Unlisted property funds may be about to shine again

Simon Turner

Wed 4 Sep 2024 5 minutesThe promise of interest rate cuts by the Fed and the RBA has been the main reason to be bullish about unlisted property funds for some time now. It’s been a long wait, but it looks like we’re nearing the expected interest rate easing cycle, at least in the US.

So is now the ideal time to consider revisiting the unlisted property fund sector? We investigate.

Higher interest rates have been a drag for unlisted property

The RBA and the Fed’s dramatic rate raising cycle has created a major headwind for most unlisted property funds over the past couple of years.

The reasons are unequivocal.

Higher interest rates cost a larger portion of a commercial property’s cash flow, which means lower distributions are available for equity investors.

Central bank cash rates also directly influence the capitalisation rate investors use to value commercial property. Hence, all other things being equal, a higher cash rate translates into a higher capitalisation rate and lower commercial property valuations.

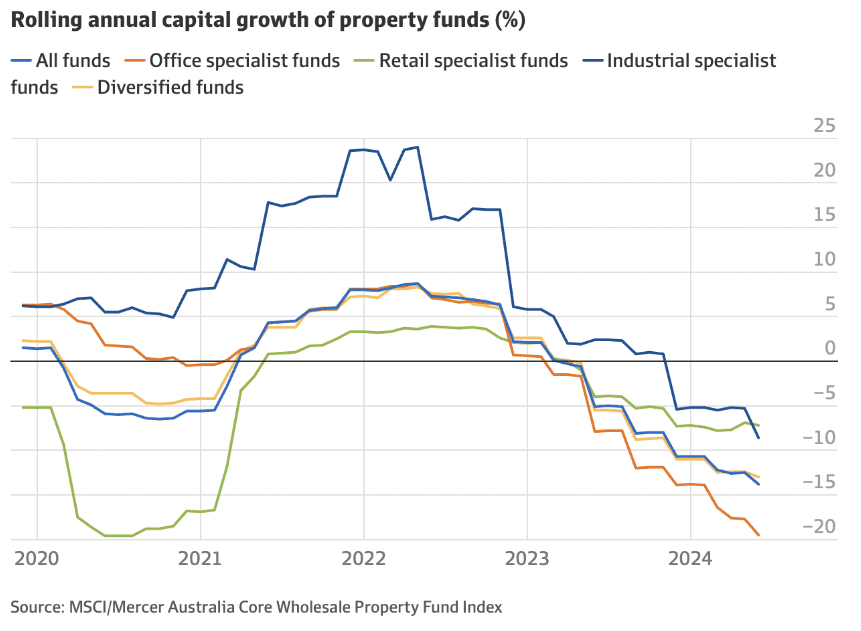

So unlisted property fund investors have faced the double whammy of lower distributions and falling capital values for more than two years. As shown below, the valuation impact has been most severe in office funds which have also faced structurally lower demand since the pandemic, whilst retail and industrial funds have also suffered to a lesser extent.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A headwind may be about to turn into a tailwind

Since central bank cash rates have been the main reason for the unlisted property fund sector’s underperformance over the past couple of years, it’s logical to assume the sector will resume outperforming when central bankers start cutting rates in earnest.

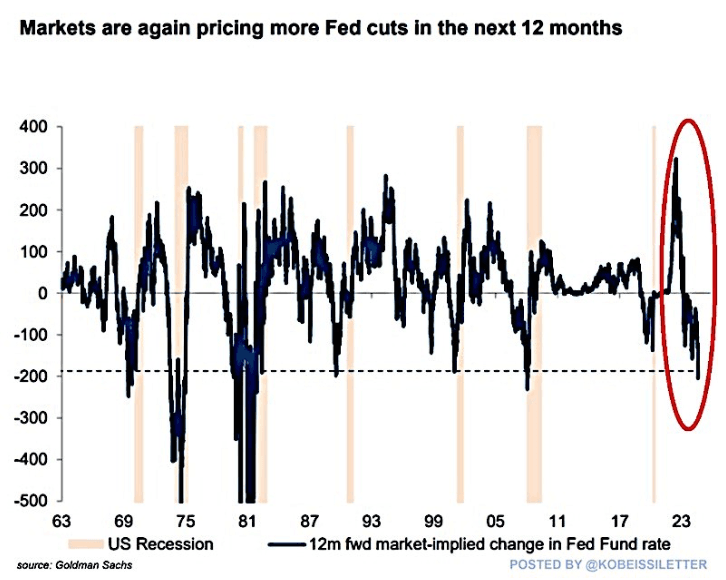

From a sentiment perspective, Fed rates are arguably the most market driver for unlisted property funds and REITs alike. In response to weakening US economic expectations, markets are now expecting eight rate cuts by the Fed over the coming year—the most since the Global Financial Crisis in 2008.

That’s a serious shift from the one Fed rate cut markets expected back in April when the US economic outlook was more positive. It’s also about as extreme as market expectations of a Fed rate cutting cycle get. Interestingly, every time markets have expected 200+ basis points of Fed rate cuts, a US recession has followed within a few months.

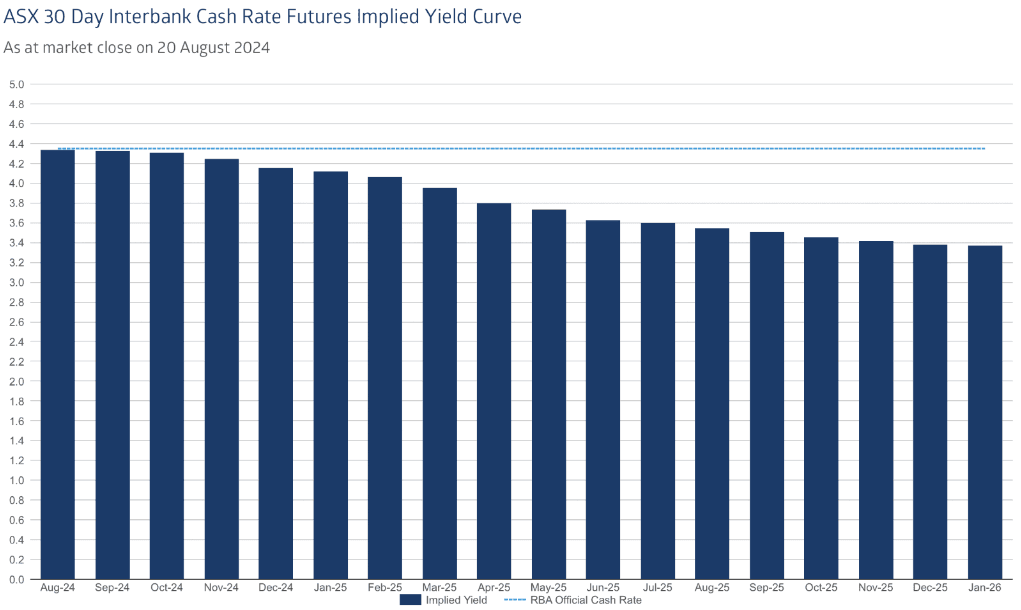

Then there’s the RBA. From a financial perspective, RBA rates are more important for unlisted Australian property funds than Fed rates since they directly influence property fund cash flows and capitalisation rates. The RBA also appears to be approaching an easing cycle. As shown below, the implied yield curve shows four RBA rate cuts are expected by the end of 2025.

With both the Fed and the RBA expected to deliver multiple rate cuts over the coming year or so, a lot of good news is likely coming for the unlisted property fund sector. With each rate cut, commercial property capital values will rise as will cash flows.

The REIT example

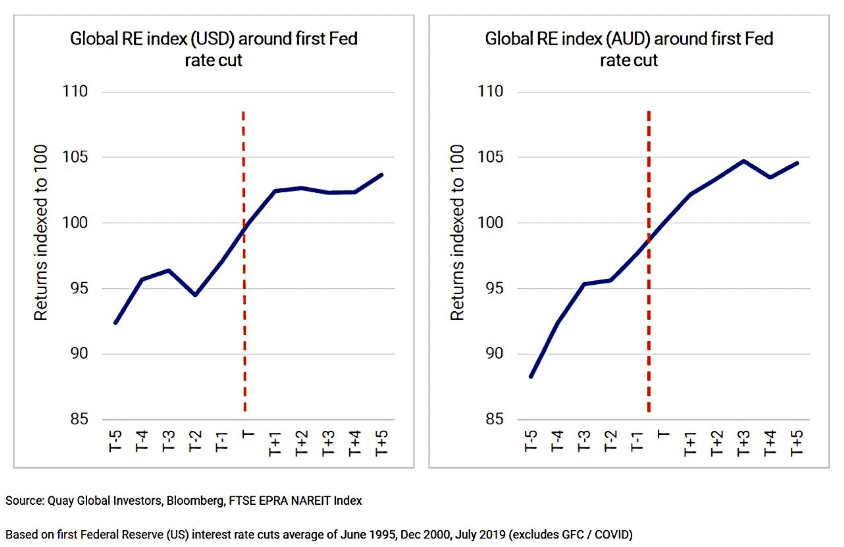

By way of example, how the REIT sector tends to respond to Fed rate cuts provides a useful guide as to how the unlisted property fund world may respond. As shown below, the listed REIT sector tends to outperform both before and after Fed rate cuts.

The implications are bullish for the unlisted property fund world.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

But the office sector challenges may take longer to resolve

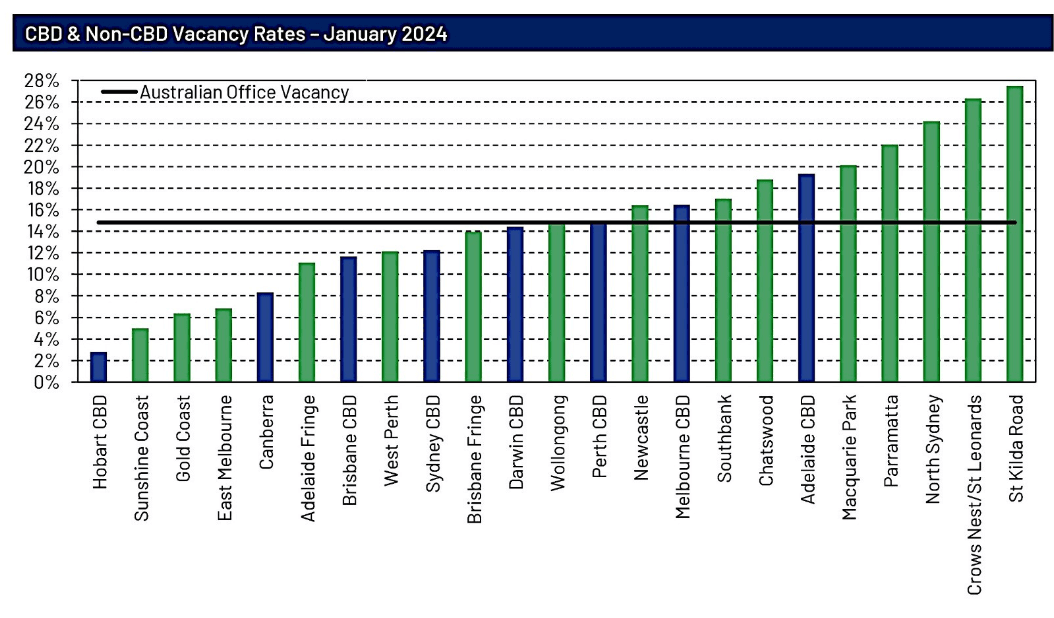

Whilst good news may be coming for the unlisted property sector in general, the office sector may remain a laggard for some time. With more workers opting to work from home, CBD office vacancy rates remain stubbornly high which is impacting upon valuations.

Lower interest rates are likely to lead to stronger cash flows for office owners, but the sector’s excess overcapacity in CBD locations is likely to take years to resolve. In the interim, investors with exposure to government-tenanted office properties in cities and towns with lower vacancy rates such as Hobart are likely to be best positioned to weather the challenges.

Get ready for the unlisted property funds renaissance

Unlisted property funds may be about to shine again. If market expectations are met with eight Fed rate cuts over the coming year and four RBA rate cuts by the end of 2025, the sector is well positioned to benefit from higher cash flows and rebounding valuations.

Positioning yourself ahead of this potential upward move may well be fruitful. Just be careful with your office sector exposure due to the ongoing post-pandemic challenges.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.