What to do if you own the most shorted stock on the ASX

Simon Turner

Tue 28 Nov 2023 8 minutesIn recent years, shorting stocks has become a common strategy for professional and individual investors alike, so there’s a growing population of investors on the lookout for stocks they believe will fall in value.

On that note, Pilbara Minerals (ASX:PLS) has become the most heavily shorted stock on the ASX despite ongoing lithium sector consolidation. At this point, the stock presents an interesting case study in what to do when you are invested in a stock with skyrocketing short interest…

What is shorting?

For those unfamiliar with shorting (or short selling), it’s when an investor borrows stock to sell it on the market with the expectation of buying it back in the future at a lower price. The investor’s profit (or loss) is the difference between their selling price and their buyback price less transaction and holding costs, including any dividends due to the shareholder.

Shorting has long been a common practice amongst the world’s hedge funds who often use their short books to reduce their net exposure to the market with the aim of generating positive returns regardless of market direction.

In recent years, a number of trading platforms have provided access to shorting services for individual investors. Hence, shorting has become a widespread strategy.

The main danger of shorting

Many professional investors have suffered large losses from shorting stocks. The main danger with this strategy is the potential for a short squeeze with uncapped upside. In contrast to owning a stock where your maximum loss is 100% of your investment, there’s no limit to the downside of shorting.

For example, if you shorted a stock at $5 which then announces an important innovation which leads to a stock squeeze up to $25, to close your trade you need to buyback the stock you sold for $5 at $25. In this example, you’ve made a 400% loss on the trade, excluding any transaction and holding costs.

Enter Pilbara Minerals, the most shorted stock on the ASX

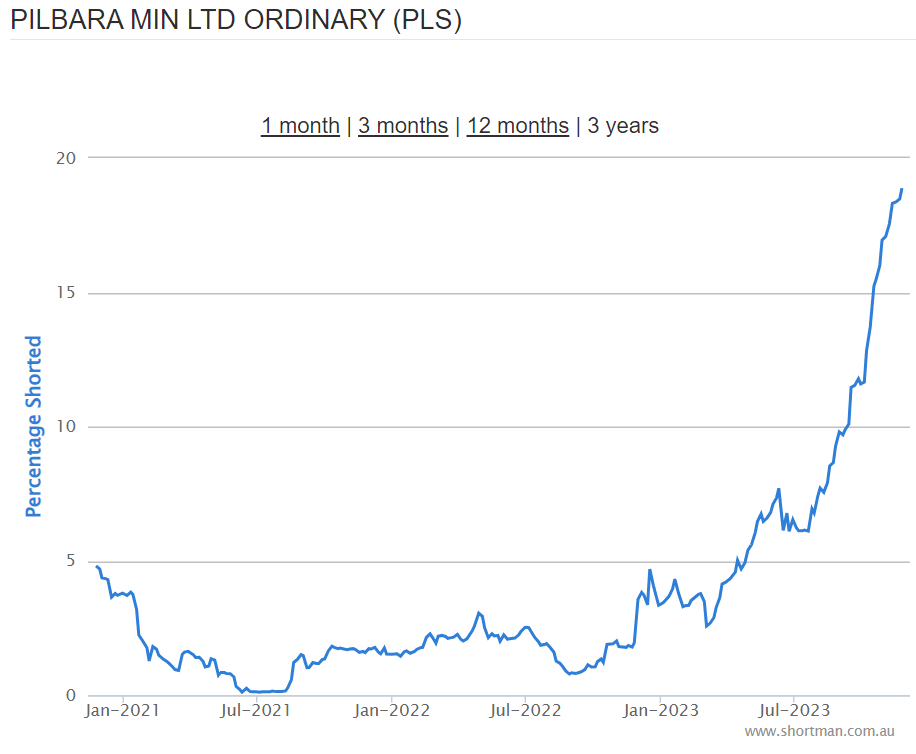

At this juncture, Pilbara Minerals offers an interesting case study in how to handle an extremely shorted stock. The stock’s short interest has skyrocketed in recent months and now stands at over 20% of its market cap. As a result, Pilbara Minerals now has the dubious honour of being the most shorted stock on the ASX.

Here’s the extraordinary chart showing the percentage of Pilbara Minerals’ stock that’s been shorted over the past 3 years…

When you see short interest increase exponentially like this, there’s usually an important fundamental driver at play such as accounting concerns, expectations of a major profit warning, or the emergence of a competitor that’s expected to significantly disrupt the company’s business model.

However, in Pilbara Minerals’ case, the main reason for this surge in short interest appears to be short-term negativity toward lithium and a lack of available liquid mechanisms to short the commodity. In other words, investors have been using the stock as a proxy for the commodity.

The more surprising context to this development is that we’re currently witnessing a land grab for the best Australian lithium assets led by Gina Rinehart’s recent acquisition of stakes in Liontown Resources and Azure Minerals. Investors who are shorting the stock clearly have a different opinion.

In the words of David Franklyn, head of Argonaut, a resources fund that holds stock in Pilbara Minerals:

“It’s a curious time. The billionaires and short-sellers are operating in different contexts and time frames. The billionaires are playing the long game, betting demand for lithium will explode as the clean energy transition picks up, while the short-sellers expect Pilbara’s share price will decline amid weak near-term conditions. Rinehart and Mineral Resources are in a land grab for tier one assets, in a tier one location, and there are not many projects around. They’re trying to at least have an influence, but ideally get control of, these tier one assets. The reason for this is if you stand back and look at the market, it’s still pretty small, and it’s in the very early stages of a massive expansion.”

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Questions Pilbara Minerals’ shareholders should ask themselves at this point

Whenever a stock you own is as heavily shorted as Pilbara Minerals currently is, it’s worth asking yourself four simple questions…

1.What was my investment timeframe when I invested in the stock?

It’s time to be honest with yourself. Were you thinking long term when you bought the stock, or was this a shorter term trade? By reminding yourself what you were thinking at the time of investment, you’ll help yourself remain on track.

2.What was my investment case when I invested in the stock?

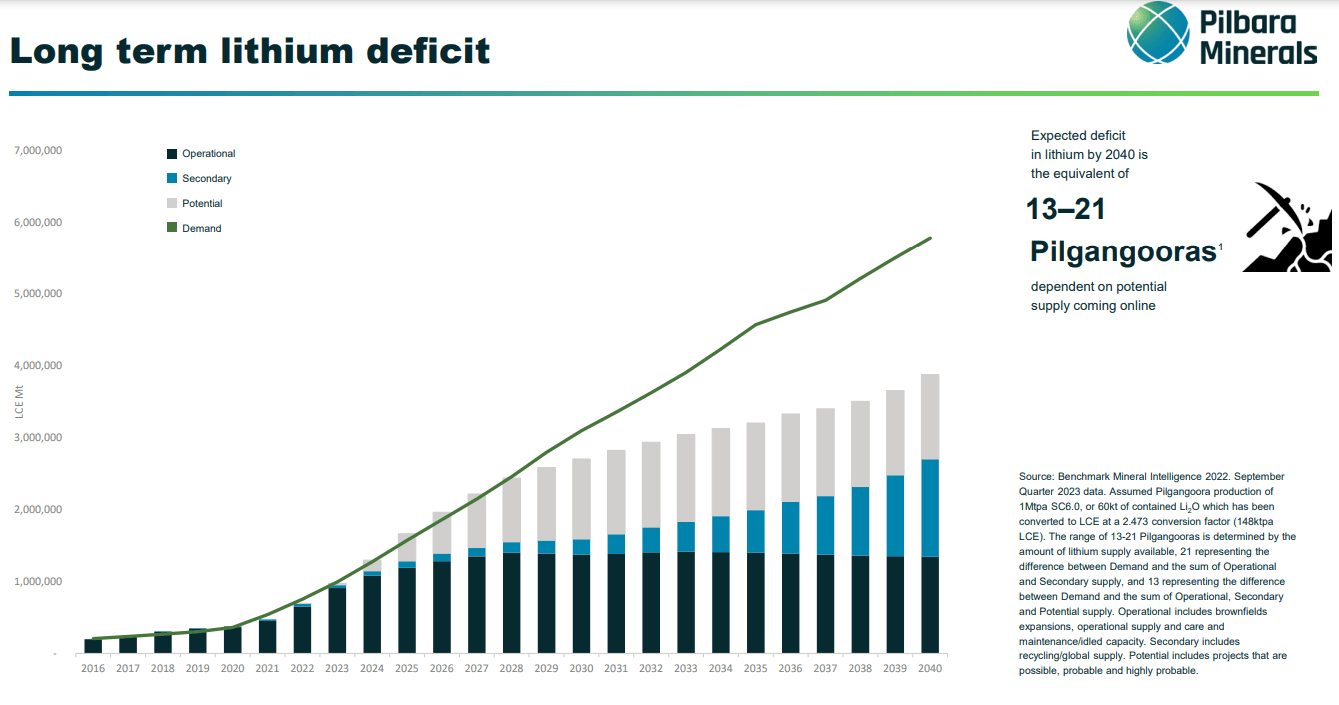

For most investors, the Pilbara Minerals investment case will be along the lines of… Pilbara Minerals is the largest spodumene pure play with a superior asset in a tier 1 jurisdiction (WA). It’s led by a respected management team and has a strong balance sheet. And longer term, lithium is expected to be in a significant deficit (as shown below) which is supportive of higher prices.

3.Does the high short interest reflect a fundamental concern I may be unaware of? Hence, does it affect my investment case?

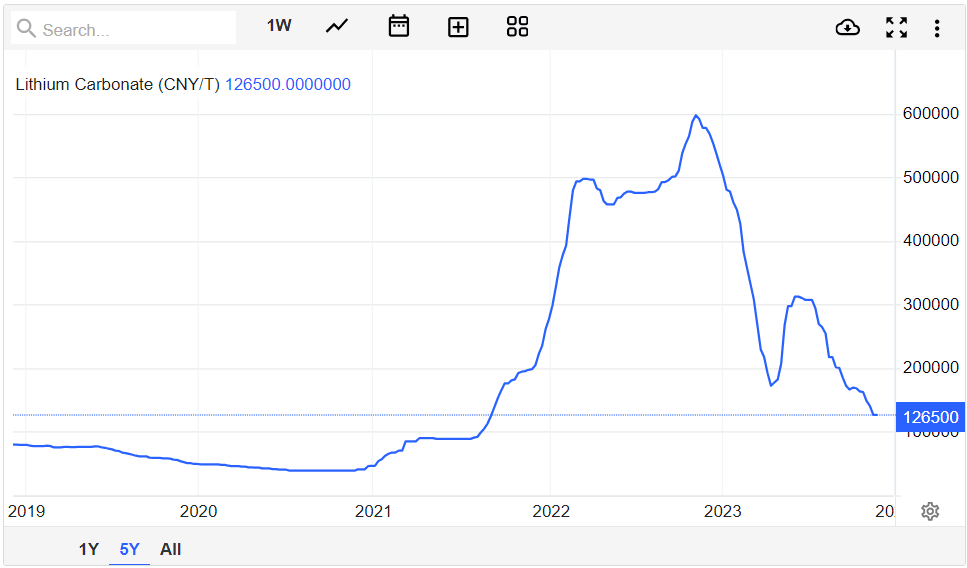

This is arguably the trickiest question to answer because we don’t know what we don’t know. However, the most commonly articulated Pilbara Minerals bear case relates to further potential weakness in the lithium price.

Whether this affects the Pilbara Minerals investment case largely comes down to your investment timeframe. For shorter term investors, the extent of recent lithium weakness and the associated electric vehicle slowdown narrative may have led them to change their minds on the stock. And let’s be honest… lithium could fall further in the short term.

However, longer term investors should remember two key points:

a) Volatility is a normal part of investing for the long term, and

b) In the commodity world, lower prices tend to lead to higher prices as some projects will be put on hold whilst the economics don’t work. Hence, shorter term commodity price weakness is often a buying opportunity rather than a reason to sell, particularly after a commodity has already significantly corrected as lithium has done (as shown below)

4.Do I still believe in Pilbara Minerals’ management, assets and strategy?

This question is usually easier to answer. In Pilbara Minerals’ case, the company’s strategy has been consistent for a number of years and its resource base has grown, so the answer is likely to remain in the affirmative for most investors.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Focus on the days to cover

Stocking a stock with over 20% outstanding short interest is not for the faint-hearted. However, arguably, it’s the number of days required to cover the outstanding shorts that investors should be more focused on in examples like this.

In Pilbara Minerals’ case, there are 556 million shares that have been shorted, and hence need to be covered in the future (according to Shortman). That implies it will take over 27 days of full trading volume to cover those shorts.

However, it’s not as simple as earmarking 27 days of the stock’s entire trading volume to buy back the stock as and when the shorts decide to cover. In that event, the market will notice that the shorts are covering because the lithium price has bottomed, or takeover speculation has emerged, or whatever the reason, and will add to the buying pressure.

It’s this emergence of buying competition that leads to a short squeeze. For example, if short coverers represent half or a third of the Pilbara Minerals trading volume during a squeeze, the upside move could be dramatic over a period of 1-3 months.

What a short squeeze looks like

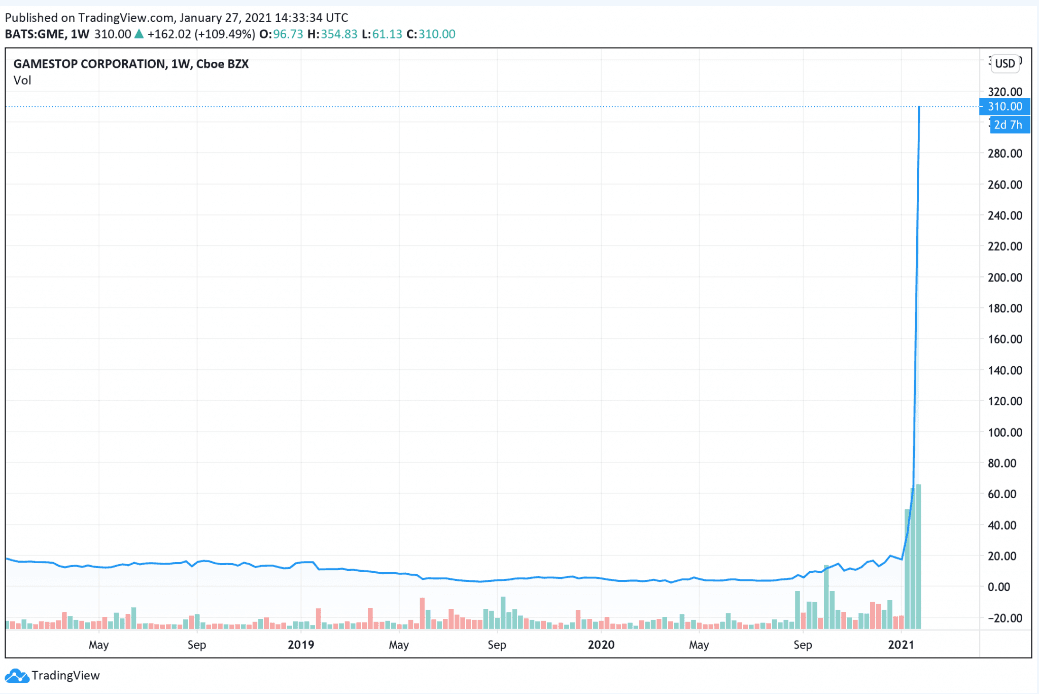

There have been many famous short squeezes in recent years. Gamestop remains a standout example which was fuelled by retail investors clubbing together in an angry mob of sorts. Those retail investors wanted to cause the shorts financial pain while making strong returns themselves.

As shown below, the stock skyrocketed to levels far beyond its fundamentals at the time.

Whilst Gamestop is an extreme example, it’s a cautionary tale of what can happen in heavily shorted stocks when strong buying interest returns.

Pilbara Minerals is vulnerable to a short squeeze

Shorting a stock like Pilbara Minerals as a proxy for shorting lithium is a dangerous investment strategy, particularly when over 20% of the stock’s market cap is already shorted. With sector consolidation being led by a successful billionaire, a lithium deficit approaching, and the global electric vehicle rollout continuing, there are a number of potential short squeeze drivers lurking in the background.

Pilbara Minerals shareholders may be well positioned to benefit from the company’s position as the most shorted stock on the ASX in the coming months. Shorters beware.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.