Three words that could change the rules of the investing game

Simon Turner

Wed 3 Jul 2024 8 minutesGlobal markets have long been fixated on what’s coming next from the world’s central bankers, particularly the Fed. But some investors may be unaware of a central bank strategy would could change the rules of the investing game if the Fed were to use it.

We investigate below the three-worded Fed policy which could matter a lot to global investors if the US Government’s spending continues unabated.

Three little words with big implications

The three words with big implications are yield curve control (YCC). Yield curve control is a central bank monetary policy that involves buying government bonds to control interest rates along the yield curve.

In contrast to the way the Fed’s (and the RBA’s) cash rate decisions influence shorter term borrowing costs, YCC allows central banks to also control longer term interest rates. In essence, YCC is a similar strategy to quantitative easing but it is price-driven rather than quantity-driven.

In the words of Greg McBride, Bankrate analyst: ‘Quantitative easing is buying a specific amount of bonds every month or on a regular basis; yield curve control is more of a blank check. It is about buying whatever quantity is necessary to keep yields below a certain level.’

The BOJ’s YCC experience

The Bank of Japan (BOJ) introduced yield curve control back in September 2016 to help address Japan’s deflation while stimulating economic growth without causing yen appreciation. Over the ensuing years, the BOJ targeted short term rates of -0.1% and a 10-year government bond yield of 0-0.5%.

However, the BOJ’s YCC strategy is currently being phased out. Most experts agree that the negative consequences of the strategy more than offset the supportive aspects.

For example, the BOJ ended up owning almost all of the country’s 10-year government bonds since they were prepared to pay a higher price for them than most investors. As a result, the entire asset class effectively disappeared from the financial markets landscape.

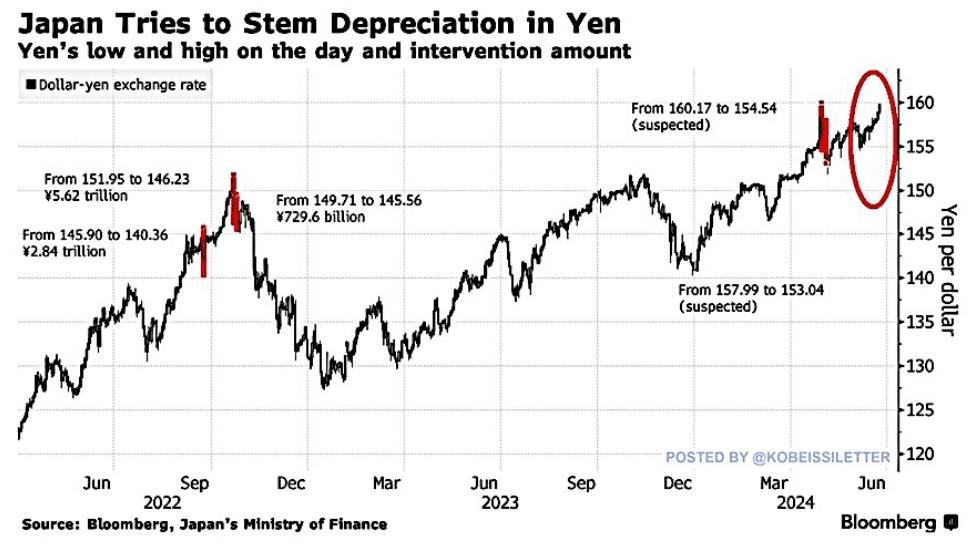

In addition, the yen has been in structural decline for years as a consequence of the BOJ’s artificially low interest rates.

Whilst yen depreciation has been helpful for Japan’s economic growth, it has become so extreme that it has led to a decrease in consumer purchasing power and a slowdown in corporate production and investment.

So the unintended consequences of the BOJ’s YCC have been significant. The experience certainly hasn’t provided evidence that YCC is a sensible or prudent strategy for the world’s central bankers to call upon.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The RBA’s YCC experience

The RBA also trialled YCC a few years ago. During the initial shock of the pandemic in March 2020, they introduced a target yield for three-year Australian Government bonds.

However, this strategy was discontinued in November 2021, and the RBA have been open about their conclusion that their YCC experience was a failure.

In the RBA’s own words: ‘More often than not, YCC ends up in bond investors challenging the central bank's yield limit once the macroeconomic backdrop and/or debt dynamics of the country at hand have changed beyond a point where that limit seems sustainable. When in due course the central bank has to give in, bond yields jack up violently, creating dislocations in the critical market for government securities while damaging the all-important credibility of the central bank essential to its influencing investors' expectations about rates and inflation. In the end, YCC seems to be a powerful short-term tool that, however, creates long-term problems of its own.’

That’s an unusually honest assessment of a central bank’s failed strategy.

So based on the BOJ’s and the RBA’s challenging experiences with YCC, it’s fair to assume the Fed won’t go down this pathway, right? Maybe. But maybe not.

The rub for the Fed

Here’s the rub … the Fed’s hand may soon be influenced by US Treasury’s growing debt burden—just as it was during and after the second world war when the Fed bought up bonds as was needed to keep yields steady.

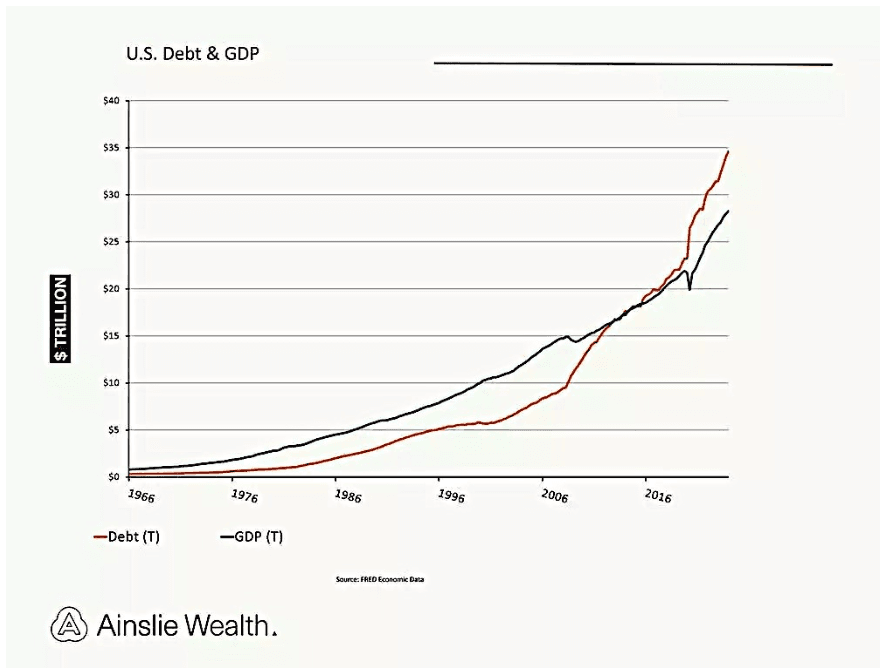

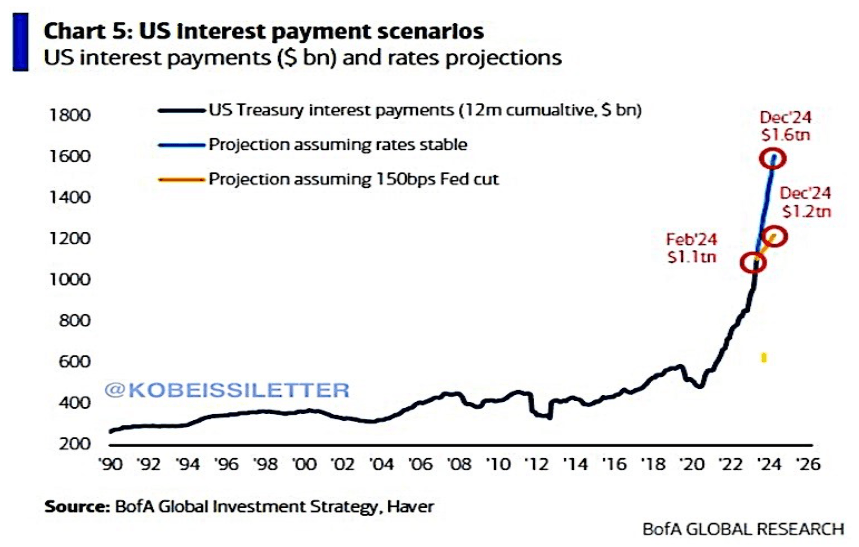

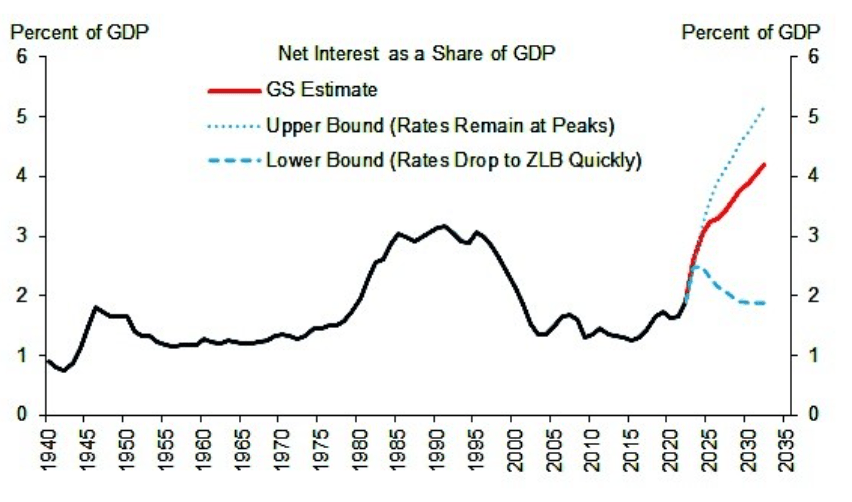

The problem faced by the Fed can be summarised in the three charts below …

US debt levels are growing at an unsustainable rate:

The interest bill on that debt is growing at an unsustainable rate:

The US Government’s interest as a percentage of GDP is heading in worrying direction:

If these trends continue, the solvency of the US Government is likely to become a more significant risk for global financial markets to contend with—and the Fed is going to be sitting smack bang in the middle of a no win scenario.

Enter YCC as a potential policy tool the Fed could call upon to help address this risk.

Bank of America CIO Michael Hartnett provides context on the role YCC could play in this scenario: ‘The reason YCC can become part of the debate is that investors rather than voters are likely to force fiscal discipline on the US government.’

The other problem the Fed faces is that as the US Government’s deficit and interest bill continues to rise, government bond yields may actually rise rather than fall since financial markets will always require a higher return when the risks are higher. Higher yields would only serve to compound the US Treasury’s debt dilemma.

In the words of Michael Hartnett: ‘The greatest credit event of all would be a recession in which US yields went up, not down.’

So higher Treasury yields could be the catalyst which forces the Fed’s hand. In this scenario, the Fed may use YCC to ensure the US Government remains solvent and the US economy is stimulated rather than stymied by bond markets. It’s definitely not outside the realms of possibility.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What it would mean for investors

If the Fed started using YCC, the rules of the global investment game could be altered in ways most investors aren’t prepared for. Here are some of the potential outcomes in that scenario:

Increased US and global investment risk – The implementation of YCC by the Fed would reveal that the financial outlook for the US Government has become more challenging care of growing deficits and interest payments. In addition, the Fed’s credibility would likely be brought into question. Those challenges would likely translate into heightened US and global investment risk.

More volatility likely – With growing systemic risks comes higher volatility. It’s easy to imagine global volatility increasing significantly from current low levels if the Fed used YCC.

Mixed/confusing outlook for bond investors – If the Fed were to buy up longer term US Treasuries until the price reached a level at which the yield met their goal, it would be bullish for US government bond investors. But this strategy is likely to cause problems for the rest of the bond market. Large swathes of the global bond market would be exposed to this disruptive dynamic which could lead to a long list of unintended consequences.

Weaker US dollar – By forcing down longer term US Government bond yields, a weaker US dollar is a likely outcome. So YCC by the Fed could represent the beginning of a longer term de-dollarization trend.

Bullish for commodities and other inflation plays such as property – A weaker US dollar is generally bullish for commodities, particularly gold, since they are priced in US dollars. Higher commodity prices would be supportive of higher inflation which would be bullish for property and other real assets.

It’s also worth mentioning that unintended consequences tend to the name of the game when YCC is used. So predicting how this scenario may play out is unlikely to be accurate.

Be ready for YCC by the Fed (just in case)

Yield curve control are the three words the Fed may utter one day that could change the global investing game in profound ways. It’s noteworthy that at this point most investors are not too worried about this left field event. For now, being aware of the risk of yield curve control and its implications is likely to put you a step ahead of most investors.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.