Why the Chinese Yuan matters more than you may realise

Simon Turner

Wed 24 Apr 2024 8 minutesHave you ever thought you were aware of all the potential market-moving macro developments, only to be surprised by a left-field occurrence which you didn’t realise was a game-changer for the global and Australian markets?

Markets price in consensual expectations which means most informed investors experience the false sense of security understanding and agreeing with the consensus provides. And the current consensual view about China is that the government there will be forced to devalue their currency to help offset domestic economic weakness.

However, if this consensual view on the Yuan is wrong, the implications for your portfolio may be more pronounced than you may realise.

What’s going on with the Yuan?

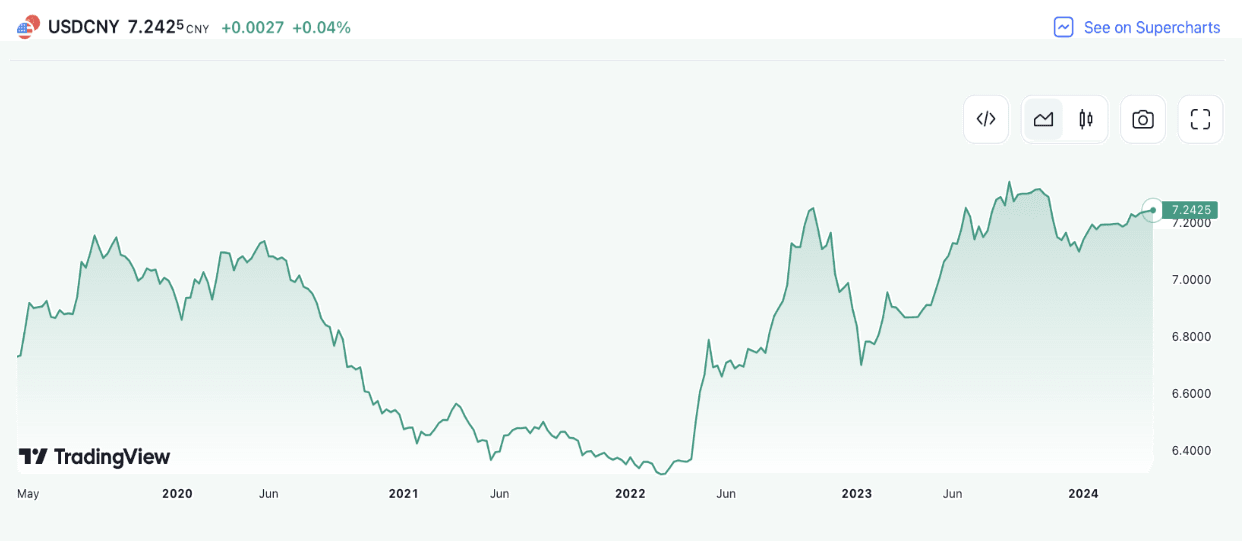

The Yuan has been under a little pressure versus the US dollar in recent months, although it has outperformed versus most investors’ expectations (a rising chart reflects Yuan weakness):

By way of background, Hibor is the price Hong Kong banks pay to borrow yuan from one another. Hong Kong is China’s largest offshore trading centre, so Hibor provides useful context which helps explain the Yuan’s capital flows.

Interestingly, Hibor has been on the rise and is approaching its highest level since 2018, which means it’s becoming more expensive to finance with Yuan from money markets. This largely explains recent Yuan weakness.

Why the direction of the Yuan matters

The reason the direction of the Yuan is so important for investors is that China arguably holds the winning hand when it comes to conquering global inflation—in the form of its innovative, low-cost manufacturing sector. In short, when the Chinese economy is thriving, it creates a powerful deflationary force all around the world.

Whether China uses its hand to its long-term advantage or to the short-term advantage of the global economy is the trillion-dollar question.

In the event the Yuan follows the consensual pathway markets have priced in and devalues, that implies global inflation is more likely to be under control. In that scenario, commodities such as gold and oil would most likely underperform, while the US dollar and developed world equities would probably outperform.

And of course vice versa. A stronger Yuan is likely to add further fuel to the global inflationary forces already at play. In that scenario, commodities such as gold and oil would most likely outperform, while the US dollar and developed world equities would probably underperform.

So the direction of the Yuan matters a lot.

Why consensus believes the Yuan will devalue

It makes economic sense that China would follow Japan’s lead by devaluing its currency. To do so would help the Chinese economy at a time when deflation and subdued economic growth are significant challenges.

China’s real (inflation-adjusted) inter-bank interest rate is currently around 3.5% which is close to a decade high, and arguably too high given the current state of the Chinese economy.

A weaker Yuan would simultaneously make Chinese exports cheaper while raising the prices of imported goods, thus addressing the deflation problem. The IMF concurred in their recent Chinese economic report: ‘greater exchange rate flexibility would help counter disinflation pressures.’

Only one pathway to a weaker Yuan

What would it take for the Yuan to weaken from here?

It’s unlikely that international capital could create a run-for-the-exits Yuan selloff at this juncture since foreigners currently own relatively small amounts of Chinese debt and equities.

As a result, a weaker currency would be hard to achieve without government intervention. But if the People’s Bank of China (PBoC) were to cut interest rates, the Yuan would almost certainly weaken.

However, if the PBoC wait until after the Fed starts cutting to reduce Chinese rates, the US-China interest rate differential will shrink, which means their ability to weaken the Yuan will be eroded. If and when the Fed start cutting rates, a stronger Yuan is more likely.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

But Xi doesn’t want a weaker Yuan

Based upon Xi’s stated objectives, a weaker Chinese currency is the opposite if what he is aiming for. Given Chinese leaders have a track record of doing exactly what they say, it’s generally prudent to take his words at face value.

A significantly devalued Yuan would be political bad news for Xi as it would confirm the Yuan is not viewed by financial markets as a credible financing and trade currency for emerging markets. It would also confirm that the US has won the global currency war, and that the Chinese economic plan isn’t working. This scenario is in direct contradiction with Xi’s stated objectives, which are focused on achieving long-term currency and bond market strength.

Hence, a weaker Yuan appears less likely than markets are currently assuming.

A more likely scenario

It’s well-known that Xi is focused on ending China’s ‘century of humiliation’ by becoming ‘a great power’ again. He believes becoming a great power means have a strong currency which China’s trade partners are prepared to trade in. In other words, dethroning the US dollar is a core part of this vision.

How far is Xi prepared to go to achieve his goals? There are two associated economic questions:

Is China prepared to weather a recession or depression in order to maintain currency strength? Most currency experts agree the Yuan is currently overvalued, so the economic impact of an even stronger currency is likely to be significant.

Is China willing to move from its current trade surpluses to deficits? To an extent, China’s monthly trade surplus are at odds with a stronger currency since the country doesn’t need to tap into the type of domestic currency government debt funding the US Government has long relied upon. Some market experts believe that sacrificing the country’s trade surpluses may be the price of transitioning the PBoC into the global central bank equivalent of the Bundesbank—as per Xi’s objectives.

Xi’s focus on making China great suggests there’s a decent likelihood that the country is prepared to pay the economic costs of achieving the currency and bond market strength he is aiming for. If this is indeed the case, a stronger Yuan may well be on the cards in the coming years.

Timing is everything

The global economic risks posed by a stronger Yuan also relate to timing.

For example, if Xi were to await US inflation reaching higher levels than at present, say 8-10%, then a stronger Yuan would be the equivalent of a knockout blow to the US, both politically and economically.

Such a move would likely lead to even higher US inflation which would be bad news for the US dollar and the US Treasury, which would arguably raise the Yuan’s profile as a lower risk global currency. China would effectively be ascertaining its dominance over the US at a time when the US was particularly vulnerable.

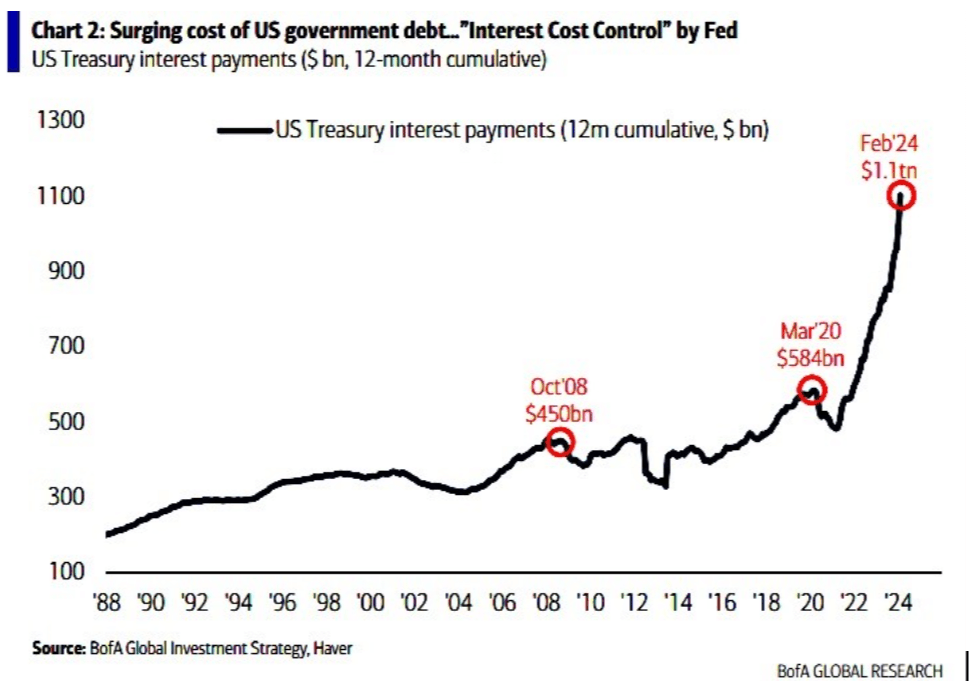

What if this is exactly the playbook the Chinese leader is aiming for? The likelihood of this scenario seems to be rising by the month with US Government debt levels continuing to grow toward the realms of being unsustainable:

Implications for Aussie investors

If indeed China is focused on achieving a stronger Yuan in the coming years, there are a number of noteworthy implications for Australian investors:

-Global inflation is likely to become a more significant risk for all investors, so positioning your portfolio accordingly may be prudent.

-The Chinese economy could be facing a slowdown which may lead to knock-on economic impacts for the exposed parts of the Australian economy. So being conscious of and careful with your Chinese investment exposure could be a sensible strategy.

-Commodities like oil and gold are likely to outperform.

-Chinese bonds are likely to outperform.

-Developed world equities, including the ASX, are likely to underperform.

-The US dollar is likely to underperform.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Keep an eye on the Yuan

The global economy is a complex interconnected organism which has the ability to surprise investors with the swing factors which move markets. At this juncture, China’s apparent desire for a stronger Yuan may well be one of those potential swing factors it pays to watch closely. If this thesis is correct, the implications for which asset classes out and underperform in the coming years could be profound.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.