The number economists are most likely to be wrong about in 2024

Simon Turner

Thu 23 Nov 2023 6 minutesIn the words of John Kenneth Galbraith, ‘We have two classes of forecasters: those who don't know, and those who don't know they don't know.’

You’d be forgiven for believing we are already in the midst of a recession given the amount of bearish economic commentary in recent months. However, at least in nominal terms, the Australian and global economies have continued to grow despite sharply higher interest rates—and it is nominal growth that matters most to equity markets.

With the end of the year fast approaching, it’s timely to consider the 2024 economic outlook—and one particular economic forecast that stands out as vulnerable to being wrong as we approach the new year…

Below-trend resilience the name of the game

Let’s start with the consensual economic narrative for the year ahead.

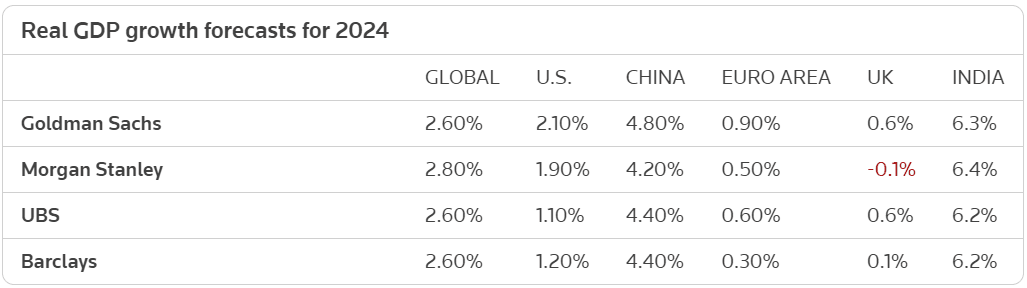

The consensual view is that there will be a soft economic landing in 2024 with 2.6-2.8% global growth—as shown below.

Whilst 2.9% global economic growth remains below the twenty-year average of 3.8% p.a. growth, it’s a picture of a relatively resilient global economy given the extent of recent interest rate increases. According to IMF forecasts, advanced economies are expected to grow at 1.4% next year down from 1.5% in 2023, whilst developing economies are projected to grow at 4.0% next year down from 4.1% in 2023.

Australian economic growth is expected to be weaker than the global average with a slowdown from 1.8% in 2023 to 1.2% next year (also IMF forecasts). Bearing in mind the population is growing at around 2.2% p.a., 1.2% economic growth implies a per capita recession. It’s hardly a bullish local outlook.

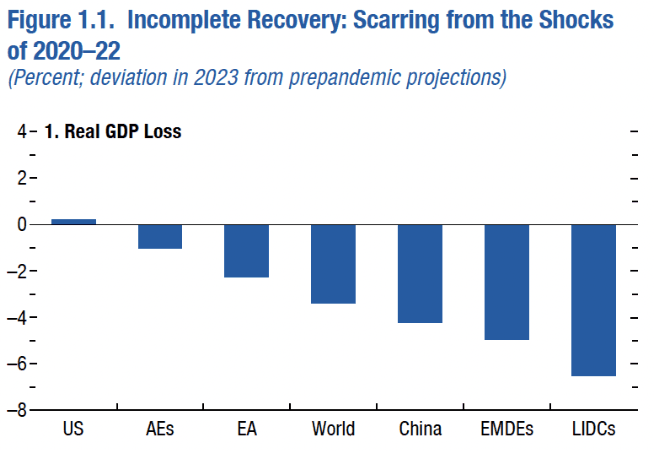

At a global level, the post-pandemic divergences are noteworthy—as shown below.

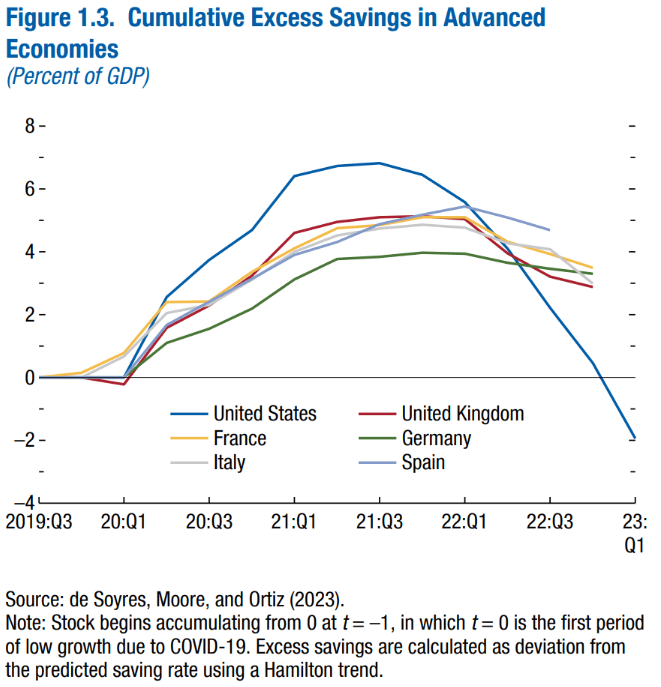

On the upside, the US continues to positively surprise driven by resilient consumption and investment supported by low unemployment. However, it’s noteworthy that the US excess savings rate, which has been so supportive since the pandemic, has turned negative as shown below.

On the downside, the Eurozone continues to decelerate, China is facing growing headwinds from its real estate crisis and weakening confidence, whilst Emerging Market and Developing Economies (EMDEs) and Low Income Developing Countries (LIDCs) are still struggling to regain their post-pandemic economic momentum.

The optimist would highlight that these downsides are already factored into the below-trend 2024 global growth forecasts, whereas the pessimist would highlight that the US savings rate is a harbinger of a more significant slowdown than is currently expected in the country that’s provided the most economic support to the global economy since the pandemic.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Economists are backing central bankers on inflation

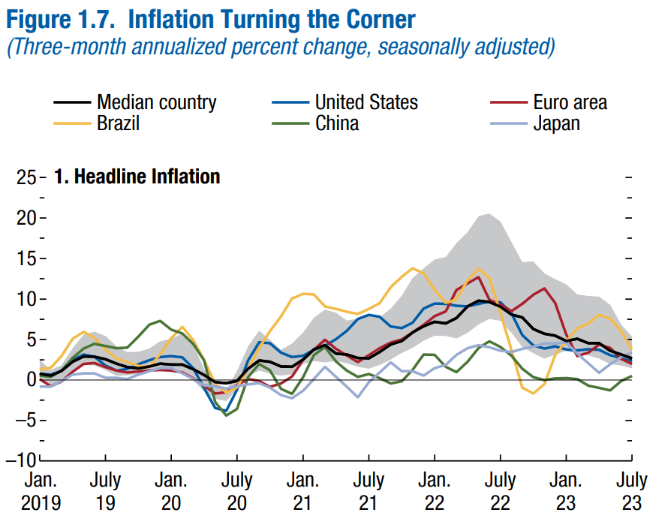

Arguably, the most interesting forecast for the year ahead is that most economists expect inflation to be under control. For example, the IMF expects global inflation to fall from 6.9% this year to 5.8% in 2024 driven by tighter monetary policies and lower commodity prices. As shown below, that view has been correct over the past year.

It’s a similar picture in the US and Australia. Headline US inflation slowed to 3.2% in October and is expected by economists to slow to around 2.5% in 2024. In Australia, inflation is expected to fall from 5.4% in the September quarter to 3.2% in 2024.

This assumption that the battle against inflation has already been won is arguably the economic forecast which could be most wrong in 2024. With the risk to energy prices lying on the upside due to low inventories and E&P spend, and the psychological forces behind inflation becoming entrenched through memory reawakening amongst consumers, the risk to 2024 inflation may yet lie on the upside.

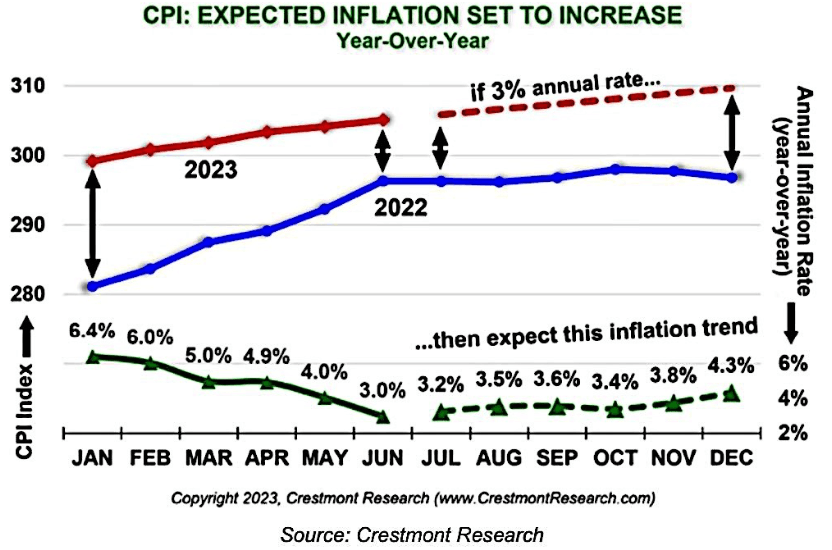

In fact, the Crestmont Research monthly forecasts shown below highlight a growing gap between US inflationary expectations and a second wave of higher inflation which may reveal itself in the coming months.

This is an important point for investors to note… if this data is correct, the US will be starting 2024 with inflation running at 4.3% which is well above the 2.5% expected next year. This raises the obvious question… is the market prematurely celebrating the conquering of inflation?

If that is indeed the case, the implications for investors are significant. The RBA and the Fed have indicated they will keep raising rates in the event inflation rises again. However, given how backward-looking central bankers are, it may take a number of quarters for them to react to the emergence of a second wave of inflation.

So higher interest rates may be coming, but possibly not in the short term. That spells volatility in both directions in 2024.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Key investor takeaways:

Global economic growth is slowing, particularly in the Eurozone and China. However, at this stage, the global economy is expected to avoid a nominal recession in 2024—as is the Aussie economy.

The US economy continues to surprise on the upside but with the excess savings rate turning negative there’s a growing risk this momentum slows and reverses in the coming months.

Markets are pricing in lower global inflation in 2024, but there are valid reasons to question this assumption. In fact, inflation could be the main economic factor forecasters are wrong about in the year ahead.

With an unusually high probability of economic surprises coming, 2024 is likely to be a volatile year for investors.

Inflation is the economic factor most likely to test investors in 2024

Economic forecasts should always be taken with a grain of salt. However, the wide range of inflationary scenarios and the resulting impact upon interest rates has arguably made economic forecasting harder than ever. In other words, it’s highly unlikely that economic forecasters are right about the 2024 economic outlook—and inflation could be the number they are most wrong about. It may be too early to throw an ‘inflation is dead’ party.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.