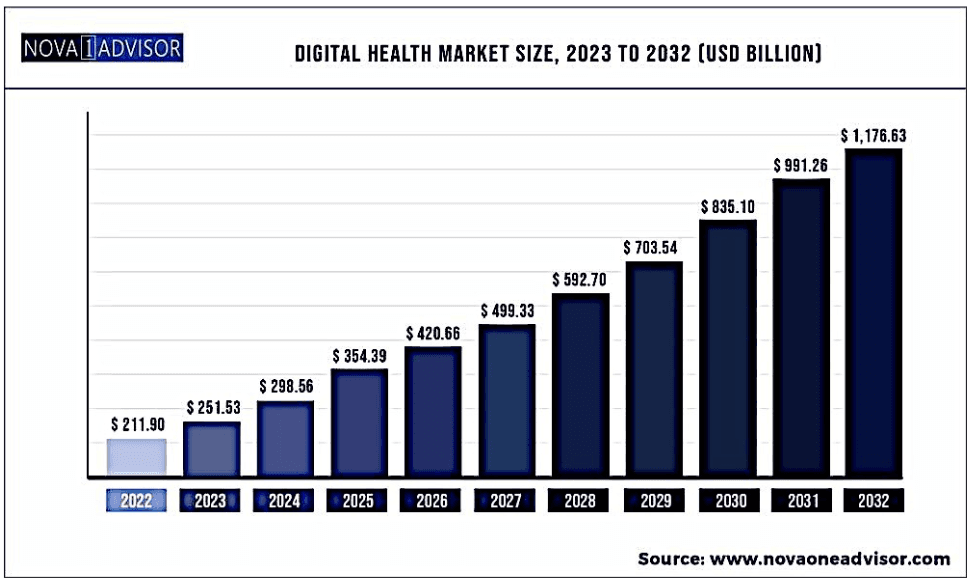

What’s going on? The investment case behind the digital health revolution is simple: healthcare spending is expected to rise as populations age and incomes rise, particularly in emerging markets. Within the healthcare sector, digital health solutions are expected to gain market share over traditional solutions largely due to the efficiency gains on offer. The global digital healthcare sector includes companies involved in telehealth, medical devices, wearables, remote patient monitoring, and digital healthcare software. The pandemic led to an acceleration of the digitalisation of the global healthcare sector and a major increase in growth rates for many leading players. But, for many of these businesses, the past year or so has seen a normalisation in growth rates from a higher base. Hence, the sector’s recent underperformance.

Will this theme keep losing? Possibly not. The long term investment case for digital health remains compelling. This is a long structural theme which is likely to reward long term investors. Grand View Research expect the sector to grow at 18.7% p.a. between 2023 and 2032. Digital health leaders such as Insulet Corp, Boston Scientific, Abbot Laboratories, Resmed, and Dexcom are positioned to benefit.

Best ETFs to gain exposure: Betashares Digital Health and Telemedicine ETF (ASX: EDOC).

5. Geared US Treasury bonds -5.6%

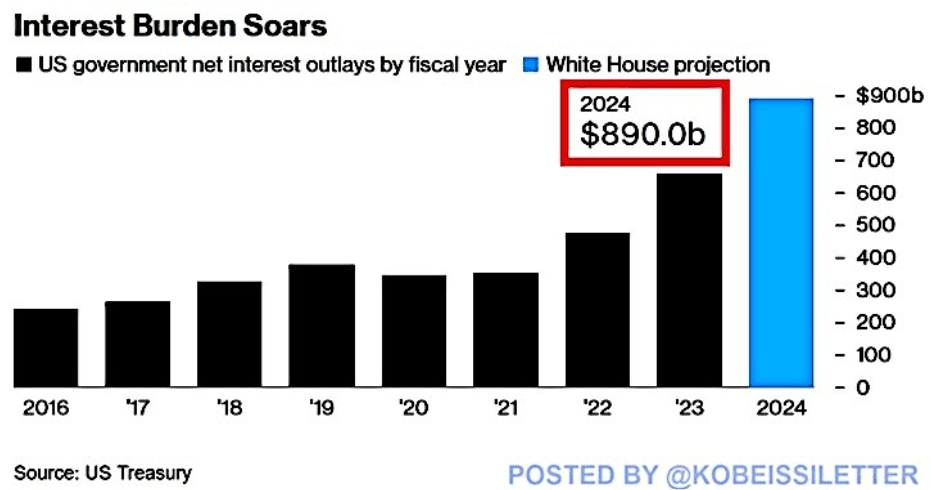

What’s going on? The US Treasury’s reliance on debt issuance has created an oversupply of its bonds for some time now. At the same time, demand for US Treasury bonds has suffered in the face of growing geopolitical risks and diversification away from US dollar denominated assets. At a more fundamental level, some investors believe the US Government’s risk profile is rising, largely due to the growing burden of its rising interest bill and its unrestrained spending habit. All these factors add up to potential ongoing headwinds against US Treasury bonds.

Will this theme keep winning? Possibly. The reasons for the recent underperformance of US Treasury bonds appear set to continue. And in the event that inflation has not been tamed and interest rates haven’t peaked, the challenges for this asset class are likely to escalate.

Best ETFs to gain exposure: Betashares Geared Long US Treasury Bond Fund (ASX: GGFD), Global X US Treasury Bond ETF (ASX: USTB)

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Opportunities and warnings

Profit-taking after post-pandemic strength in digitalisation-driven assets is a common theme amongst these underperforming investment themes, particularly in the cases of cloud computing, global cybersecurity, and digital health. This makes intuitive sense since these three sectors were amongst the strongest performers in the prior few years. With the structural growth drivers remaining as compelling as ever in these three market segments, recent weakness could well be creating opportunities for investors.

The future of payments theme also looks compelling longer term but the market is becoming more competitive so picking the right winners is likely to be more important. And recent weakness in US Treasury bonds may continue due to the longer term nature of the challenges in this market.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.