The energy conundrum

Simon Turner

Mon 24 Jul 2023 5 minutesAs the transition towards net zero gathers pace, the energy sector has found itself in the midst of a generational shift. Investment into sustainable energy sources has structurally increased, whilst fossil fuel investment has faced ESG-driven investment headwinds which has led to constrained oil exploration budgets.

Most would agree it’s good news that investment markets are focused on enabling the transition to low carbon energy sources such as renewables and nuclear while fossil fuels are deemphasized in the global mix.

But what if markets haven’t factored in the supply of oil needed during the transition to net zero by 2050? What if the seeds of a major energy crisis have unwittingly been sown amidst the shifting energy supply mix?

Fossil fuels still dominate the energy mix

Let’s start with the current reality of fossil fuels dominating the energy mix.

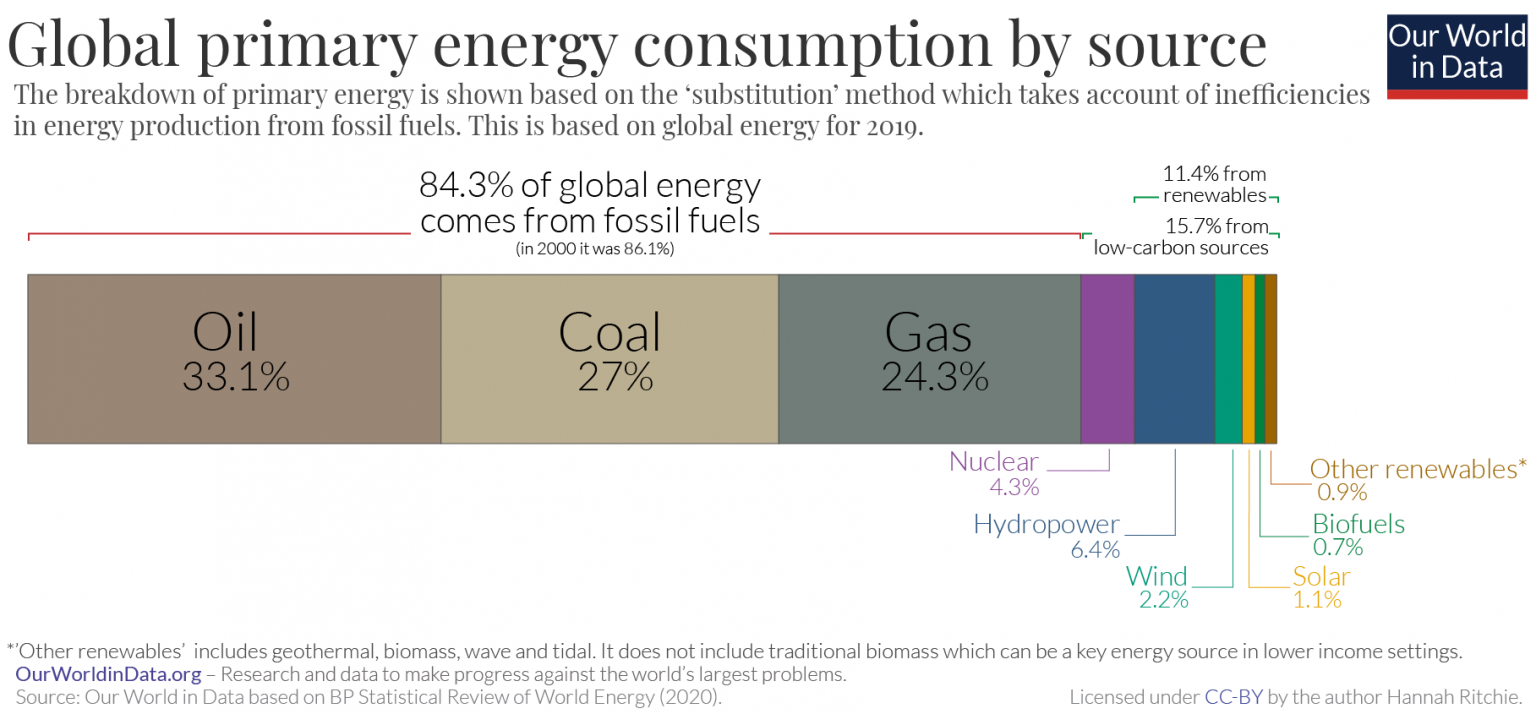

Despite all the progress made in raising the portion of global energy supply derived from renewables and low carbon sources, 84% of energy is still derived from fossil fuels with 33% from oil and 24% from gas—as shown below.

Whilst fossil fuels are expected to trend downwards as a portion of global energy supply in the coming years, there’s no escaping the fact that oil remains of vital importance as an energy source now—and will do throughout the energy transition.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Lower E&P spend over the past decade

Oil and gas companies have reacted to the energy transition as you’d expect.

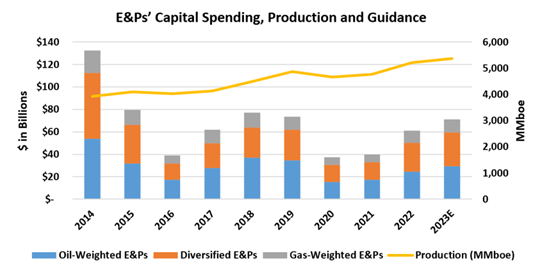

In the face of growing ESG-driven capital constraints and the expectation oil and gas will represent a decreasing portion of global energy supply, they’ve decreased their exploration and production (E&P) spend as shown below. At the same time, many oil and gas companies have increased their investment into renewables and other low carbon energy sources.

Oil inventories tell a concerning story

To the oil market…

What a wild ride it’s been for oil since the pandemic hit. Who could forget the 2020 oil price crash or the slingshot move on the upside in the ensuing two years (shown below).

So are these wild oil price swings over, or is there more to come?

Oil inventories could hold the answer.

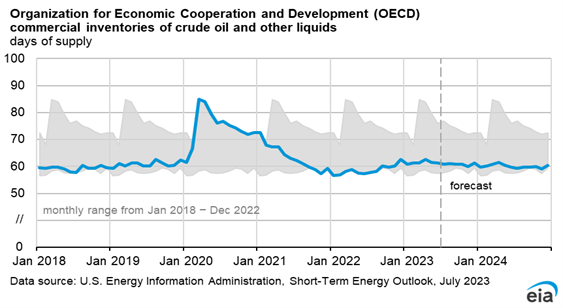

Global oil inventories have remained relatively static in recent months as shown below.

However, it’s the market context behind these stable oil inventories which is more illuminating.

This static inventory picture occurred whilst a number of significant events were playing out which directly impacted global oil demand and supply. Namely…

-China’s 200 days of lockdown led to an estimated demand loss of 500m bbl across Asia (Praetorian Capital estimate).

-The Global Strategic Petroleum Reserve released over 300m bbl of oil.

-Russia dumped c.150m bbl of oil on the global market before sanctions kicked in.

-A warm winter in Europe and the US reduced heating and propane demand by c.100m bbl.

In combination, these events led to a net reduction in oil consumption of 1bn bbl over c.200 days. That’s around 5% of global oil demand.

So these events should have caused a substantial increase in oil inventories throughout that period. And yet, oil inventories remained roughly stable.

In other words, an additional c.5m bbl/day of oil was consumed despite these four powerful headwinds.

It’s noteworthy this was a period when sharply rising interest rates incentivised oil buyers to run down their oil inventories to save on holding costs.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A potential energy crisis in the making

Bearing in mind three of oil’s four headwinds have recently reversed (China’s lockdown is over, the Strategic Reserve release has ended, and Russia is no longer dumping oil), as well as the fact global oil demand tends to grow every year, it seems likely that we’re entering a phase of structural oil deficits.

That means higher oil prices are likely…potentially much higher oil prices.

In theory, we should be expecting oil prices to move to a level which effectively destroys c.5m+ bbl/day of oil demand to ensure the market remains in equilibrium.

This is where the talk of a potential energy crisis comes from.

To destroy 5%+ of global oil demand will be extremely hard to do given the Global Financial Crisis destroyed only 2% of oil demand.

This situation is so bullish for oil prices that a rising oil price may in fact represent a greater risk to investment markets than higher interest rates at this juncture.

We may be talking $150, or even $200+ oil, over the next couple of years—even without an energy supply shock thrown into the mix.

Hence, the seeds of an energy crisis could already be sown.

Be aware of the risks posed by a potential energy crisis

You’ve been warned…the risk of a global energy crisis over the coming couple of years is arguably underestimated by markets.

Being prepared in advance for significant market shifts is at the core of prudent risk management. Whilst no one can predict the daily or even weekly movements in the oil price, being aware of a potentially larger upward move in the oil price could well be prudent.

At the very least, it may be worth stress-testing your portfolio in the event of $150 or $200 oil to gauge how this risk and opportunity would affect your performance.

Remember, successful investing is often about being ready for the events the herd is dismissing as unlikely.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.