How to overcome your fears as an investor

Simon Turner

Thu 3 Aug 2023 8 minutesWhen you consider your track record as an investor, do you regretfully dwell on that one investment that blew up and cost you more of your net worth than you’d like to admit in public?

Or are you overconfident in your abilities to generate strong returns despite the evidence to the contrary?

If it’s a yes to either of these questions, don’t worry, you’re not alone. Most investors experience these feelings some or all of the time. The truth is both are fear dressed up in different attire. And unaddressed, both have the potential to negatively impact your future investment returns more than you may realise.

The good news is it’s possible to overcome your fears as an investor—or at least to learn to coexist with them in a consensual relationship.

Our fears come from a good place

The human race has long depended on fear for its survival.

For good reason… If you were a caveperson living amongst the long list of animals which could kill and eat you, being fearful of dangerous animals was a powerful means of staying focused on avoiding high risk situations which could result in your death.

As such, fear was originally a helpful emotional response which provided people with valuable guidance to help them stay alive.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

But for investors fear is extraordinarily unhelpful

However, the challenge for investors is that fear impacts our minds and bodies in extraordinarily unhelpful ways when it comes to investing…

Fear reinforces short-term thinking as surviving is more about making it through the day than thriving over the long term. Hence, fearful investors tend to trade rather than invest for the long term.

Fear increases stress and anxiety as it encourages investors to watch their portfolio’s share prices like a hawk. This excessive focus on short term share price movements transforms investing into a stressful process of trying to interpret stock moves on a daily basis.

Fear prioritises loss aversion over the long term growth-oriented mind-set needed for successful investing.

Fear leads to reactive gut-instinct-driven responses which can be disastrous for investors in an era when putting a trade on is as easy as one click. In other words, fear activates our flight-or-fight response which often inspires investors to sell their stocks at exactly the wrong moment.

Fear transforms minor investment risks into deal-breakers. Fearful investors aren’t able to gauge risk on a spectrum of low to high as they tend to perceive all risks as high risk. Similarly, fearful investors often view every single stock or macro-economic data-point as all-or-nothing events.

Fear fuels pessimism since fearful investors are in a negative emotional state which colours their view of the world at large.

In short, fear has the capacity to sabotage every single pillar of investment success. So it’s arguably the biggest obstacle most investors must address if they’re to realise their full investment potential.

Don’t let your battle scars overwhelm you

As Howard Marks said, “There are old investors, and there are bold investors, but there are no old bold investors.”

It’s easy to see why investors become fearful. Over the years, the accumulation of an ever lengthening list of investment losers can chip away at your confidence and make you feel bitter about the investment game.

Let’s be honest…this is the real reason so many investors diversify and invest in lower return asset classes. They’re fearful they’ll get it wrong in the higher return, higher risk asset classes where getting it wrong is the most financially painful.

But the ability to look the market in the eye and absorb its short term blows is all part of the humbling investing game—as is the ability to accept defeat when you’ve made a mistake ahead of selling and moving on.

There’s no escaping the fact that succeeding at the investing game depends on conquering your fears.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

So how do you overcome your investing fears?

There are 6 steps to work through when you’re ready to lay your investing fears to rest…

1.Understand the consequences of not overcoming your fears - Let’s start by being honest about the stakes. The consequences of not overcoming your fears may be accepting that you’ll need to work for an extra decade to compensate for the sub-par investment returns you’re on track to achieve. When you understand how much is at stake, it becomes a lot easier to view overcoming your fears as an essential step which will make positive changes to your life.

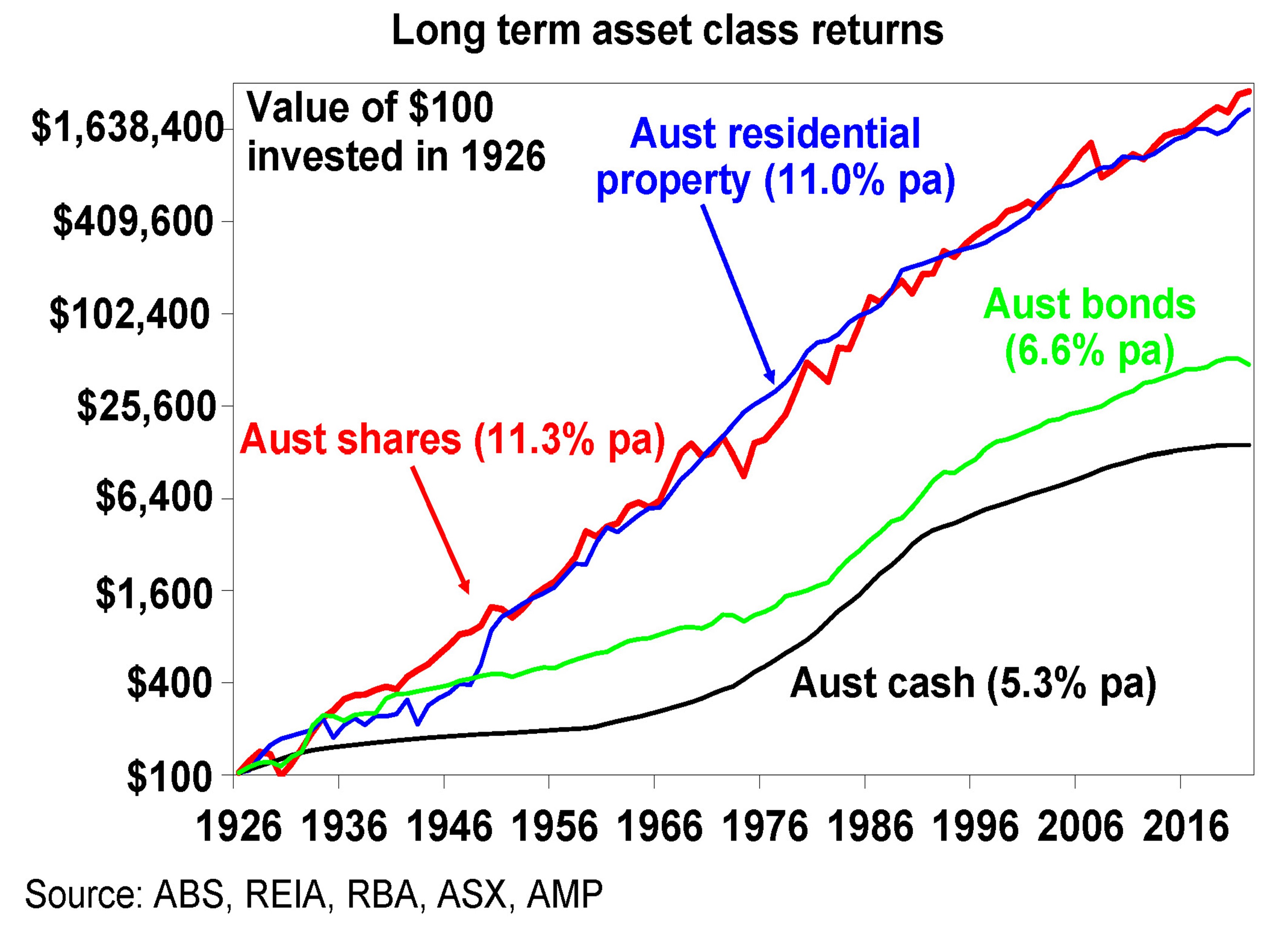

2.Reassess the worst case scenario - It’s time to get real about the risks you’re up against. Do any of them deserve the flight-or-fight response you’ve become used to experiencing? Is your life really at risk if you were to make an investment mistake? Are your fears likely to manifest in reality? This is a grounding process based upon looking at reality and realising it’s probably not nearly as scary as your fears are leading you to believe. During this step, it’s worth referring to the long term data on investment returns such as the chart below.

Even the most fearful of investors can’t argue the 11% p.a. return Australian equities and residential property have generated over the past century justifies their fears.

3.Articulate a positive investment goal - Write down what your investment goal is along with your timeframe to achieve it. Make sure you frame your goal in a positive way rather than in terms of avoided negatives. For example, I would like to grow my net wealth to $x million within the next 10 years by investing in equities, bonds, and property with that time horizon in mind.

4.Visualise yourself achieving your goal - Imagine experiencing the feelings you expect to experience when you achieve your goal. For example, imagine the serenity and relief you’re on track to experience when you achieve the financial freedom your goal implies. Once you become adept at this you’re likely to actually experience those emotions today. And every time your fears re-emerge, visualise yourself achieving your long term goal again. Remind yourself this is the reason you’re on this pathway—and that there’ll be ups and downs along the way.

5.Expand your comfort zone - A key part of overcoming your fears is to be able to step outside of your comfort zone into the learning or growth zone. This is the mental space where investment returns prosper. It’s also one of the more challenging steps to get used to since most people feel anxious when they do it. One of the more helpful strategies to help with this step is to learn about others who’ve taken this step successfully. For example, reading the biography of one of your favourite investors may prove useful. And remember, the more used to stepping into the growth zone you become, the more your comfort zone will expand.

6.When stress and anxiety returns, take a deep breath and let it go - It’s important to accept that this process is about overcoming your fears rather than avoiding them. It’s natural that they’ll continue to pop up from time to time. When they do, be ready to let them go with the help of deep breathing, which has helped many investors navigate the stresses of investing. Also, consider avoiding unnecessary stressors like checking your portfolio’s stock prices on a daily or hourly basis. You want to maximise your chances of sticking with your investment plan over the long term. That means minimising the stress of investing through all means at your disposal.

Overcoming your fears can help you become a better investor

There’s an expression in investment circles which perfectly summarises the importance of overcoming your fears: ‘It’s hard for scared money to make money.’ It’s worth rereading that.

Investing is similar to playing sport. You can only win if you keep taking the shots. That means overcoming your fear of missing along with any other fears which are holding you back. So if you’re looking to improve your investment returns, overcoming your fears could be the game-changer that enables you to start generating the kind of investment returns you always dreamt of.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.