Why lithium gets investors’ hearts racing

Simon Turner

Fri 14 Jul 2023 5 minutesIt won’t have escaped most investors’ attention that lithium continues to reign supreme as the market’s hottest commodity. Lithium stocks such as Pilbara Minerals (ASX:PLS) and Allkem (ASX:AKE) are once again amongst the strongest performers on the ASX year to date.

As with all investment themes, it’s worth delving deeper than the lithium headlines and associated stock outperformance to understand the longer term investment case.

Undersupply the name of the game

The lithium investment case can be described in one word…undersupply.

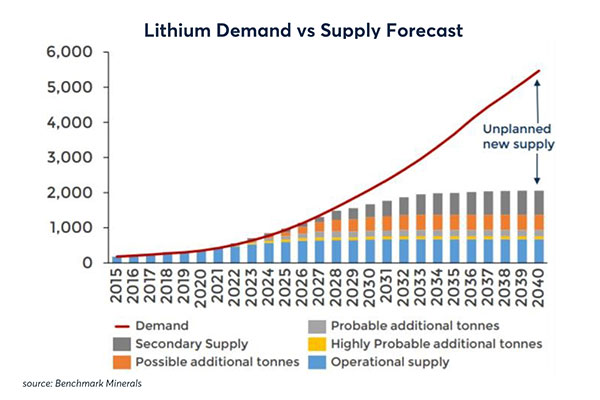

As shown in the chart below, demand for lithium is expected to significantly outgrow supply in the coming decade and beyond.

Lithium’s primary demand growth driver is the transition towards a carbon neutral world which depends upon massive lithium resources to supply the expected rollout of electric vehicles and energy storage systems, both of which rely heavily on lithium-ion batteries.

For example, each Tesla battery contains between 5 and 75 kg of lithium.

Electric vehicles have increased from 0.7% of global sales in 2015 to 14% in 2022, so a structural change in lithium demand is well underway.

Hence, we’re talking enormous growth in expected lithium demand as the energy transition accelerates.

The International Energy Agency (IEA) expects lithium demand to grow more than 40-fold by 2040 if the Paris Agreement carbon reduction goals are to be met.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

High lithium prices would encourage more investment

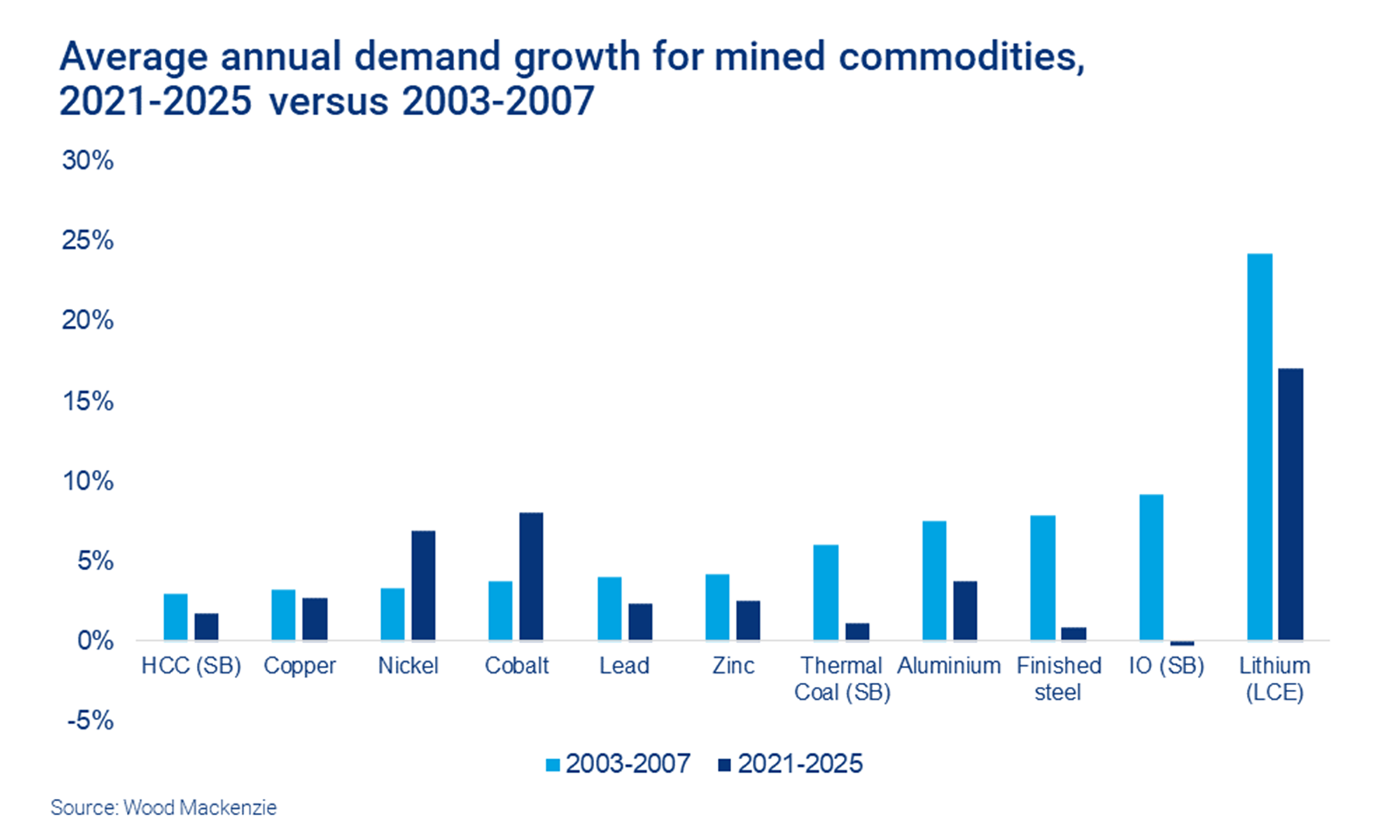

Most analysts agree that lithium demand growth will remain strong as illustrated in the bullish Wood MacKenzie lithium forecasts below.

Assuming forecasts such as Wood MacKenzie’s are roughly correct, it will be challenging for lithium supply to match these growth rates, hence the expected lithium undersupply over the coming decade and beyond.

One caveat when discussing commodity undersupply forecasts…The way commodity markets tend to work is that once the economic incentive to increase supply is attractive enough and demand expectations are firmed up, investors will fund the required supply growth—and often more.

In other words, if the lithium price is high enough supply growth is likely to be higher than many analysts forecast at this juncture.

There are two implications for investors to be aware of:

The potential for higher lithium prices is significant as the energy transition gathers pace.

In the event of higher lithium prices, it will be prudent to keep a close watch on lithium supply growth which is likely to be higher than is currently expected.

Bear in mind the short term headwinds

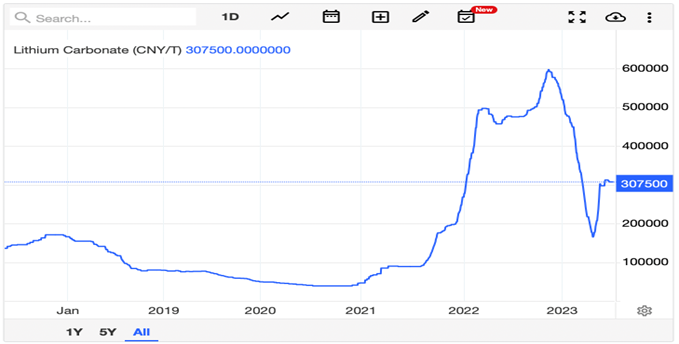

It’s not been all good news for lithium thus far into 2023 as shown in the commodity’s volatile price performance below.

One of the main reasons for lithium’s year-to-date weakness is China’s withdrawal in January of its subsidies for electric vehicle purchases after a decade of support. Carmakers responded by increasing discounts in order to maintain their Chinese electric vehicle sales growth.

In addition, a major lithium discovery occurred in Iran which is expected to increase global reserves by 10%. The quality of the massive 8.5mt deposit as well as Iran’s ability to mine and export it remains to be seen.

The net impact of these two developments have created a short term headwind for lithium which may continue to play out in the coming months.

In fact, Goldman Sachs expects lithium prices to decline over the next 18 months. Many lithium players believe this forecast is too bearish, but lithium is famously volatile so predicting short term price moves is often more about moving against the herd than the commodity’s underlying fundamentals.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Not all lithium projects are created equal

It’s also worth being aware that there are two main types of lithium projects: hard-rock spodumene projects and lithium brine.

In simple terms, hard-rock spodumene projects utilize proven technologies to extract lithium from the earth in rock form. These projects are generally valued at a premium due to the efficient process and the attractive economics which lowers the risk profile.

In contrast, lithium brine projects tend to trade at a discount as they are regarded as higher risk and less efficient. This process involves evaporating everything else out, leaving the lithium carbonate behind after expending a lot of resources.

As with investing in general, it’s advisable to ensure you’re aligned with the risk profile of a lithium company/project before you invest.

Lithium’s crown not going anywhere soon

The transition to a net zero world is just getting started, and that means demand growth for lithium is in the early stage of a very long term innings.

There will be plenty of ups and downs along the way, and lithium faces ongoing headwinds in the coming months. However, lithium’s chronic undersupply challenge implies higher prices are likely to be needed to incentivise sufficient supply growth in the coming decade and beyond.

In other words, long term investors are likely to be rewarded for staying the lithium course, whilst shorter term investors are likely to be well served by doing the opposite to the herd.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.