What investors need to know as AI grows up to become AGI

Simon Turner

Wed 15 Jan 2025 7 minutesDoes the acronym AGI inspire the same mix of excitement and terror in you as AI does? Probably not, but that may change soon.

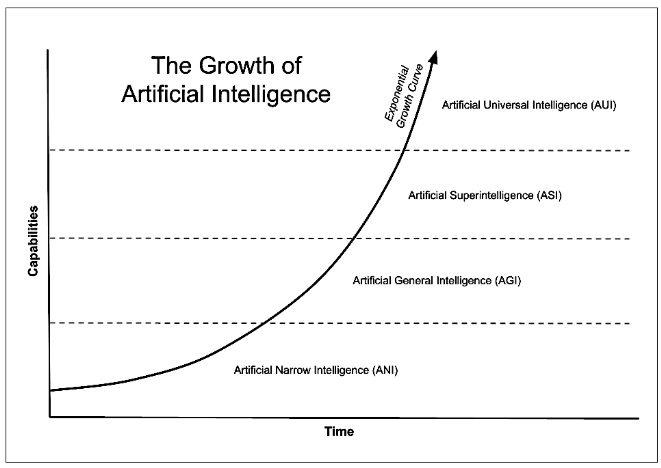

AGI stands for Artificial General Intelligence. The difference between AI and AGI is that Artificial General Intelligence is at least as good as human intelligence for a wide range of tasks that require intelligence.

According Sam Altman, the CEO of OpenAI, AGI is coming this year which means that, for the first time in history, ‘computers will be able to automate the great majority of intellectual labour’.

In other words, many of us were right to worry that artificial intelligence is indeed coming for our jobs.

The ramifications are also significant for investors…

AI remains a young investment thematic

Despite the fact that it’s has been in development for at least half a century, AI only really came to the fore as a global investment theme in late 2022 when OpenAI unveiled its latest version of ChatGPT to the world.

It’s important to bear in mind just how transformative that step was—and also how early we’re at in AI’s development curve.

In the two short years since then, generative AI's large-language models have significantly increased in size. OpenAI's current AI model, GPT-4 already has ten times the parameters of GPT-3.5, resulting in greater flexibility and reduced errors.

AI models have also become smaller in that period, enabling their use on mobile devices and reducing their reliance on centralised servers. That’s great news from an energy, convenience, and performance perspective.

In addition, many AI models are now multi-modal, which means they’re capable of processing audio, video, and text inputs.

The theme behind these evolutions is inescapable: AI is evolving fast.

Enter Artificial General Intelligence

According to Mr Altman, AI is on track for its biggest leap forward ever this year. He believes 2025 is the year when AI transitions into Artificial General Intelligence (AGI), meaning it will be at least as good as human intelligence for most tasks that require intelligence.

OpenAI’s latest AI model, known as o3, represents solid progress toward AGI, performing well versus previous models.

However, there’s still a gap to bridge before OpenAI achieves AGI. François Chollet’s recent evaluation of o3 concluded: ‘I don’t think o3 is AGI yet. o3 still fails on some very easy tasks, indicating fundamental differences with human intelligence.’

It’s worth bearing in mind that OpenAI is incentivised to fast-track the development of AGI care of OpenAI’s deal with its largest shareholder Microsoft.

The issue is Microsoft has invested a cool $US13 billion in OpenAI to date in return for access to the company’s AI technology—which it has already integrated into software products. However, their deal doesn’t cover OpenAI’s future AGI models.

So as and when OpenAI develops AGI, Microsoft will need to pay a lot more for access, otherwise it will need to let OpenAI pursue AGI deals with their competitors.

Given their dependence on Microsoft to date, it seems likely that OpenAI are keen to move beyond their Microsoft partnership by broadening their customer base.

So a lot hinges on the development of AGI for both OpenAI and Microsoft. As such, it’s possible that the talk of AGI arriving this year may relate more to their evolving contractual discussions than to the arrival of a game-changing technology investors should be aware of.

Mr Altman concurs: ‘My guess is that we will hit AGI sooner than most people think, and it will matter much less … it’s like, AGI can get built, the world goes on mostly the same way (except) the economy moves faster, things grow faster.’

If Mr Altman is correct, we’re likely to see OpenAI’s AGI technology quietly emerge this year without a correspondingly large economic or investment impact.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Enter Agentic AI

The other evolution we’re likely to see in 2025 is the arrival of ‘agentic AI’ which takes on moderately complex tasks on a users’ behalves with their permission, but without requesting step-by-step instructions.

Google’s CEO Sundar Pichai has already starting referring to this year as the beginning of the ‘agentic era’, although it’s ‘still in the early stages of development’.

In other words, get ready for your phone to start making suggestions which AI agents believe may be helpful.

For example, an AI agent on your phone may notice you’re stuck in traffic and may offer to send a message to your next meeting to let them know you may be late.

Be ready to be bombarded by helpful voices with positive intentions.

The AI Holy Grail is coming ‘in a few thousand days’

So you’ve possibly come to terms with AGI’s likely arrival in our lives, but there’s a bigger development coming in the next few years that’s more likely to be a game-changer … the arrival of the AI holy grail: artificial superintelligence (ASI).

ASI performs above human intelligence on all fronts, and is ‘at least a few thousand days away’ according to Mr Altman.

The impending arrival of ASI scares many experts, including Mr Altman (despite the fact he’s instrumental in developing the technology) …

‘…there is a long continuation from what we call AGI to what we call super intelligence, and that’s when we should get worried. I expect the economic disruption to take a little longer than people think because there’s a lot of inertia in society, but then for it to be more intense than people think. So, in the first couple of years, maybe not that much changes. And then maybe a lot changes in the economy.’

It’s fair to say, once AI evolves into ASI, life as we know it is likely to change in a million ways. This is a big deal for workers and investors alike.

Investment implications

We believe there are six main investment implications investors should be aware of:

Whether or not AGI arrives this year doesn’t change the likelihood that AI is here to stay as a dominant long-term investment theme.

Investors are likely to search for ways to play this theme beyond Nvidia in 2025.

On that note, Microsoft is also a dominant AI play although the OpenAI deal evolution remains a short term risk to be aware of.

Google is emerging as another dominant AI player with the ‘agentic era’ expected to start benefitting the business this year.

If the AI investment theme once again dominates markets in 2025, growth funds are more likely to benefit than value funds since most AI-focused stocks are trading at higher valuations.

One of the best ways for most investors to gain exposure to this fast-evolving investment theme is to invest in a managed fund with the requisite specialist experience, or in a targeted ETF with a diversified portfolio of relevant stocks such as Global X Morningstar Global Technology ETF.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

AI likely to remain a dominant global investment theme

AI is here to stay as an investment theme regardless of whether OpenAI achieves AGI this year. In fact, the arrival of AGI may be an investment red herring.

Whilst the ascent of AI sector may have outpaced its economic potential in the short term, its long-term significance is hard to argue with. If the industry is on track to achieve ASI within a few short years, the implications are significant for all parts of the global economy.

Watch this space and be ready for heightened volatility along the way.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.