The case for active fund management

Ankita Rai

Thu 5 Sep 2024 5 minutesActive fund management has long provided investors with easy access to professional management expertise across a range of asset classes.

With equity markets reaching high valuations driven by tech stocks, stock picking has arguably become more important than ever. So it may be an ideal time to increase your exposure to active funds with the stock picking expertise required to navigate what’s coming next in financial markets.

Active funds avoid concentration risk

The growth of mega-cap stocks with strong fundamentals has significantly boosted many market-cap-weighted passive index funds.

In the US, this success story has been driven by tech giants like Nvidia, Microsoft, and Alphabet, part of the ‘Magnificent Seven’ group that led the rally in the S&P 500. In Australia, the financial and materials sectors have fuelled the growth of the S&P/ASX 200.

Since passive funds track indices like the S&P/ASX 200 or the S&P 500 and weight their components based on market capitalisation, the largest companies dominate the index. This creates an embedded risk that investors might be overlooking: concentration.

Take the S&P 500 Index, for example, which is the most popular benchmark for US stocks. Over the past decade, the share of the index's market value held by the top 10 companies has surged from 14% to 33%. This means that investing in the S&P 500 increasingly depends on the performance of these top 10 companies, most of which are tech giants.

Similarly, concentration risk is evident in the ASX 200. The top 10 constituents of the ASX 200 account for a significant 47% of the index. Commonwealth Bank and BHP alone make up a large portion of the index.

If these companies face challenges or their sectors decline, the entire index, and thus the portfolios of passive investors, could take a hit.

This concentration risk is further exacerbated by the cyclical nature of sectors like financials and materials, which are highly sensitive to economic shifts. Therefore, any downturn in the economy could lead to significant losses for investors who are overexposed to these sectors.

The case for active management

Active managers can uncover relatively unknown opportunities by selecting high-conviction stocks of all market caps, going beyond simply tracking the market.

This is especially true in categories such as small-caps, mid-cap international equities, and fixed income, where skilled managers can navigate complex market dynamics and outperform passive funds by exiting troubled positions early or avoiding them altogether.

Morningstar’s Active/Passive Barometer 2023 shows that mid and small-cap active funds have beaten their passive counterparts by 1.4% per year over three years and 2.9% over a decade. Almost 90% of these active funds outperformed passive ones over ten years.

Active funds like Allan Gray Australia Equity and Perpetual Australian Share highlight the benefits of this hands-on approach.

Allan Gray Australia Equity A posted an 11.76% return over the last year with its contrarian approach, which targets overlooked opportunities. Similarly, Perpetual Australian Share generated an 8.55% return by investing in undervalued Australian industrial and resource stocks.

Active funds also often get a boost by participating in share placements or IPOs, which can further enhance returns.

That said, this advantage doesn’t always apply to large-cap active funds, which have had a tougher time consistently outpacing passive funds. Finding overlooked opportunities in the well-researched large-cap market can be challenging, and only the top-performing active funds tend to beat the index.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Active investing in fixed income

Equities often steal the spotlight, but fixed income also presents a strong case for active management, especially with current expectations of Fed rate cuts.

While passive bond funds, which follow broad indices, might struggle to deliver solid returns in a low-rate environment, active bond managers can spot high yield opportunities and adjust their strategies to better navigate interest rate changes.

Fixed income ETFs now constitute 14% of the total Australian ETF market, a substantial increase from the 7% market share they held ten years ago.

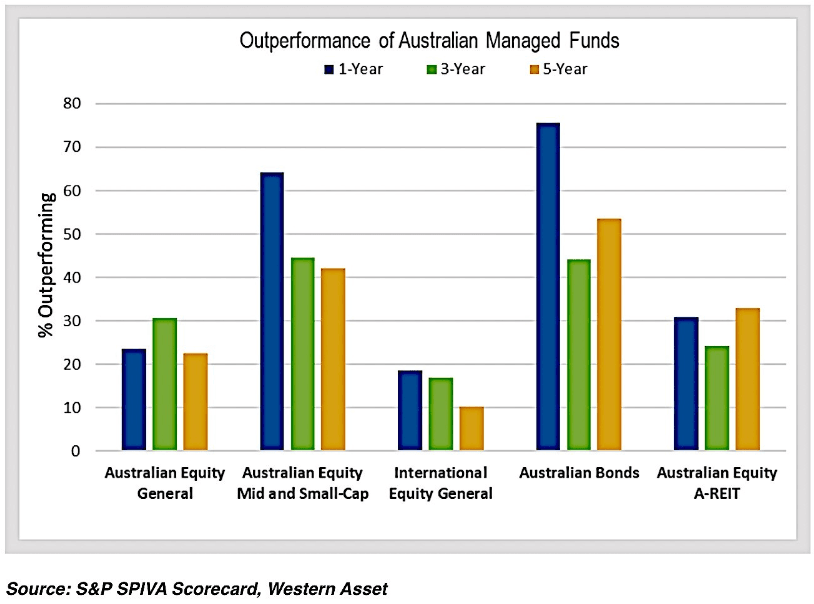

This advantage is evident in the SPIVA scorecard, which surveys active fund performance against their benchmarks. It highlighted 2023 as an exceptional year for Australian active bond funds, with 74% outperforming the index.

In fact, active managers have been particularly successful in navigating credit risk and duration adjustments, benefiting from favourable market trends.

For instance, the Perpetual Dynamic Fixed Income Fund posted a 6.74% one-year return by actively managing its credit risk and duration.

Active management has also proven valuable in the high-yield bond category. Over the past year, high-yield bond funds have returned 8.8% on average.

The Mutual High Yield Fund is a standout example with a one-year return of 11.6%. Its focus on structured credit and shorter credit durations helped it protect its capital value during market volatility.

Active bond ETFs also becoming popular

The rise of active bond ETFs is giving investors more options to tap into the expertise of active managers while enjoying the flexibility and lower costs typically associated with ETFs.

Though less popular than passive ETFs, active fixed income ETFs have been gaining market traction due to their ability to selectively allocate to the most attractive bond issuers.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Maximising returns with active investing

The true strength of active management is its flexibility and responsiveness to market shifts. By providing better downside protection, enhancing diversification, and capitalising on short-term market movements, active strategies can create long-term value for investors.

This dynamic approach has the potential to offer not only better returns but also a smoother investment journey.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.