If the Australian Mortgage Fund Sector Were to Follow the Example Set in the US

Simon Turner

Mon 8 Sep 2025 5 minutesThe Australian mortgage fund sector has grown to become an important bridge between investor capital and property lending. While the sector remains comparatively young, its recent trajectory invites a compelling question: what if the sector were to follow the path carved out by the more mature US market? The answer may provide valuable insight into the opportunities and risks that lie ahead…

Australia’s Mortgage Fund Sector: Scale & Growth Drivers

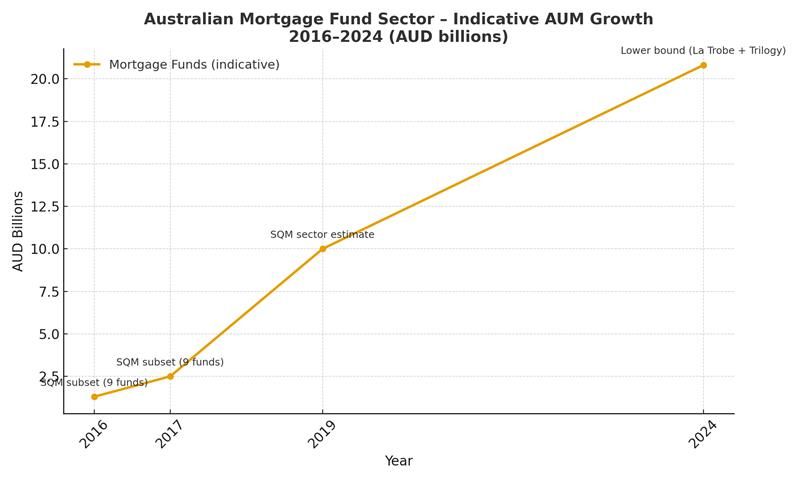

Australia’s mortgage fund sector has grown significantly in recent years, as per the market size estimates below.

It’s easy to understand why. In recent years, the local mortgage funds have benefited from a number of structural growth drivers:

Bank retrenchment from many commercial property loan markets.

Greater non-bank flexibility in niche lending segments such as bridging finance and development loans.

ASIC has tightened its liquidity and disclosure norms, while APRA has raised its lending standards.

The upshot is the mortgage fund sector has been filling gaps left unaddressed by the banking sector, and is well-positioned to continue doing so looking forward.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The US Comparison

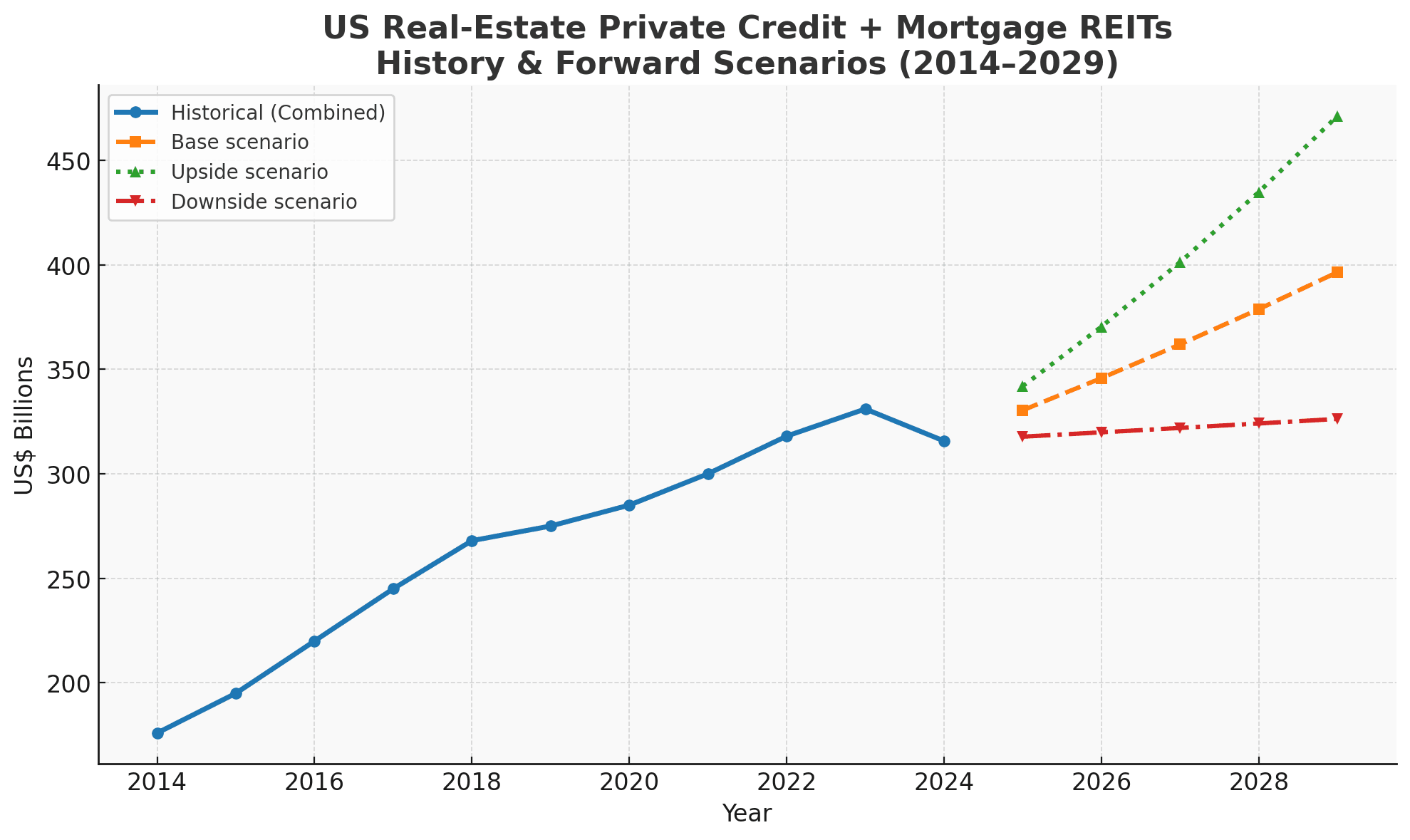

Real-estate private credit and mortgage REITs are the US equivalent of Australian mortgage funds, and have also been growing over the past decade. The combined pool of U.S. real-estate private credit and mortgage REITs have benefitted from a surge in private real-estate debt fundraising as institutional investors have increasingly sought stable, floating-rate returns from property credit.

Here’s an estimate of the historical and expected growth of the US real estate private credit and mortgage REIT markets.

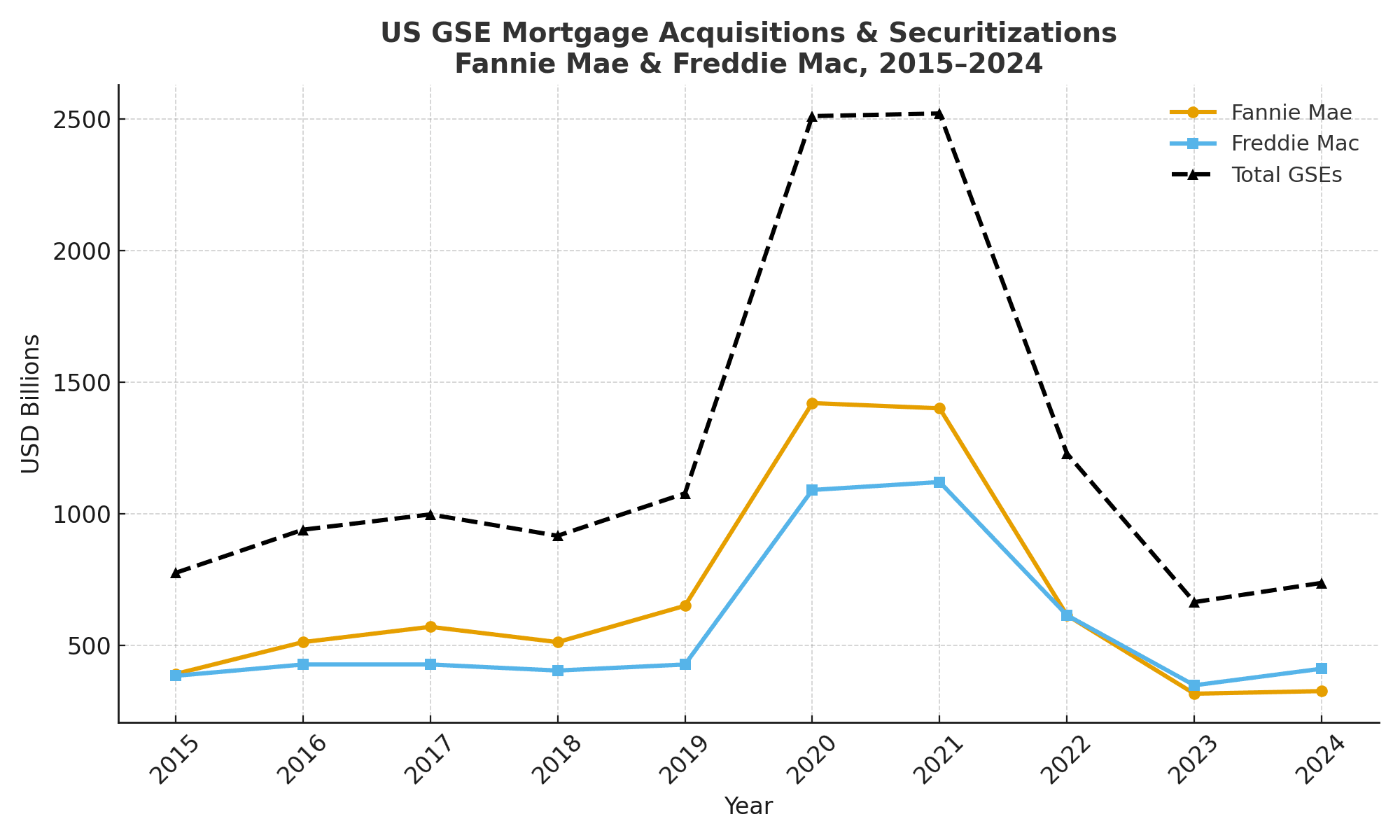

In addition, there’s also the enormous Fannie Mae and Freddie Mac markets which are US Government sponsored initiatives aimed at providing liquidity to the country’s mortgage market. These markets represent the world’s most systemically important mortgage market, and have been on a rollercoaster ride over the past five years. In short, there was an historic pandemic-era surge, followed by a rate-driven contraction, and now we’re witnessing the first signs of market stabilisation—as shown below.

For the purposes of this discussion, we’ll be excluding Fannie Mae and Freddie Mac from the mortgage fund comparison since they benefit from an implicit government guarantee which makes them incomparable with local mortgage funds from an investment perspective.

Having said that, it’s worth bearing in mind that these two markets support around 70% of US home loans and we don’t have the equivalent in Australia.

Australian Mortgage Funds: What If…

Australia’s mortgage fund sector sits at a crucial turning point. Having weathered the impact of higher interest rates on commercial property valuations, the stage is set for the next phase of growth.

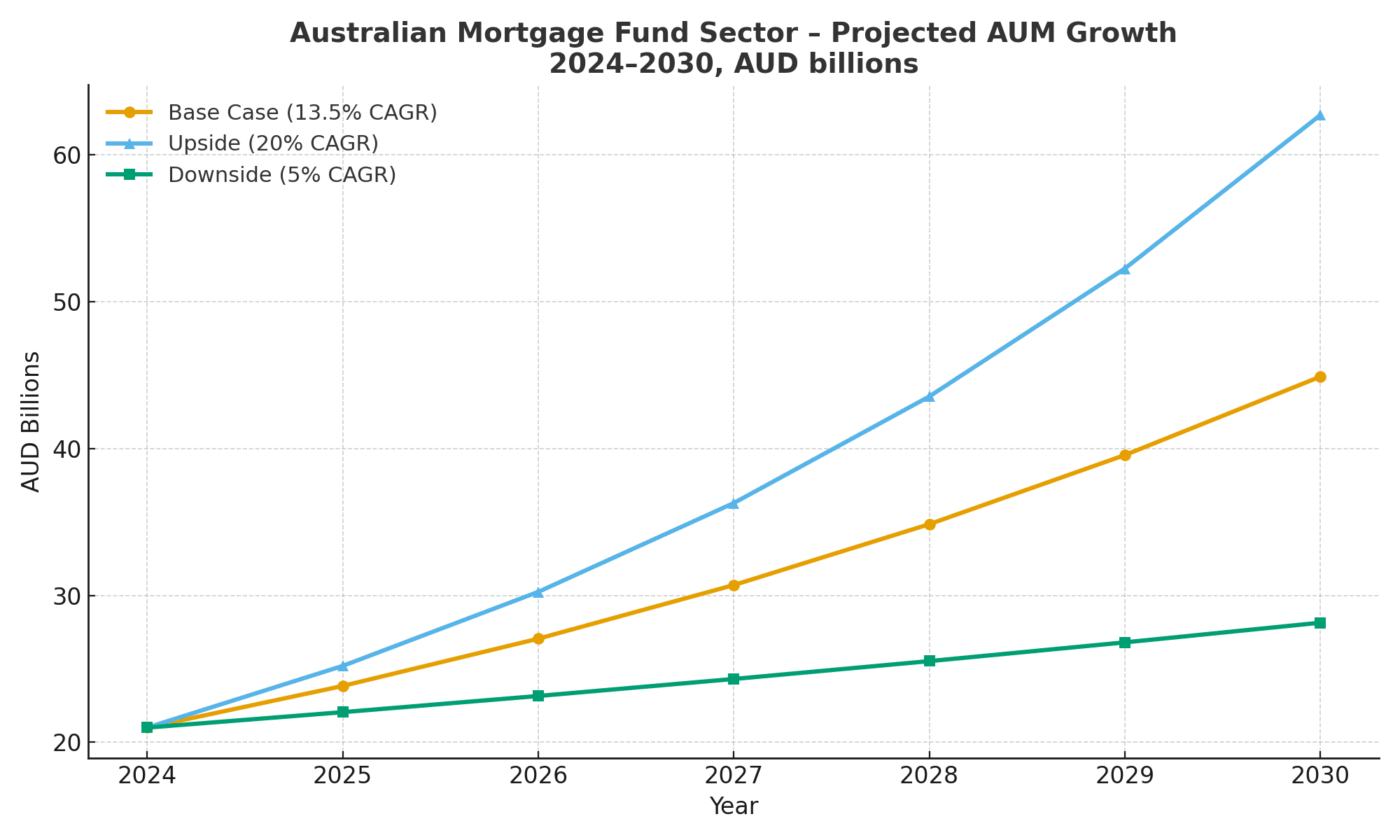

If the local sector mirrors the US pattern, low-to-mid-teens annual AUM growth looks achievable.

Under a base case, funds could climb from $21 billion today to more than $40 billion by the end of the decade. Faster and supportive regulatory changes, stronger refinancing flows, and expanding retail appetite could accelerate that to $55–70 billion. Even in a downside scenario of sluggish growth and tighter credit, assets are likely to edge higher.

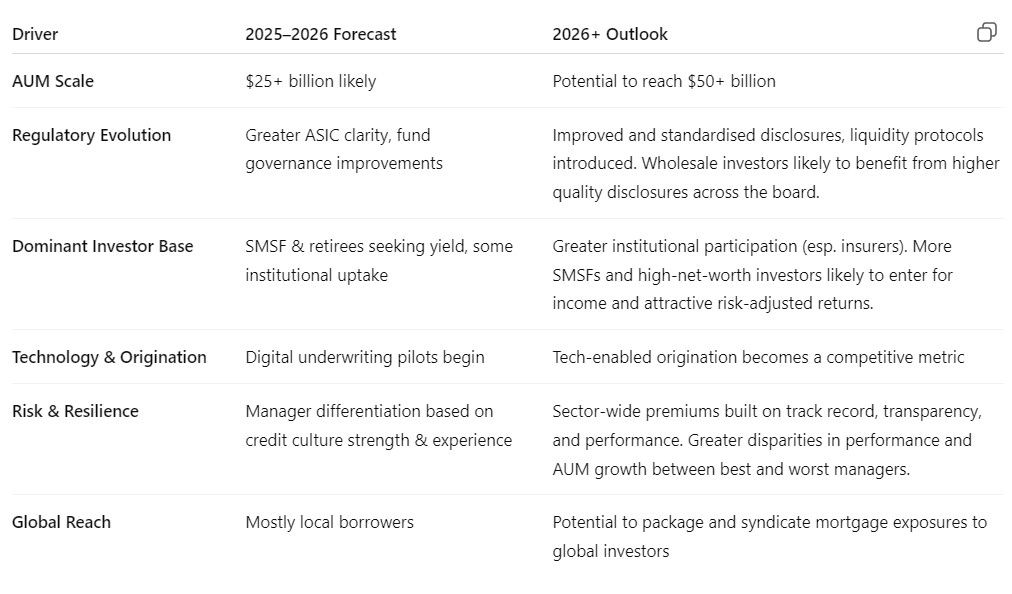

This base case scenario translates into a local mortgage fund market positioned to grow into a much larger and more sophisticated asset class which is likely to lead to a number of evolutions:

If this is a reflection of what may be coming, Australian mortgage funds are well-positioned as a fast-growing, yield-rich corner of the managed funds universe.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What Australian Investors Can Learn from the US Example

By comparing Australia’s mortgage fund market with the US equivalent, several lessons for investors emerge:

- Scale & Liquidity are Important

US Example: The scale and constancy of Fannie Mae and Freddie Mac underpin vast mortgage markets. Their securitisation model enables deeper liquidity, investment-grade instruments, and broader capital access, elements often lacking in smaller fund ecosystems.

👉 The Australian Opportunity: The local mortgage fund sector may benefit from developing securitisation frameworks and institutional support mechanisms. A move toward standardised/enhanced disclosures and potentially a central liquidity facility could help smooth cyclical capacity constraints and improve investor confidence.

- Mortgage Fund Resilience & Risk Management is Vital

US Example: Rapid non-bank expansion exposed fragilities in parts of the market, spurring calls for liquidity backstops during market downturns.

👉 The Australian Opportunity: As ASIC increases its scrutiny of the mortgage fund sector, fund managers need robust governance, transparency, and liquidity management (e.g. redemption gates matched to asset liquidity). Building investor trust through conservative LVRs, low arrears, and excellent disclosure standards will increasingly differentiate the top-tier funds from the rest of the field.

- Foster Technology & Innovation

US Example: Growth in the US mortgage market is being enhanced by rapid lending innovations and wider digital adoption.

👉 The Australian Opportunity: Mortgage fund managers who invest in credit analytics, streamline their underwriting, and build innovative digital platforms can widen their funding access, reduce their costs, and attract a broader borrower base. So technology is likely to play a greater role in driving AUM growth, and thus differentiating the sector’s winners and losers.

A Sector Poised to Mature

Australia’s mortgage fund sector, still nascent compared to the equivalent US market, has significant long-term potential. For 2026 and beyond, investors can expect double digit annual AUM growth, a shift toward standardisation and securitisation, a broader investor base, tech-enabled origination, and disciplined risk management increasingly separating the top-tier managers from the rest.

With these tailwinds at play, the Australian mortgage fund sector is likely to further evolve into a distinctive, resilient, and institutional-grade asset class.

Mortgage Funds Worth Checking Out

Click to watch 268 Fund's Insight Series Podcast

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.