Can retail investors overlook Temu's soaring success?

Ankita Rai

Wed 20 Dec 2023 5 minutesPDD, the company behind the discount-retailing app Temu, recently surpassed Alibaba to become the most valuable e-commerce player in China. In November, the market capitalisation of this Nasdaq-listed start-up reached $US195.5 billion, surpassing Alibaba's $US182.6 billion.

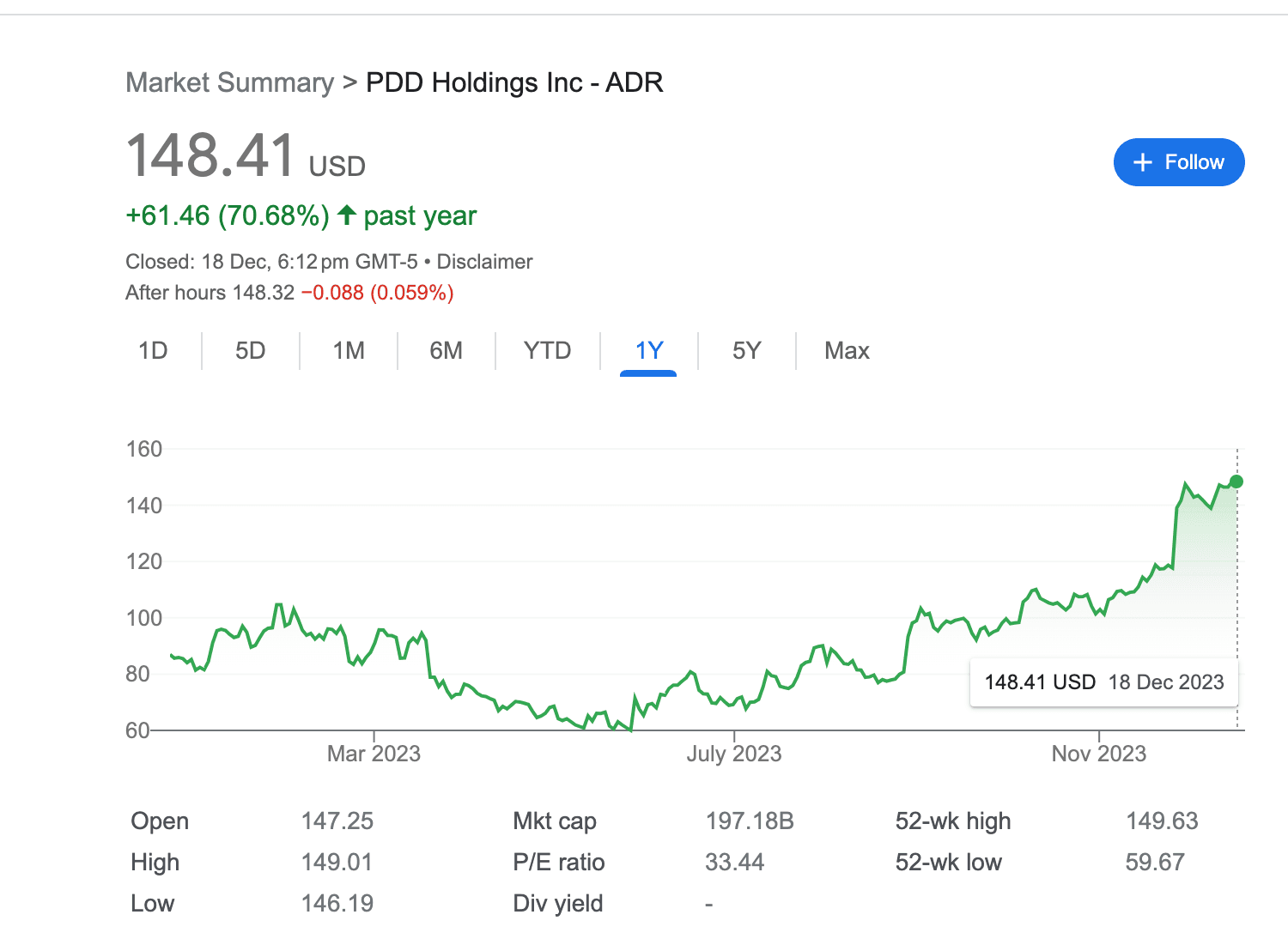

Over the past year, PDD Holdings' stock has surged by over 70% to $US148 (as shown below), driven by robust growth in the domestic market coupled with aggressive expansion overseas, led by the US.

PDD’s revenue growth has been impressive. The latest quarterly data revealed the Chinese discount marketplace experienced a remarkable 94% growth in third-quarter revenue, reaching $US9.44 billion. Revenue from transactions also soared, increasing 315% in the same quarter to almost $US4 billion.

That's no small feat for an eight-year-old upstart that’s going head-to-head with Alibaba on its home turf. At this point, the company is even posing a threat to global giants like Amazon, while established players like eBay are losing shoppers to bigger rivals such as Amazon.com and Walmart.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Taking on the discount retailers

During the past year, PDD's overseas initiative, Temu, became the most-downloaded app in the US and much of Western Europe after its rollout in September 2022—eating into the sales not just of Amazon and Shein, but also of legacy discount names like Dollar General.

It's in the US market where Temu is taking the discount store category by storm. As of November, Temu's market share has risen to nearly 17% within the discount stores category according to data analytics firm Earnest Analytics. In the realm of digital downloads, Temu maintains its lead as the most downloaded free app in the country.

This is a global trend. In September 2023, the Temu app was downloaded over 40 million times, surpassing the popularity of Amazon's marketplace app.

It’s a similar story in Australia. Temu ranked third in Australia's e-commerce rankings, outperforming local competitors just six months after launching in March. With 7.68 million monthly visits in Australia during October (SimilarWeb), Temu has already surpassed local players Kogan.com and Catch.com, who are backed by retail giants Woolworths and Wesfarmers respectively.

It’s clear Temu has become a hit among Aussie and global bargain-hunters alike.

What sets Temu apart are its addictively fun browsing and game-like features, causing shoppers to spend nearly twice as much time in the app as they do on Amazon.

Local analysts are predicting an impact on retailers like Kmart and Big W, if Temu gains further scale.

Value for money = a key growth driver

Temu's growth hinges on price leadership and delivering value for money.

The global cost-of-living crisis has been a significant contributor to PDD's exceptional gains this year, fostering demand for its mass-produced, unbranded goods—a pivotal factor in its success. In the face of high interest rates and inflation, consumers are increasingly inclined toward value-conscious shopping, providing a boost to retailers in the discount retail category. Analysts see PDD as well-positioned to continue taking advantage of the trend, thanks to its robust network of merchants.

International expansion is also a major growth driver for PDD. Since Temu's introduction in the US in September 2022, it has swiftly expanded to 47 countries, gathering 100 million active users by November. In comparison, Amazon boasts 167.2 million Amazon Prime members in the US as of 2023, showing a more modest 14.4% increase since 2020. This underscores Temu's remarkable growth trajectory.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Discovery-driven retail here to stay

The viral success of TikTok, Shein, and Temu has demonstrated that discovery-driven retail provides a superior customer experience. Unlike traditional search-driven retail models like Amazon, PDD places a premium on discovery, crafting a unique user experience that sets it apart.

Additionally, PDD enhances the shopping journey by aggregating demand and guiding consumers to their next purchase.

As a result, according to Morgan Stanley, Temu’s swift disruption of the retail sector could pose a substantial threat to some prominent legacy retail names.

With a unique user experience, competitive pricing, and a robust supply chain, PDD has the potential to carve out a sustainable niche in this market.

Navigating Temu’s impact

It's too early to determine the extent of the threat posed by Temu, whether it be upon dollar stores, discount retailers, or Amazon. However, one thing is certain—Temu's surge in popularity aligns with a period when global consumers are economising due to pressures on discretionary budgets. This serves as a significant tailwind for its current growth spurt.

For investors, it's crucial to closely monitor the evolving retail landscape as these new-age e-commerce platforms shape consumer habits, particularly among middle and lower-income users aiming to maximise their spending power. The potential shake-ups in spending habits could well catalyse even greater change across the retail sector.

Key takeaways for investors:

Temu's parent company PDD surpassed Alibaba as the most valuable e-commerce player in China fuelled by robust growth in the domestic market and aggressive expansion overseas. The Nasdaq-listed e-retailer reached a market cap of $US195.5 billion in November, surpassing Alibaba's $US182.6 billion.

Temu has become the most-downloaded shopping app in the US, Australia, and Western Europe, impacting the sales not only of Amazon, eBay, Catch.com, Kogan and Shein, but also challenging legacy discount retailers like Dollar General, which were once considered immune to economic slowdown and retail disruption.

With disposable income challenges becoming more common all around the world, Temu is well positioned for further global market share growth, which spells more disruption across the retail sector.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.