Will these winning investment themes keep winning?

Simon Turner

Tue 18 Jun 2024 6 minutesWith inflation and interest rates remaining higher for longer, the implications for which investment themes have been outperforming and underperforming in recent months has been profound.

If you’re exposed to the strongest performing investment themes, it’s worth sense-checking your conviction levels to ensure you’re exposed to market segments which are positioned for longer term outperformance. So we delve into the strongest investment themes of the past three months below and ask the question: will these themes keep outperforming?

Winning investment themes

Using Betashare’s ETF performance data as a guide, the following investment themes have been the best performers over the past three months.

1. Global Gold Miners (Currency Hedged) +34.6%

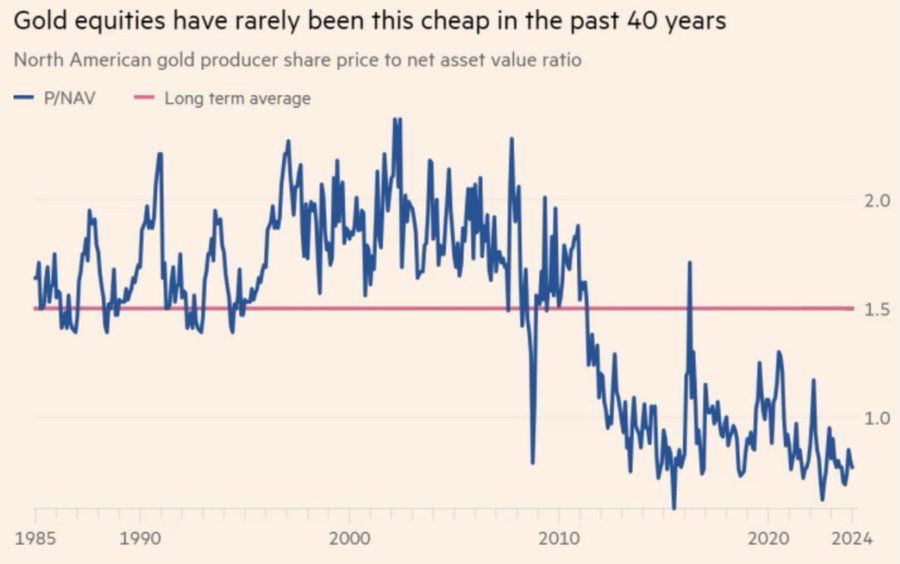

What’s going on? Gold miners are finally starting to outperform after a challenging few years. Global gold miners have tended to outperform gold during bull markets while they’ve generally underperformed during bear markets. While the sector was slower to wake up to gold’s emerging bull market this time around, arguably because of the market’s obsession with all things AI, the sector is starting to play catch up.

Will this theme keep winning? Probably. There’s still ample room for gold stocks to run with gold stocks remaining historically cheap versus gold, although it’s generally worth being aware of gold’s seasonal trading patterns with June being the weakest month of the year on average. Once the current period of weakness or consolidation is past us, most gold mining analysts are expecting the bull market to resume its course. So now may be a good time to ensure you’re positioned for the next potential leg of the rally.

Best ETFs to gain exposure: Betashares Global Gold Miners ETF – Currency Hedged (ASX: MNRS), VanEck Gold Miners ETF (ASX: GDX).

2. Energy Transition Metals +21.4%

What’s going on? The energy transition from fossil fuels to clean energy solutions is continuing to gather pace driven by corporate and government commitments and the associated business opportunities. The long list of metals required for renewable energy generation, battery storage solutions, and the electric vehicle rollout includes copper, lithium, nickel, cobalt, graphite, manganese, silver, and rare earth elements.

Will this theme keep winning? Probably. The long term bull case for energy transition metals has always been the growth in metals demand coupled with constrained global supply. The recent outperformance of energy transition stocks reflects the recovery in many of these commodity producers from oversold levels for the same reason. In addition, more investors have been buying commodity stocks in recent months due to their built-in inflation protection attributes. This dynamic is likely to continue for as long as inflation remains elevated.

Best ETFs to gain exposure: Betashares Energy Transition ETF (ASX: XMET), Macquarie Energy Transition ETF (ASX: PWER).

3. Gold Bullion (currency hedged) +14.8%

What’s going on? Central bankers have been loading up their gold reserves in recent months, particularly the Chinese, Indian, Turkish and Kazakhstani central banks. The main reason for their gold buying is to diversify their reserves away from their paper currencies while gaining liquidity from a ubiquitous asset without credit risk. At least, that’s the official explanation. It’s also likely that central bankers, like gold bugs, are watching global debt levels, particularly US Government debt, with a growing awareness that it’s unlikely to be repaid unless more money is printed. That would further stoke inflation while creating an effective a race to the bottom for many leading currencies. In that context, owning gold is a compelling strategy to protect and stabilize wealth.

Will this theme keep winning? Probably. The world’s central bankers may well be onto something. If the wider investment community follow their lead, gold’s recent outperformance could be the beginning of a longer term trend. Gold’s seasonal trading patterns show June is the weakest month of the year on average. Once the current period of weakness or consolidation is past us, many gold analysts are expecting the bull market to resume its course. So now could be an ideal time to get positioned for the next potential leg upwards.

Best ETFs to gain exposure: Betashares Gold Bullion ETF (ASX: QAU), VanEck Gold Bullion ETF (ASX: NUGG).

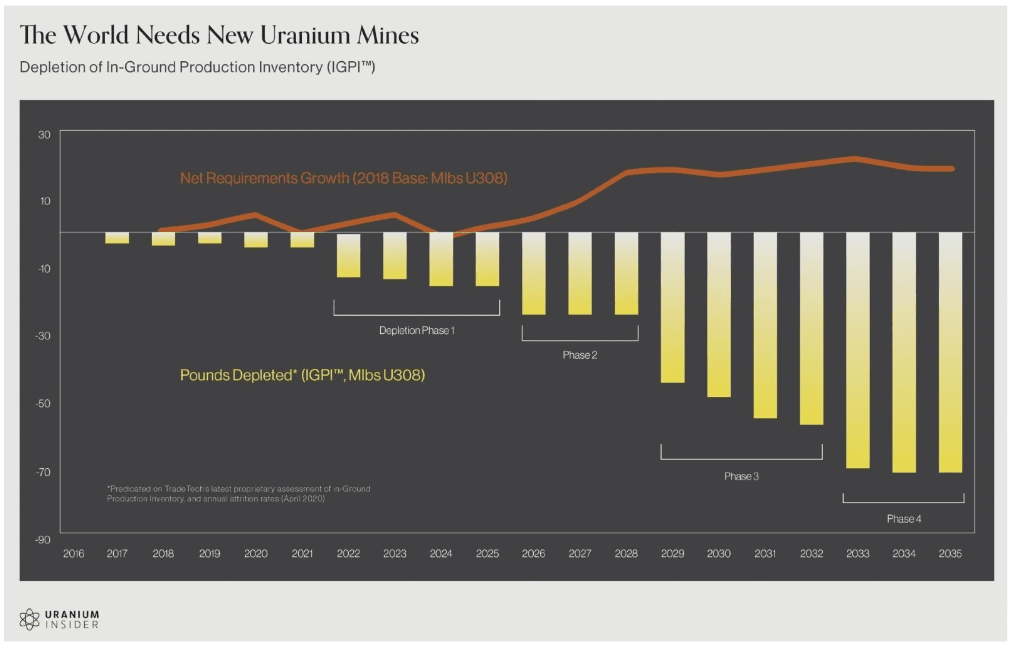

4. Global Uranium +14.0%

What’s going on? Uranium has entered a structural deficit phase which is creating underappreciated upside risks for the uranium price that are starting to be reflected in the physical market as well as in the value of uranium producers and developers. With demand growing and supply likely to remain constrained for many years, the uranium investment case is arguably more derisked now than for the past decade or so.

Will this theme keep winning? Probably. It’s hard to envisage a scenario in which the uranium price doesn’t trend higher in order to incentivise enough global production to address the massive structural deficits which are likely to cause supply constraint challenges for the nuclear sector. Uranium is a volatile commodity which should be weighted accordingly.

Best ETFs to gain exposure Betashares Global Uranium ETF (ASX: URMN), GlobalX Uranium ETF (ASX: ATOM).

5. Global Banks (Currency Hedged) +11.7%

What’s going on? The global banking sector has been a solid performer over the past three months with higher interest rates translating into higher net interest margins for some leading players.

Will this theme keep winning? Possibly not. Unrealised losses are on the rise across the global banking sector, and banks with commercial real estate exposure are vulnerable to the knock-on effects of the sector’s growing challenges. In addition, after a series of US regional bank collapses, there are a growing number of banks on FDIC’s Problem Bank List which suggests the sector’s risks are rising. Investors may be well advised to reassess their exposure.

Best ETFs to gain exposure: Betashares Global Banks (ASX: BNKS).

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Some themes are likely to continue outperforming but be selective

It’s noteworthy that the top four winning investment themes of the past three months have all been commodity related. The underlying driver in each case is similar: commodity demand is growing but supply isn’t growing as fast. In the case of gold, uranium, and the energy transition metals, there’s a compelling case to be made for continued outperformance over the longer term, although volatility is likely to remain high—so be ready for that.

The global banking sector is the standout of the top five investment themes of the past three months where the foreseeable future is likely to become more challenging than the recent past.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.