Dividend investors could be shouting more drinks

Simon Turner

Fri 28 Jul 2023 6 minutesThe world of yield investing has been through a dramatic transformation in recent months as central bankers have raised rates at an unusually aggressive pace. Equity and bond markets have fast adapted to this new world order, but what happens if the current yield split between equities and bonds doesn’t apportion risk fairly?

The implications for equity investors are significant. In this new world order, dividend investors could well be shouting more drinks than investors who depend upon capital gains in the coming couple of years.

A rare meeting of yields

It’s important to understand the broader market context at present.

Given the US market continues to lead Australia and other developed markets, let’s start with the US yield data where something remarkable is occurring.

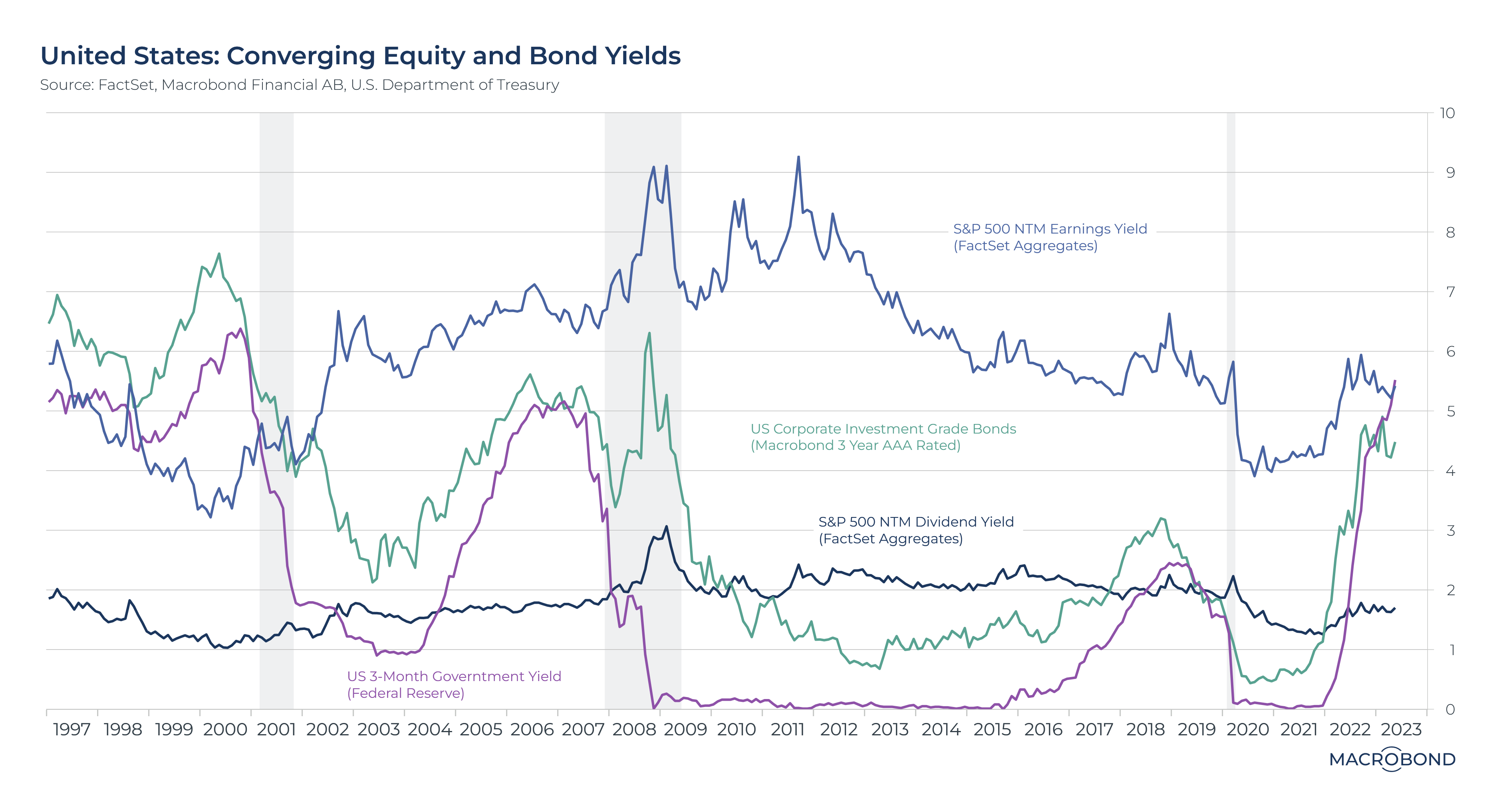

As shown below, US equity yields, US Government bond yields, and US Corporate bond yields have all converged in recent months.

You’d be forgiven for scratching your head at this point.

Surely, equity investors should be compensated for being exposed to the significantly higher risks of owning equities over bonds, right? So financial theory tells us, but markets are ignoring the textbooks at present.

It’s not the first time this had happened. Check out what happened in the late 90s in the chart above. That was also an un-theoretical period when equity yields fell below government and corporate bond yields. We all know how that ended. Over the ensuing years, government and corporate bond yields fell while equity yields rose. Translation: equities fell and bonds rose.

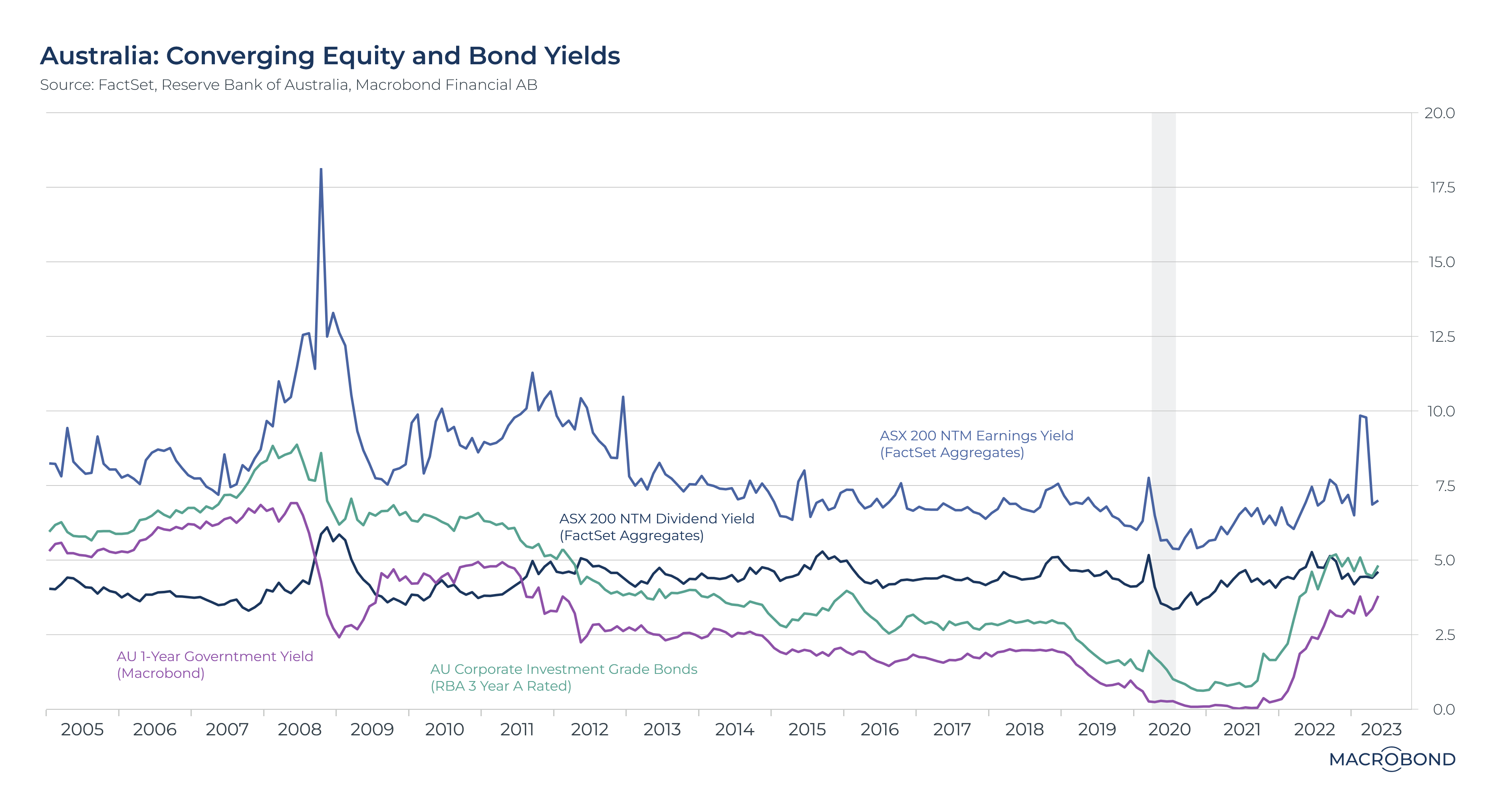

In Australia, the current situation is similar to the US although thankfully the equities earnings yield still exceeds government and corporate bond yields by a margin—as shown below.

It’s no surprise the Financial Times recently questioned whether (US) investors are currently being incentivised to own stocks.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What it means for investors

The first implication for investors is that global and Australian equities appear expensive versus bonds, or bonds appear cheap versus equities—or a combination of both.

Without knowing how the market will resolve this unusual risk misalignment challenge, the second implication is that a portfolio of equities which generate solid cash-flows and pay attractive dividends is likely to outperform a portfolio of non-dividend payers over the coming year or two.

The reason is compelling…businesses which can pay sustainable and rising dividend streams tend to be mature companies with well-established competitive advantages and visible long-term prospects. These businesses are positioned to outperform during equity market selloffs as they are generally regarded as defensive. They are also more likely to be value stocks if they are offering a decent yield—positive cash flow generation is likely to be in their lifeblood.

Beyond steering investors towards defensive cash flow generating stocks, dividend investing offers investors another key advantage during weaker market conditions. By receiving a portion of their investment return in dividends each year investors are able to reinvest into market weakness, further compounding their long term returns.

For all these reasons, dividend investing is generally regarded as a lower risk strategy. And lower risk strategies are often a prudent approach when markets face unusually high levels of uncertainty—like right now.

What to look for as a dividend investor

Dividend investors tend to be on the lookout for companies with long term track records of paying growing dividend streams—these businesses are known to many as dividend aristocrats.

Often it’s more important for dividend investors that a company increases its dividend each year than its yield being amongst the highest.

To identify these dividend-paying powerhouses means looking under the hood of potential investments with a view to finding businesses which are well placed to continue growing their dividends regardless of what happens in the economy.

The payout ratio is a key calculation in this process as it provides context as to how sustainable a company’s dividends are. For example, a 50-60% payout ratio is generally regarded as more sustainable than a 90% payout ratio.

Franking credits are also a key consideration in Australia as they make a significant contribution to long term returns for dividend investors.

The end result for most dividend investors is a portfolio of stocks with pretty good but not amazing yields—usually in the 3-6% range rather than 8%+. This is because the higher dividend yield stocks are often unsustainable or reflective of higher business risks.

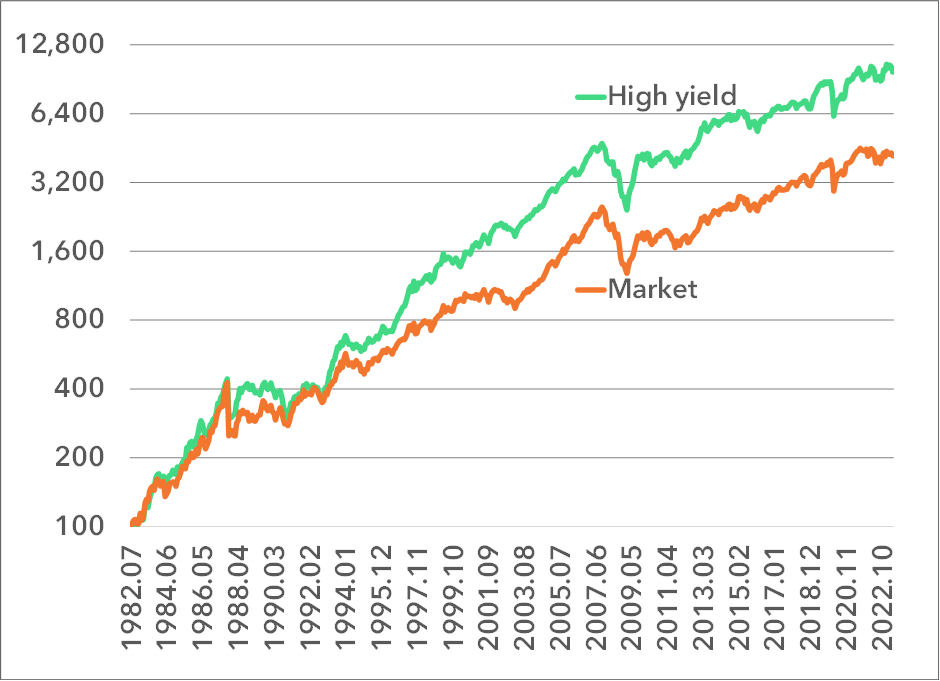

The long term performance of this dividend focused strategy speaks for itself. As shown below, high yield investing has significantly outperformed the All Ordinaries over the past 41 years with an 11.9% p.a. return versus 9.6% p.a. for the broader market.

Source: Hamilton 12

Of the 2.3% p.a. outperformance of the high yield strategy, around half was contributed by franking credits and around half by the high yield strategy.

That’s compelling evidence of the power of dividend investing over the long term—as well as the importance of franking credits.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Dividend investing ticks the boxes for an uncertain market

In this strange new financial world in which we find ourselves, equities appear expensive relative to bonds. Markets will resolve the issue one way or another in the coming years, but it’s clear the risks facing equity investors are heightened at present.

Dividend investing stands out as a strategy which is well positioned to outperform in the face of this uncertain outlook. So you may find investors who successfully identify companies with sustainable and rising dividends are more likely to be buying the drinks over the coming years.

Long live cash flow generating companies which pay healthy dividends.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.