Time to make higher interest rates your friend

Simon Turner

Fri 7 Jul 2023 5 minutesIf you follow the financial news closely, you may be tired of hearing about the RBA’s incessant rate rising and the resulting tales of woe around the country. It sometimes feels like interest rates are monopolising the airwaves at the expense of everything else. But what if hearing the words, “The RBA raises rates yet again,” were to inspire joy in your world (or at least indifference) rather than dread?

Australia is particularly exposed to higher interest rates

Let’s start with the sobering news.

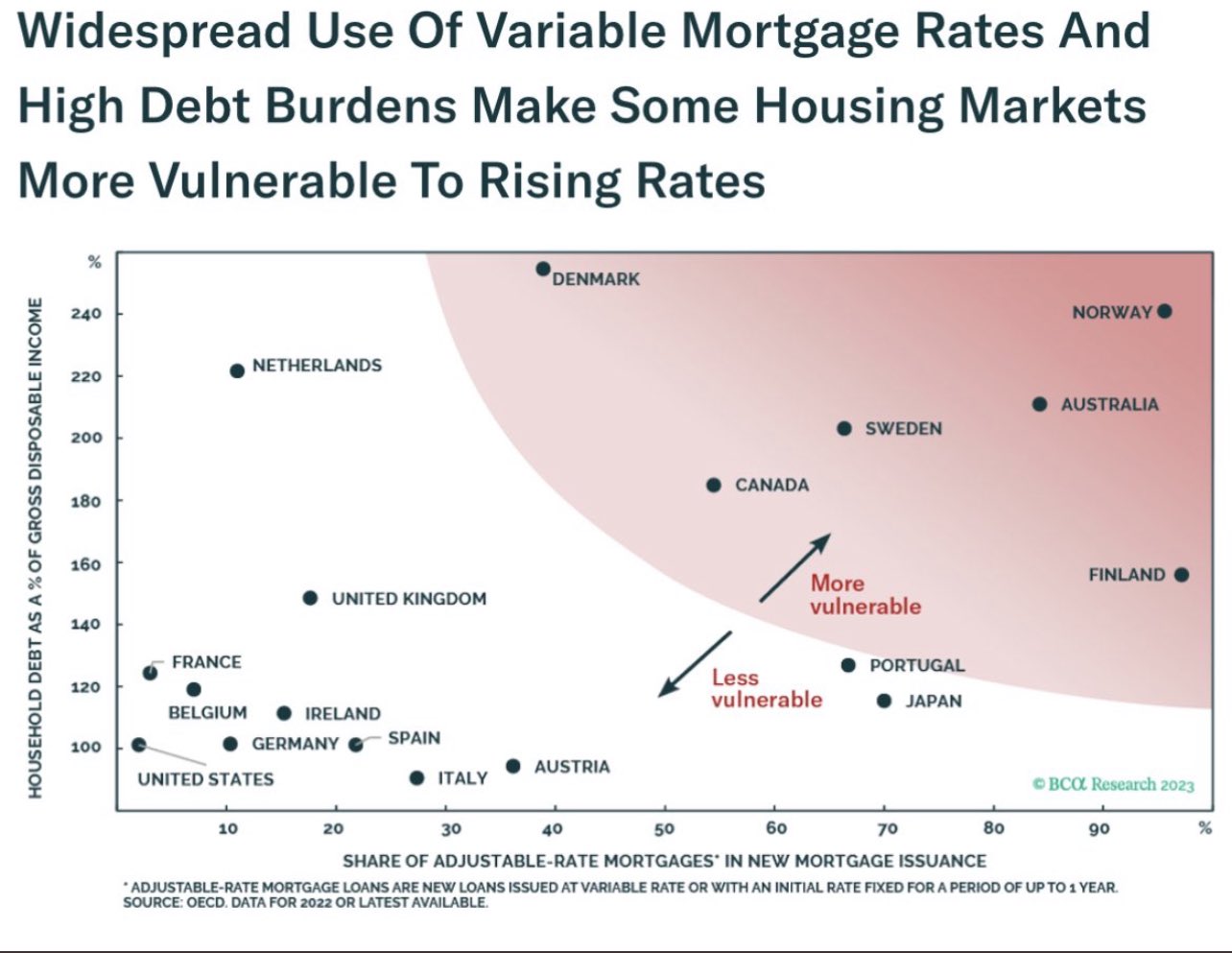

Australian mortgagees are particularly exposed to the rising rate cycle due to the country’s heavy prevalence of variable rate mortgages and the high level of household debt. As shown below, both these metrics place Australia at the vulnerable-to-rising-rates end of the global spectrum.

In other words, there’s a large and growing population of Australian mortgagees who are grappling with how to handle higher interest rates at this very moment.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How to transform a vulnerability into a strength

Transforming a vulnerability into a strength may sound like personal training advice at the gym, but it’s core to navigating any financial challenge—including rising interest rates.

As most personal trainers will concur, the starting point is your mind-set toward the challenge.

In the famous words of Eckhart Tolle,

“Accept – then act. Whatever the present moment contains, except it as if you had chosen it. Always work with it, not against it.”

In the case of adapting to rising rates, Mr Tolle’s powerful advice means accepting that central banks around the world, including the RBA, remain in the midst of a rate raising cycle.

It also means accepting that most economic experts didn’t predict such an aggressive response from central bankers.

Case in point…many Australian economists expected a pause at the RBA’s June meeting—but the RBA rose rates for a twelve time whilst their rhetoric suggested they aren’t finished.

And let’s not get started on how inaccurate the longer term rates guidance by the RBA’s Governor proved to be.

Once we’ve accepted that truth, putting too much weight on economists’ predictions of how high the RBA will raise the cash rate may well prove fruitless.

In fact, Mr Tolle’s quote may contain more valuable advice for navigating future interest rates than any economist.

Welcome to wherever you are

Once we’ve accepted that rates are rising and the experts don’t know how high they’ll go, we can look at our own position with fresh eyes.

We can also stress test our financial position in the event interest rates continue rising beyond current expectations.

For example, how will you be impacted if the RBA’s cash rate is increased from the current 4.1% to 5.1%? Or 6.1%? Or higher?

When you ask yourself these questions, remember that few expected rates to be where they are now a year ago.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

How to make higher rates your friend

So you’ve accepted that interest rates are on the up. That’s a great start. It’s now time to “work with it, not against it.”

Everyone’s situation is unique to them, but here are some strategies which may help you reposition yourself to thrive in a world of higher interest rates:

For homeowners struggling with the impact of higher interest rates on their disposable income (otherwise known as mortgage stress), it may be time to develop or fine-tune a financial plan which allows you to raise your income and reduce your expenditure. On both sides of that equation there are numerous proactive strategies which in combination could add up to a game-changing improvement in your disposable income. For example, to raise your income you could consider learning a new skillset, adding a side-gig to your repertoire, asking for a pay rise, or developing a passive income source. Bearing in mind additional savings can be used to pay down debt or save on interest care of your mortgage offset account, the incentive to save hasn’t been so strong for many years.

For property investors struggling with the shift from positive to negative cash flows from their investment property portfolio, it may be time to sell an investment property, repay some debt, or reduce your personal expenditure. By ensuring you’re positioned to navigate future rate rises without undue stress which forces you to take unintended action, you’re ensuring your investment objectives can be achieved over the long term.

For investors whose portfolios have suffered in the face of higher interest rates, it may be time to ensure you’ve got an appropriate portfolio weighting in assets and companies which benefit from higher interest rates. For example, the financial sector has historically benefited from rising rates. Companies such as banks, insurance companies, brokerage firms, and money managers may be well positioned to benefit in a higher interest rate world.

Financial peace of mind is the goal

Another famous quote to conclude with… “With acceptance comes peace.”

By accepting that interest rates may continue rising, home owners and investors can take an important step toward empowering themselves to thrive independently of the outcome of the RBA’s monthly meetings. That in itself could be a game-changer for many.

The best time to take any required action or to seek advice is now.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.