The charts that tell the surprising story of markets in 2024

Simon Turner

Fri 19 Apr 2024 4 minutesWhat a year 2024 is turning into for global investment markets. Long term trends and playbooks are being turned on their heads on a weekly basis. It’s emerging as a year when it pays to have a long term investment plan to follow while the noise gets louder and adds to the market’s confusion. It’s also a year in which it’s important to understand why global markets are surprising so many investors to ensure you remain unsurprised by what’s happening, and thus comfortable sticking with your plan.

Here are a few charts which may provide context…

The charts that tell the story

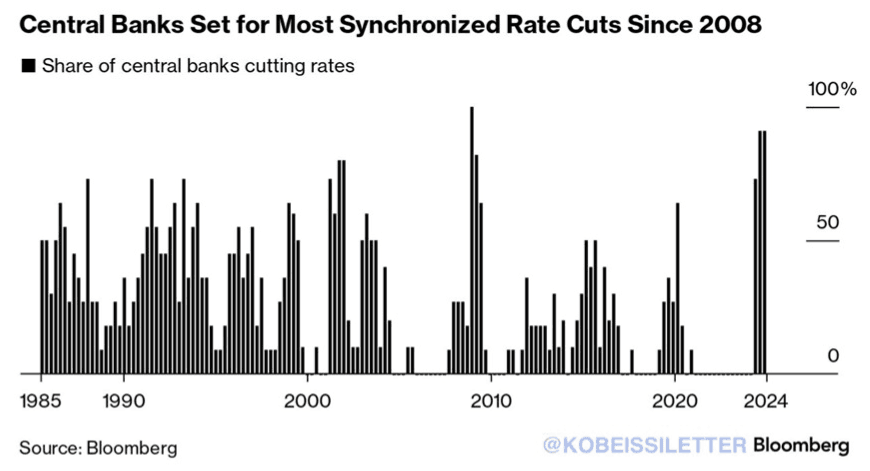

Interest rates remain front and centre for global markets. Central bankers all around the developed world are unusually synchronized in their readiness to follow the Fed’s lead in cutting rates in the coming months:

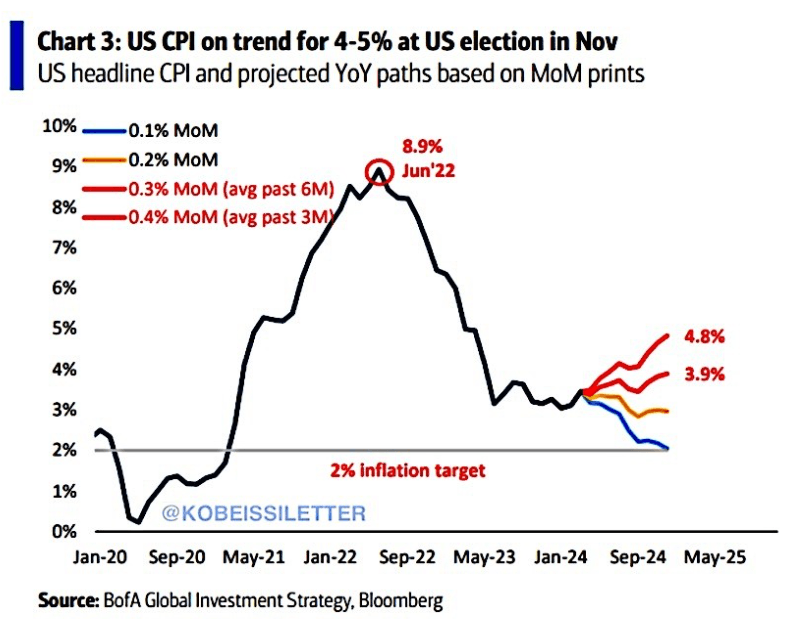

Whilst central bankers all targeted their common enemy, inflation, during their recent rate raising cycles, it has begun to trend in the wrong direction of late, particularly in the US:

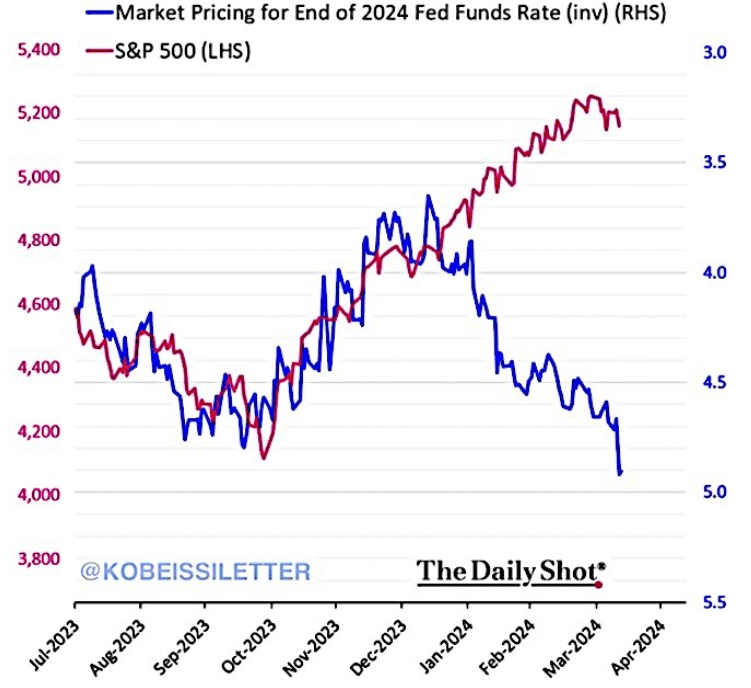

As a result of inflation remaining so persistent, the Fed is now expected to cut rates only twice this year, down from the 6-8 rate cuts expected four months ago. Normally, the pricing out of 4-6 Fed rate cuts would lead to a significant US and global equity market selloff. However, whilst there’s been a minor selloff in recent days, the direction of equity markets has diverged from Fed Funds rate expectations to an abnormal extent:

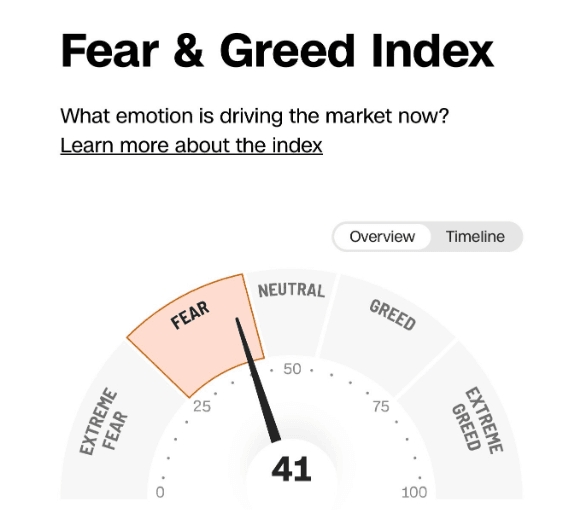

But at the same time investors have become more fearful with the fear index hitting ‘Fear’ levels for the first time this year:

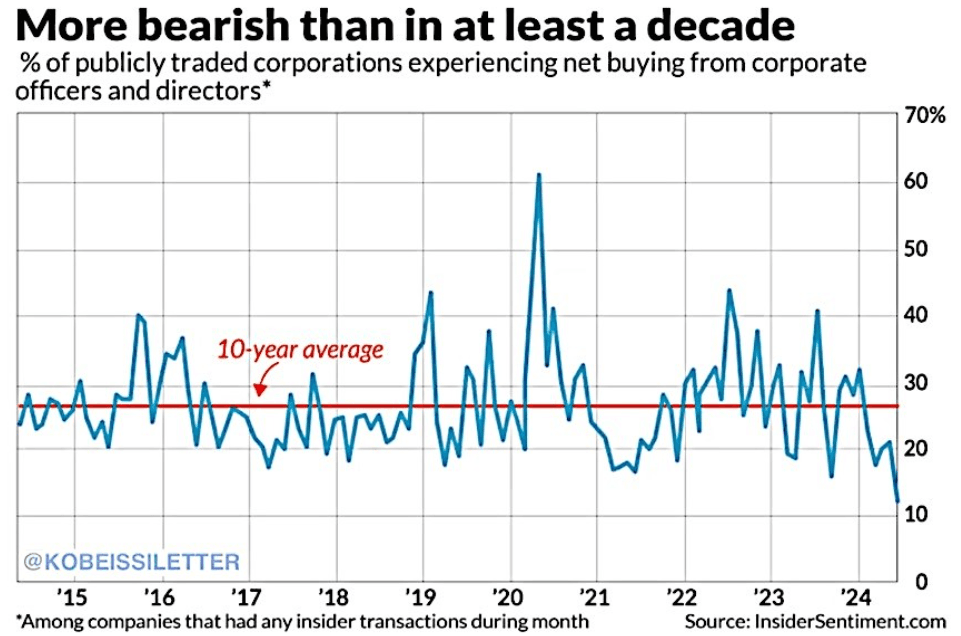

Corporate insiders are also fearful and have been selling stock at the fastest pace in over a decade:

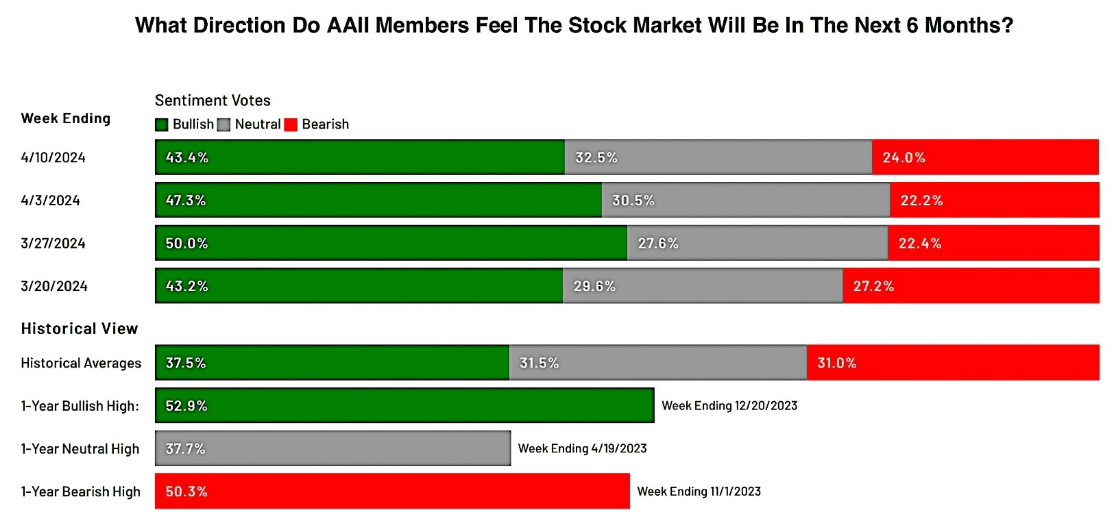

And yet, the bull-bear ratio remains relatively bullish:

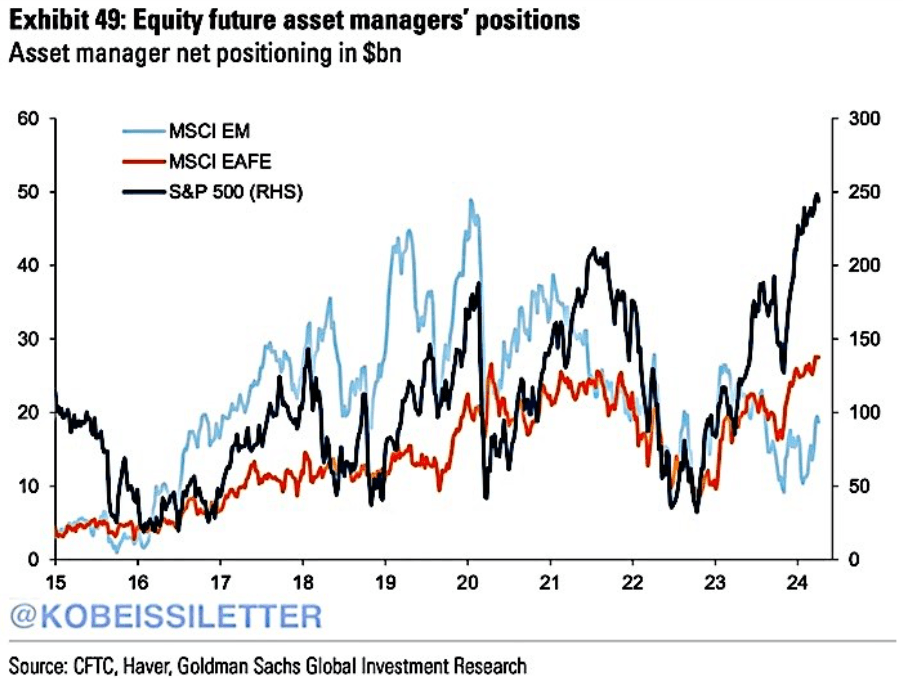

Global money managers also remain bullishly positioned in equities:

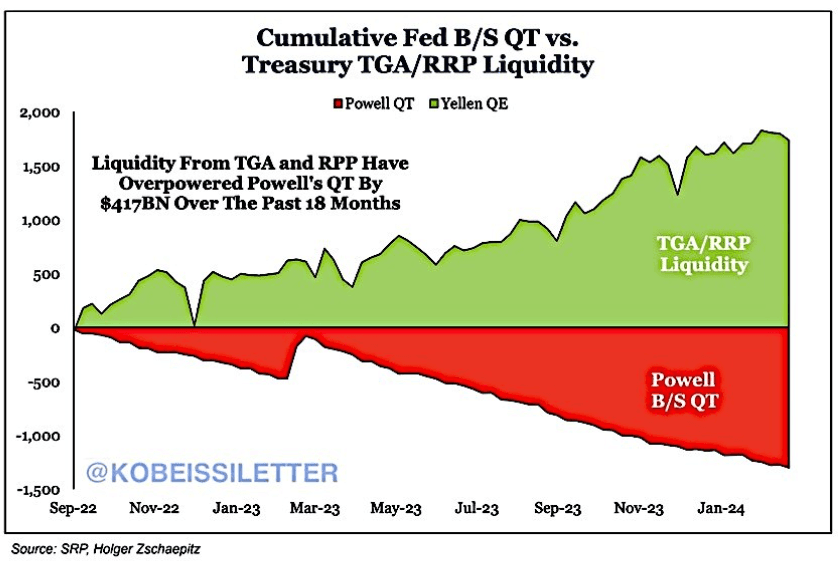

Then there’s the US Treasury’s ongoing liquidity boosting activities which have more than offset the Fed’s quantitative tightening activities over the past 18 months:

Confused? Join the club

So there’s a lot going on in global investment markets.

It’s certainly unusual for equity markets to hit fear levels concurrent with so much insider selling at a time when global equity markets remain elevated versus expected interest rates, money managers are extremely long equities, and the bull-bear ratio suggests investors remain modestly bullish.

Interpreting so many contrary signals is the crux of the challenge for investors this year.

The most plausible explanation for this unusual state of affairs is that money managers and individual investors are fast realizing that equities offer inflation-protection attributes which are hard to achieve in bonds and many other mainstream asset classes.

So with the consensual view of inflation shifting toward a higher-for-longer expectation, protecting against the wealth-eroding impacts of inflation appears to be driving investors to own equities despite their growing fear.

As a result, equities are arguably currently trading with greater defensive attributes than bonds.

This turning on its head of the way bonds and equities are perceived could well be the 2024 theme which continues to surprise and wrong-foot investors more than any other.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A year in which surprises are to be expected

It seems like a new investment playbook has arrived during the first few months of 2024 with the re-emergence of persistent global inflation which is driving investors to take adaptive action aimed at protecting the value of their assets.

Be ready to not be surprised by more of the same throughout the year.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.