Are any asset classes defensive these days?

Simon Turner

Thu 16 Nov 2023 6 minutesIt’s been a challenging year for most investors with sharply higher interest rates leading to significant underperformance in asset classes which used to be regarded as defensive such as government bonds. The rules of the game have been turned on their head.

With most economists expecting an economic slowdown in 2024, savvy investors are searching around for defensive assets well positioned to outperform in an economic slowdown scenario. Before you make the assumption that your long-held beliefs about what’s defensive applies in this strange new world, let’s delve into what defensive means…

What is a defensive investment?

According to Degiro, defensive investing is: ‘a strategy where you take as little risk as possible and choose stable investment products that have proven themselves over the years… products that provide stable returns.’

This definition aligns with Warren Buffet’s famous quote about rules number one and two of investing being: don’t lose money. It’s hardly contentious as a definition so let’s use it.

That means we’re aiming to tick three main boxes in our search for defensive investments:

- Minimal risk and volatility;

- A high level of stability confirmed by a long-term track record;

- An expectation of positive returns regardless of what happens with the economy.

What the long-term data tells us

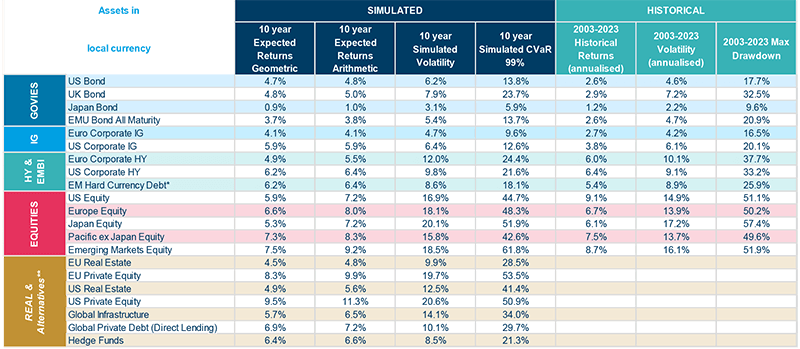

Let’s start with the global data for the past 20 years (shown below).

According to our defensives definition, we’re looking for assets which have historically generated a positive return with relatively low volatility and maximum drawdown (let’s assume a maximum maximum drawdown of 20%).

The asset classes which best tick these boxes are:

US/Euro investment grade credit – Historic returns have been 2.7% p.a. in Europe and 3.8% p.a. in the US, and their key defensive attributes are their relatively low volatility and maximum drawdowns. Some may argue that a maximum drawdown of 20.1% for US investment grade credit is high for a defensive investment but in the context of the 50-60% maximum drawdowns in most equity markets, it’s on the low side.

US/Japan government bonds – It’s similar with government bonds. Historic US bond returns have been 2.6% p.a. and Japanese bonds have returned only 1.2% p.a., while their volatility and maximum drawdown is acceptable for a defensive investment. Surprisingly, UK government bonds failed the maximum drawdown test.

Let’s not beat around the bush, that’s a short list of defensive assets. However, the data doesn’t include Aussie investment grade credit and government bonds which tick the same defensive boxes. Cash also isn’t included and it also ticks our defensive boxes.

Then there’s gold which isn’t on the list. It has traditionally been regarded as defensive although it fails the drawdown test with maximum drawdowns akin to equities. That’s not to say gold won’t outperform from here, but investors should be aware that it doesn’t always perform with defensive attributes.

What about defensive equities such as healthcare stocks? They are obviously more defensive than cyclical stocks such as mining stocks, but they still generally fail the maximum drawdown test. When equity markets are in panic mode, the selling tends to be indiscriminate.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

To the present…

2023 has been characterised by the central bankers causing havoc across financial markets by raising interest rates at the fastest pace in history. Some investors have viewed this as evidence that developed market economies are strong enough to absorb sharply higher interest rates, while others are concerned that higher interest rates will result in an economic slowdown, or even a recession.

Against this backdrop, you’d expect defensives to have performed reasonably strongly year-to-date.

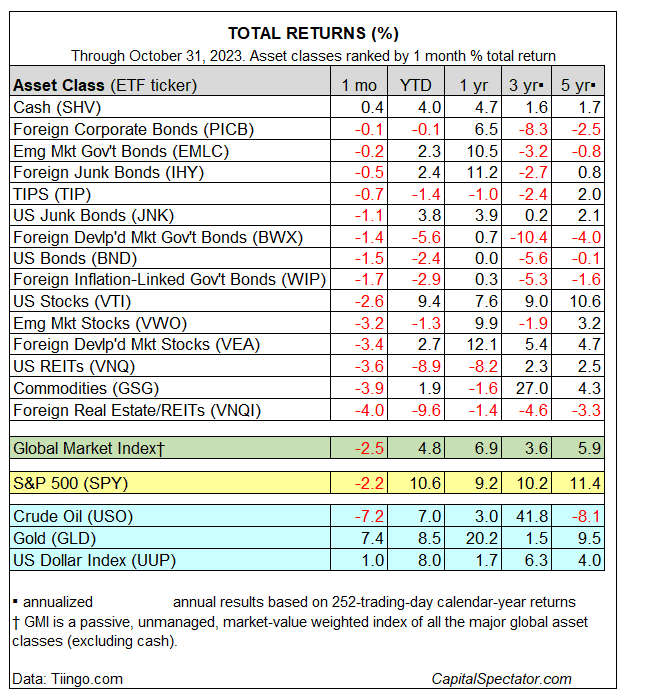

As shown below the strongest year-to-date returns have been generated in developed market equities, cash, emerging market bonds and, commodities. Cash is the only defensive asset class amongst the outperformers.

Conversely, the weakest returns have been generated in REITS and developed market government bonds. REITs aren’t generally regarded as defensive but developed market government bonds are, particularly in the US. In fact, the dramatic underperformance of long term US Government Treasury Bonds may well be the most revealing of the challenges investors are facing in their search for a port in the storm…

The defensives dilemma

The fundamental challenge with defining what’s likely to perform with defensive attributes looking forward lies in the contradictory interpretations of sharply higher interest rates and inflation common across markets…

a) On whether inflation can be contained:

If central banks’ aggressive rate raising successfully contains inflation as intended, Australian and US interest rates are most likely at, or approaching, a peak.

Bearing in mind this scenario poses ongoing economic risks, investors seeking defensive assets can look backward for the answer. Government bonds and investment grade credit are likely to outperform in this scenario, whilst economically sensitive equities are likely to underperform.

b) On how central banks respond in the event inflation can’t be contained:

But what if central bankers aren’t able to contain inflation as intended? This is the wild card scenario which is causing havoc for investors as it raises unanswerable questions such as: will the RBA and the Fed continue to raise rates if it becomes clear that their toolbox isn’t fit for purpose? And will they ignore the resultant economic carnage?

In this scenario, the definition of what’s defensive in the future is likely to be different from the past. All government and corporate bonds are likely to underperform, whilst equities with strong pricing power are likely to outperform alongside gold, cash, and investment grade credit.

So the definition of which assets are likely to perform as defensives in the coming years largely comes down to inflation and how central bankers respond. Being aware of the weight markets are likely to put on these factors is likely to help investors navigate this economic minefield.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Navigating the defensives challenge

Investors are facing an unusually challenging asset allocation decision at this juncture.

For those seeking the protection of defensive assets, it well be that the optimal strategy is to focus on assets which are least exposed to the vast array of inflation and interest rate outcomes—for example, term deposits and investment grade credit.

Whilst gold lacks the defensive attributes of cash and credit, it is also likely to outperform in both scenarios since higher inflation and lower economic growth have both traditionally been supportive of the yellow metal.

However, in this strange new world, there’s a growing risk that government bonds may not recapture their long-held position at the defensives table. That would represent a dramatic change versus the past twenty years.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.