The Cheapest Commodity in the World Right Now

Simon Turner

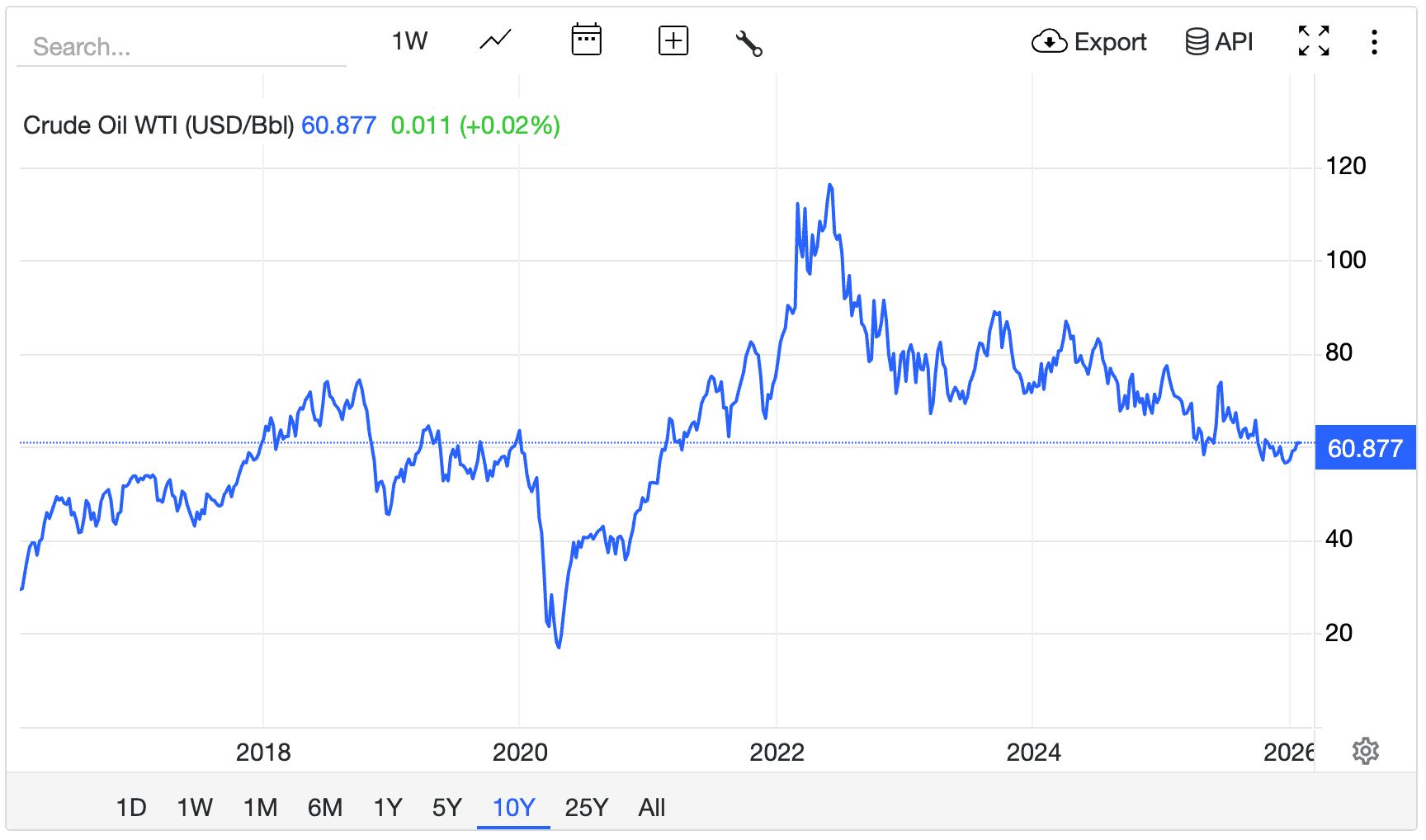

Thu 29 Jan 2026 7 minutesFor most of financial history, oil has been the beating heart of the global economy as it has fuelled transport, industry, and economic growth. But in early 2026, oil may well hold a less impressive title: the cheapest major commodity in the world. It’s currently trading at a price that defies historical patterns and conventional market wisdom.

Even as a growing chorus of market experts talk up oil’s longer term demand growth, the oil price sits near multi-year lows of around $US60 per barrel.

So what’s going on here? And what does it imply about what’s coming?

Why Is Oil So Cheap?

The current cheapness of oil reflects an unusual imbalance in oil market fundamentals.

There are two main issues at play:

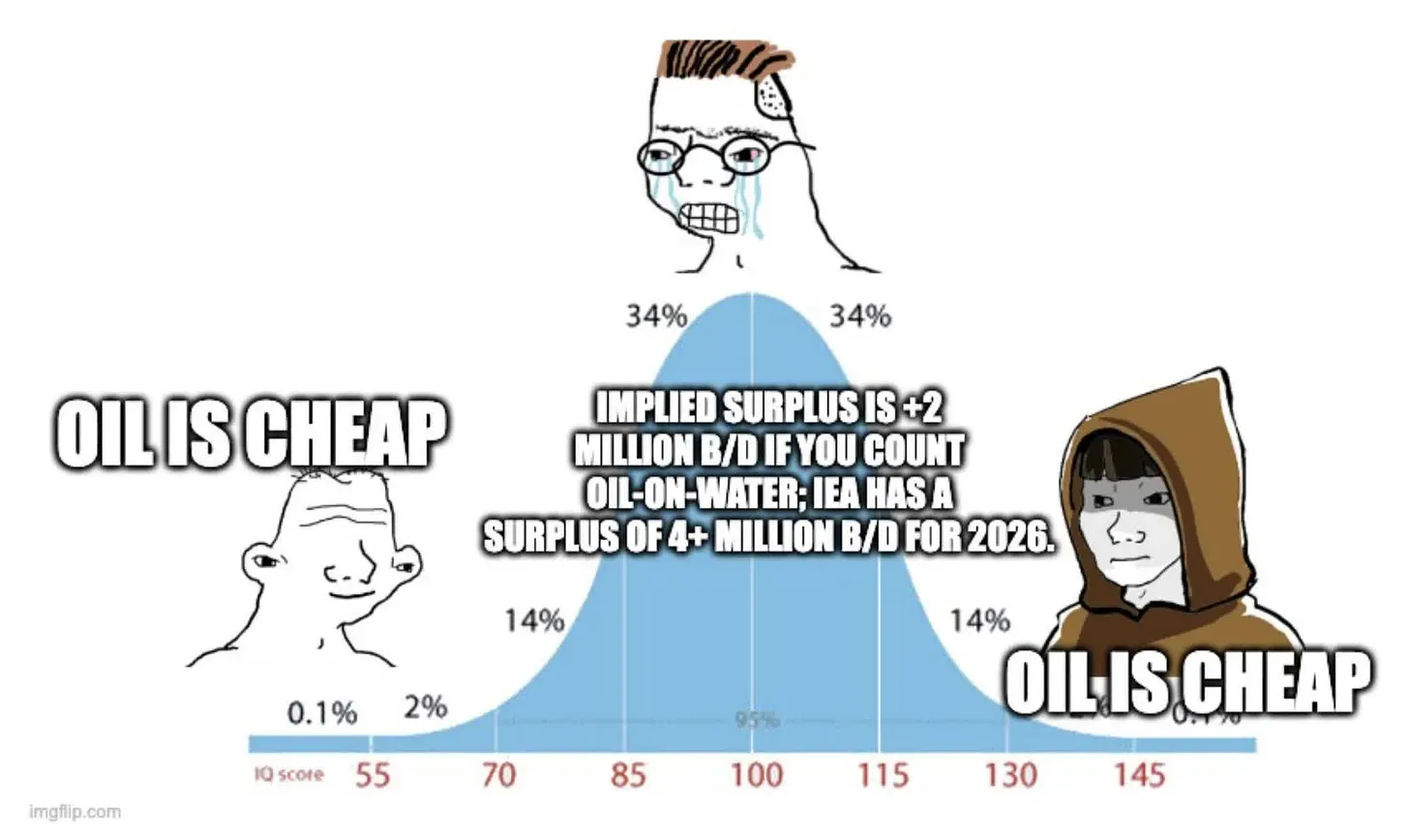

1. The popular narrative is that supply is outpacing demand by a wide margin.

The International Energy Agency (IEA) projects global supply growth in 2026 to outstrip demand growth by millions of barrels per day, creating one of the broadest gluts outside of crises like the pandemic.

This oversupply is apparently coming from both OPEC+ and non-OPEC producers. Technological advances in shale and unconventional production, deep water developments in offshore Guyana and Brazil, and resilient output from major producers have expanded global capacity.

Meanwhile, according to the IEA (who’ve consistently underestimated demand in recent years), demand growth isn’t keeping pace. Global demand is expected to rise by 930k barrels per day this year, according to their projections.

In short, this apparent combination of stronger supply growth and weaker demand growth has pushed the oil cycle toward the current low prices we’re witnessing.

2. Investor sentiment on the energy sector remains deeply bearish.

This bearish pressure has been reinforced by some in the investment community. A number of prominent oil forecasters have repeatedly revised their price expectations lower, citing persistent oversupply and structural demand headwinds.

Check out J.P Morgan’s warning from a couple of months ago:

In other words, investment banks like J.P Morgan still believe there’s too much oil relative to near-term consumption. And that belief is becoming a self-fulfilling prophecy as bearish investment positioning is reinforcing a low oil price.

The consensual view is that this will remain the case until either demand accelerates or supply is materially reined in.

What ‘Cheapest Commodity’ Really Means

Calling oil the ‘cheapest commodity in the world’ isn’t just about its low unit price per barrel versus recent history.

By most relative measures such as energy content per dollar, global risk premia, the oil-to-gold ratio, and forward price curves, oil appears substantially undervalued right now.

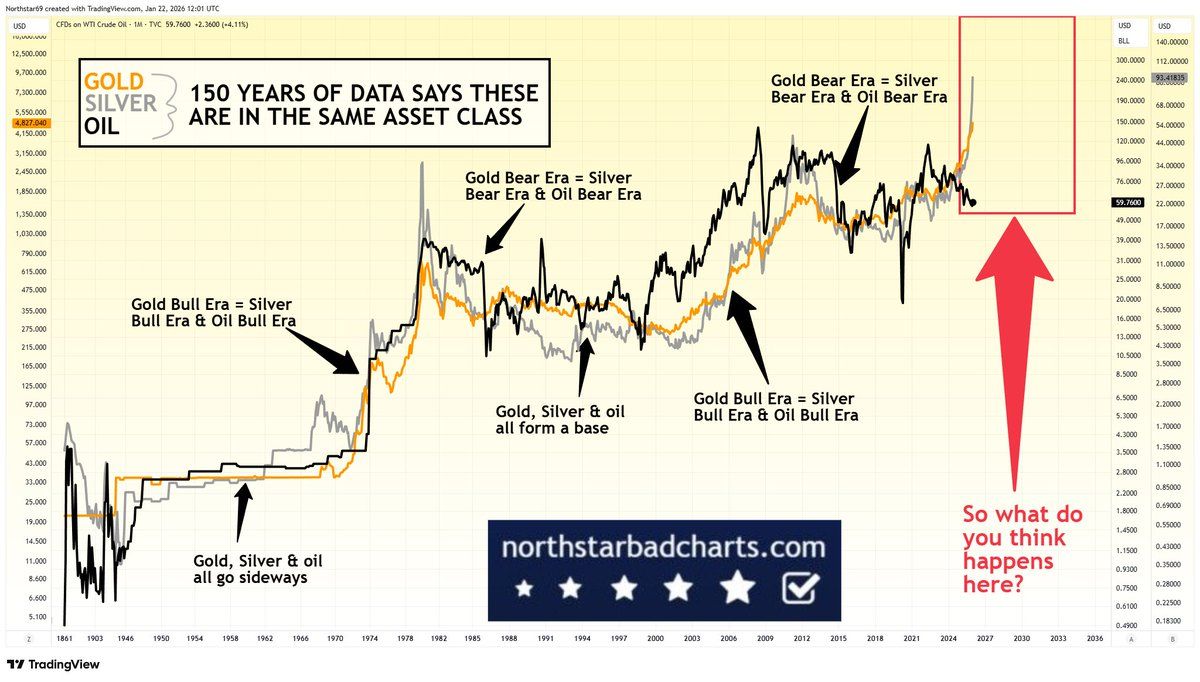

As shown below, the long-term data is supportive of oil correlating with gold and silver up until recently when oil has underperformed and the oil-to-gold ratio plummeted.

In fact, except for during the pandemic, we’ve never seen oil this cheap relative to gold. And unlike COVID, which was led by the brutal demand destruction arising from government-mandated shutdowns, this relative underperformance stems from gold surging to new record highs.

This story is far from isolated. Other commodities like copper and gold have seen structural deficits driving their prices upwards while oil languishes.

This is why more and more commodities experts are highlighting that oil may well be the cheapest commodity in the world right now.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Implications for the Future

A cheap oil environment has material macroeconomic and financial implications for markets:

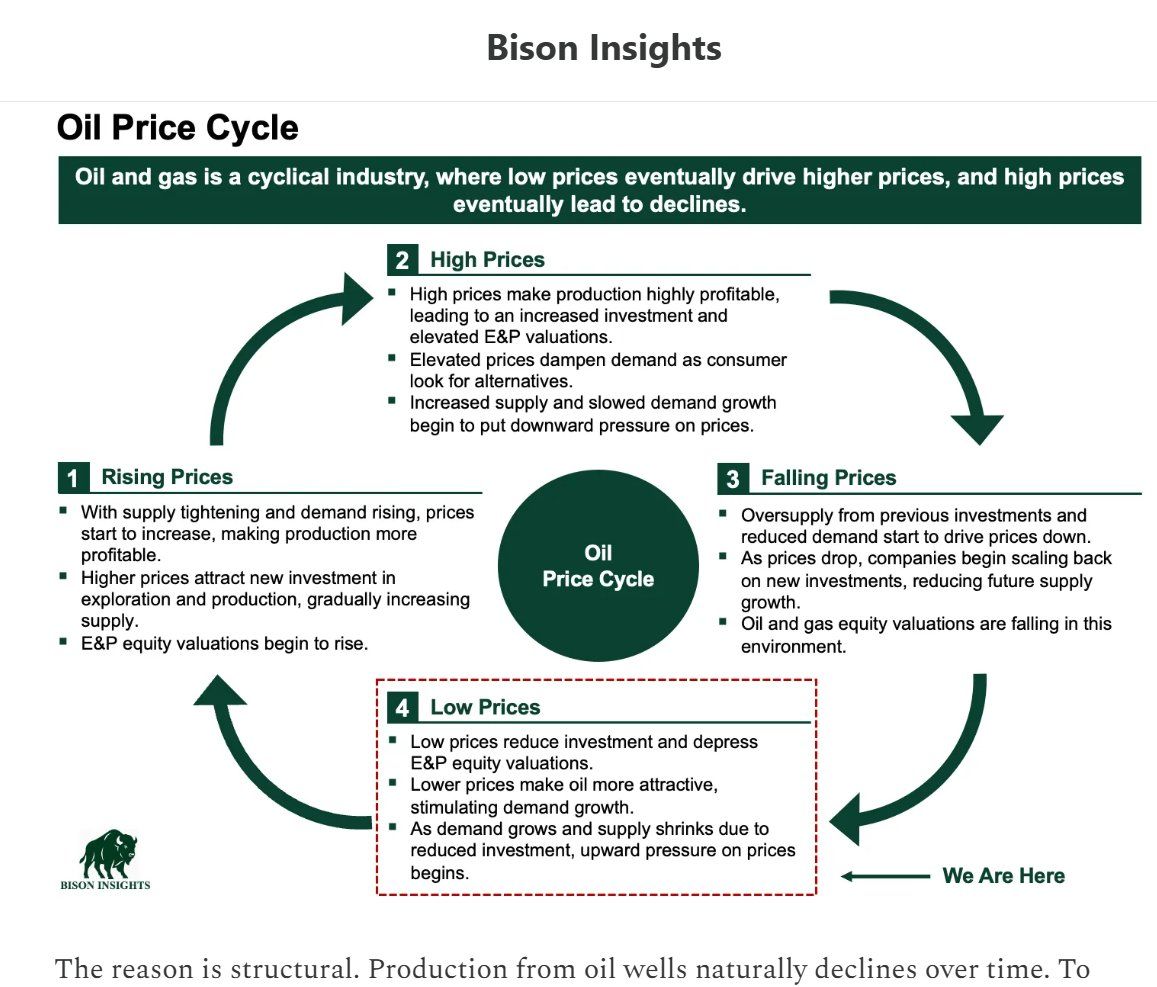

- The Oil Cycle Appears Likely to Improve Sooner Than Later.

As the famous saying goes, the cure for bear markets is low prices.

Herein lies the main reason to be bullish on oil longer term: at the current oil price, oil producers are not being incentivised to invest in expanding future production.

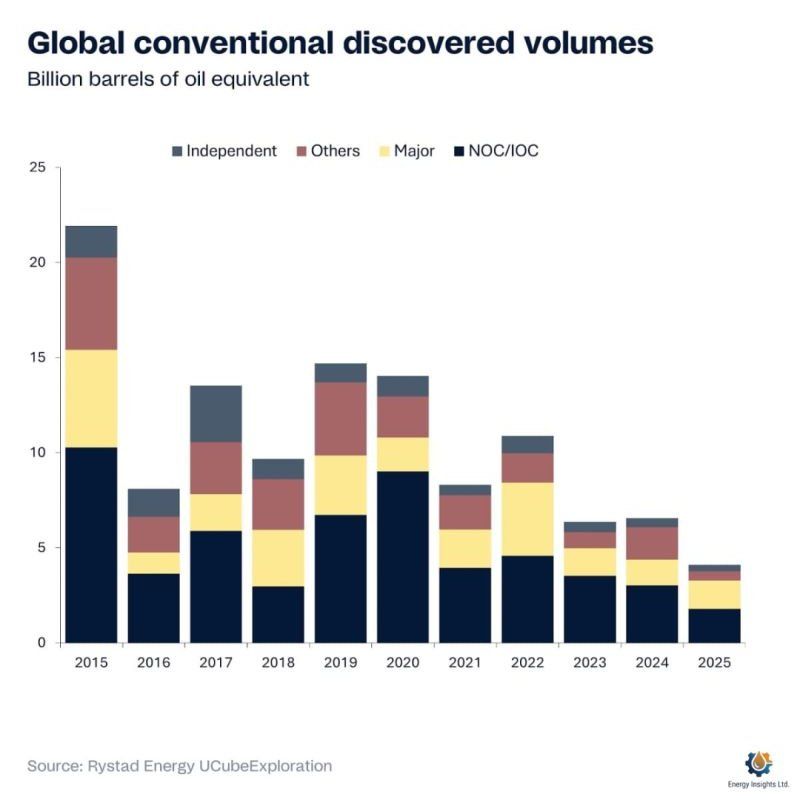

The numbers support this thesis: global oil discoveries are shrinking as a result of decreasing exploration activity and depletion of the largest, easiest-to-find fields.

This is the way cycles work. Low oil prices force producers to allocate capital very selectively. Growth capex gets deferred and production declines over time. The upshot is that the oil market could quickly tighten without new investment.

There’s only one solution to this longer term challenge: higher oil prices.

- Shifting Inflationary Pressures.

Lower energy costs have clearly exerted disinflationary pressure on the global economy, potentially altering central bank expectations and the direction of real interest rates. Global leaders such as Trump want this to happen and have been doing all they can to support lower oil prices.

However, as and when the powers that be lose control of the oil price, the upside move could be dramatic. The implications for global inflation and interest rates could be equally significant.

- Energy Sector Valuations.

With the oil price this low, the major energy companies face margin compression in their upstream operations. Only the lowest-cost producers such as Middle Eastern sovereign assets enjoy significant profitability at a $US60 oil price. Moreover, higher-cost shale, deep water, or Arctic projects are marginal or uneconomic at these levels.

As a result, the energy sector’s valuations are unusually low versus the rest of the market. If the oil price does bottom in the short term, a sharp sector rebound appears likely.

- Climate Transition Dynamics

There’s also an energy transition implication to be aware of.

Lower oil prices make fossil fuels more attractive economically relative to renewables in the short term, potentially slowing the pace of the energy transition unless carbon pricing or policy support offsets that incentive.

So once higher oil prices return, the energy transition is likely to have more economic tailwinds helping its progression.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

What This Means for Investors

There are two important takeaways for investors:

1. Re-evaluate Energy Allocations with Nuance

Cheap oil doesn’t necessarily mean the energy sector will rally immediately.

However, it’s worth remembering that energy stocks often price in price expectations well ahead of fundamentals, and at current levels many energy stocks reflect a particularly pessimistic outlook. In other words, being ready for a sector recovery in advance is likely to prove fruitful.

Picking exposures to the funds and ETFs exposed to energy sector leaders with strong balance sheets, low production costs, and disciplined capital strategies can help navigate this environment with a longer term perspective in mind.

2. Factor Energy Transition Themes into Returns

Climate-aware portfolios should arguably avoid simplistic exclusion of the energy sector.

Many oil companies are focused on raising their low carbon energy exposure, while a higher oil price would be bullish for the energy transition, especially if capital discipline and transitioning demand patterns drive future oil scarcity.

Consider investing in renewable energy funds and ETFs such as Octopus Renewable Energy Opportunities Fund (OREO) and VanEck Global Clean Energy ETF (ASX: CLNE) to capture the transition upsides of a rising oil price.

Cheap Oil Requires Investor Thought

Oil’s current cheapness reflects structural imbalances in supply, demand growth, inventory, and financial market expectations. It’s a strategic inflection point that suggests it’s time for careful energy sector positioning, scenario planning, and integration with broader macroeconomic and climate transition themes.

In a world where energy markets are reshaping global growth trajectories, understanding why oil is so cheap today might be among the more important questions investors ask themselves this year, and possibly this decade.

Funds mentioned

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.