How to become a residential property mogul

Simon Turner

Thu 4 Jul 2024 8 minutesIf you’re the owner of one investment property, you’re the esteemed member of a 2.2 million club of wealth builders. Whilst owning one investment property is a great achievement, you may not be as well positioned as you think you are to generate the type of wealth most investors are aiming for in retirement care of their property portfolios.

Breaking through the one investment property barrier may, in fact, open up a pathway toward living the retirement of your dreams. We investigate how to become a residential property mogul below.

Australia’s property love affair ain’t ending any time soon

Australia’s love affair with residential property is hard to understate.

According to ABS and CoreLogic, a massive 56.7% of Australian household wealth is held in residential property with a value of $10.4 trillion (as at the end of January 2024). There’s $2.3 trillion of outstanding mortgage debt on that property so the average loan to value is 22%.

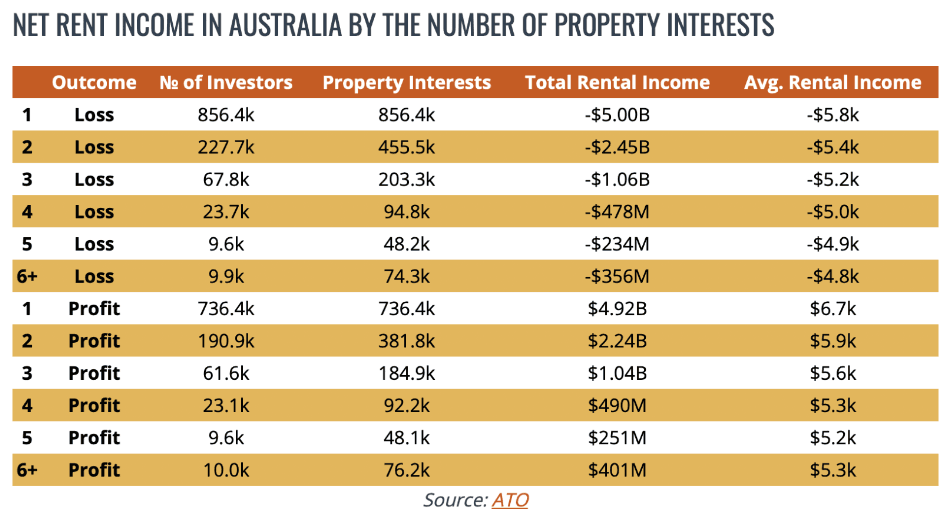

2.2 million, or 20% of Australian taxpayers, own at least one investment property, and 72% of those property investors own just one property. As the ATO data below shows, there’s minimal correlation between average income per property and the number of properties owned by those investors. Average (ATO declared) rental income per property ranges from a $6,700 profit to a $5,800 loss (both reported by owners of one investment property).

The key takeaway from this data is that owning one investment property is unlikely to make you rich. It’s the investors who amass multi-property portfolios who are best positioning themselves for fruitful retirements.

Why most investors stop at one property

The question budding property moguls will want to understand is: why do the majority of property investors stop at one property?

There are a number of reasons:

Buying the wrong first property – This is arguably the most significant barrier to portfolio expansion since the first investment property is the one and only equity growth engine investors have at their disposal when they’re in the early stages of their property journey. If the wrong first property is purchased, investors are unlikely to be able to tap into equity growth to help access the required funds to buy a second property.

Unprepared financial foundations – By failing to plan, many property investors plan to fail. Building a property portfolio depends upon understanding your financial position, borrowing capacity, and investment plan. Without having these foundations in place at the get go, it’s going to be challenging to move beyond the one investment property barrier.

Dissuaded by their mistakes – Making mistakes is a common part of all investment journeys, but when some property investors encounter losses, bad tenants, or the many other pitfalls of property investing, they are often stopped in their tracks. Their fear of failure overrides their commitment to building a residential property portfolio which generates the type of wealth they are aiming for.

Not having the right relationships – Building a property portfolio depends upon having the relationships with excellent mortgage brokers, accountants, and property advisers. Often, when investors try to build a property portfolio without these relationships in place, they run into knowledge barriers that stop them progressing. The key is to develop these relationships prior to investing in your first property.

The list goes on, but you’ll notice the common themes: not planning and not thinking long term.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Buying the right first property

So buying the right first property is more important than most property investors realise.

Here’s a list of what to look for in your first investment property to ensure you are positioned to build a multi-property portfolio:

Invest in larger capital cities where economic and wage growth is likely to continue. The properties in the inner and middle ring suburbs of capital cities are likely to attract residents who are working in the nearby city, and generating above average disposable incomes.

Invest in up and coming suburbs which are undersupplied and offer lifestyle advantages. These areas are generally positioned to generate superior capital growth as residents with higher disposable incomes will be attracted to live there.

Invest in the best streets within your target suburb. For example, avoid main roads, streets with shops on them, train lines, flight paths, and commercial/industrial areas.

Aim for both capital growth and positive cash flow. Whilst capital growth is more important for portfolio building than positive cash flow, it’s more motivating to achieve both. With the right mind-set and investment plan, it is possible to achieve capital growth and positive cash flow.

One more tip: it’s generally advisable to pay a bit more for an investment grade property that aligns with your investment plan than to save money by buying a lower quality property.

Becoming a property mogul

So you’ve bought the right first investment property and you’re ready to build a portfolio.

The next key question is: how do you break through the one property barrier that most investors stop at?

Here’s a basic roadmap of how many successful property investors build their portfolios:

Develop an investment plan which incorporates the building of a residential property portfolio of investment grade properties (as described above). More importantly, commit to following your investment plan over the long term. Property is an expensive asset class to buy and sell so it’s essential that you’re thinking long term about execution.

Raise your borrowing capacity by increasing your income. As a general rule, for each dollar you earn, you’re likely to borrow four dollars, so you’ll be able to borrow more if your income is trending upward. It’s a lot easier to increase your borrowing capacity with positive cash flow properties in your portfolio as opposed to loss-makers.

As your first investment property (hopefully) increases in value, tap into the equity growth by requesting a bank revaluation. For example, if your property has increased in value from $480,000 to $600,000 with an 80% loan-to-value mortgage, an additional $96,000 of equity may be withdrawn to help buy another property. This is the trick successful property investors use to grow their portfolios faster than they’d be able to by relying only upon their borrowing capacity. This equity tapping strategy allows investors to benefit in real time from the capital growth in their portfolios.

Once you move beyond your first investment property, keep going. With each additional property you buy, your ability to keep expanding your portfolio improves since you have more properties through which you’ll be growing your equity. For example, if you have four properties which have appreciated 10% in a year, you may be able to tap into an additional $400,000+ of equity to be used to buy another property. The maths gets easier with each additional property in your portfolio.

One final tip: stay focused on investment grade properties as you build your portfolio. It’s vital that you keep buying properties which are generating the capital growth and positive cash-flows required by your investment plan.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Or … there are fund managers who can do the heavy lifting for you

There are also passive alternatives available to budding residential property moguls as a number of managers have launched unlisted residential real estate funds in recent years.

For an asset class which has historically required a significant amount of management effort per dollar invested to deal with setting up loans and managing tenants, the concept of large-scale passive residential real estate vehicles could open up the asset class to a much wider group of investors.

As with all investment opportunities, savvy investors will be assessing the growing list of residential real estate funds in terms of the expected returns on offer versus the risk involved.

Let the land cycle work for you

It’s also worth considering the property cycle as you build your portfolio.

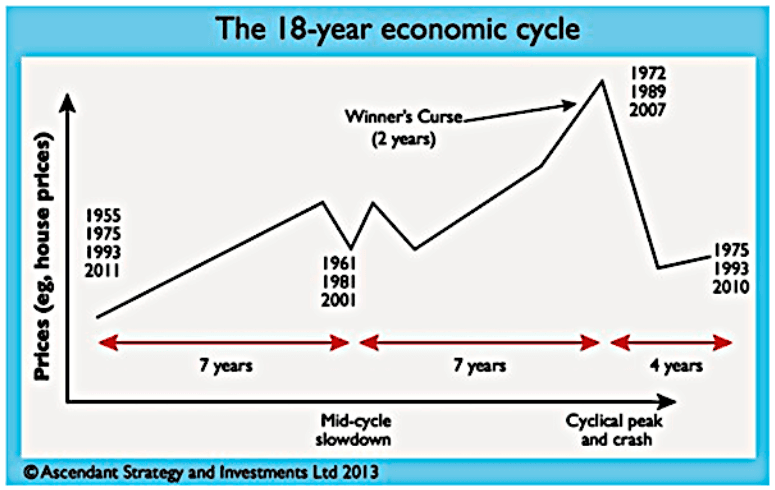

On that note, Phil Anderson’s land cycle research is insightful and potentially helpful for budding property entrepreneurs. Phil’s research shows there’s a repeatable land cycle at play with fourteen years of a rising market followed by four years of a falling market.

It’s worth reading Phil’s book The Secret Life of Real Estate and Banking for a greater understanding of the land cycle and why it tends to repeat.

If the land cycle is once again following its typical pathway, we’re approaching the Winner’s Curse stage of the cycle. That’s potentially bullish for residential property over the coming couple of years.

Play the long game

If you’ve always dreamt of amassing a residential multi-property portfolio that ensures you can live comfortably in retirement, the key is to buy your first property and keep going.

Whilst breaking through the one property barrier is a challenge for most investors, it’s possible if you follow the well-worn pathway of property success. Buying the right properties at the right time will enable you to grow your property portfolio equity which will allow you to buy more properties and amass more wealth. Or, let a residential property fund manager do the work for you.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.