Is BNPL ready for a comeback?

Ankita Rai

Wed 6 Dec 2023 6 minutesThe buy now, pay later sector finds itself at the centre of a perfect storm, propelled by robust Black Friday/Cyber Monday sales and the deferred implementation of BNPL laws.

Services such as Affirm, Afterpay-owner Block, and Klarna played a pivotal role, facilitating a substantial $US7.3 billion in consumer spending during the recent five-day sale event in the US. Cyber Monday alone witnessed a remarkable 43% increase in BNPL purchases compared to the previous year, according to Adobe data.

The holiday spending spree has triggered a rally in major BNPL stocks, indicating a resilient consumer base that favours flexible spending options amid mounting cost pressures. This momentum is further fuelled by the postponement of BNPL laws until 2024, aiming to regulate the sector similarly to credit card companies.

Despite challenging economic conditions and a tough 2022, the BNPL sector, once favoured by Aussie investors, seems poised for a comeback. This resurgence is evidenced by record transaction volumes, reduced losses, and heightened competition from major tech players entering the space.

Record sales defy investor scepticism

The surge in Black Friday sales confirms that the sector isn't going anywhere anytime soon despite soured investor sentiment.

In fact, BNPL stocks were among the biggest winners of this year's Black Friday sales. According to Adobe Analytics, much of this year’s jump in e-commerce activity was fuelled by buy now, pay later options.

However, it's not just record transaction volumes during the sale event that have brought life back to BNPL stocks like Affirm, Afterpay, Klarna, and Zip; it is their improved earnings profiles combined with a growing focus on profitability.

For example, BNPL player Affirm has gained more than 164% year-to-date after surpassing earnings expectations. Its net loss narrowed to $US171.8 million in the first quarter ending September, down nearly 32% from the loss of $US251.3 million a year earlier.

Afterpay-parent Block also soared on a lift in full-year 2023 earnings guidance to a $US1.66 billion - $US1.68 billion range, up from previous guidance of US$1.5 billion. Its third-quarter net revenue grew 24% to US$5.62 billion as it continues to focus on cost control with an 'absolute cap' on headcount pledged by CEO Jack Dorsey.

Things are looking rosier for Zip too, which is facing increased competition in the US from Affirm, Klarna, and Block. It hit monthly profitability in the United States, New Zealand, and Australia for the first time in June and narrowed its net loss to $413 million for the fiscal year ending June 30th, from a whopping $1.1 billion last year. It’s now focused on achieving profitability in the US and Australia, with its recent quarterly update showing a 45.7% year-on-year increase in North American revenue, reaching $97.8 million.

Another player, Klarna, reported its first quarterly operating profit in four years. In the three months ending September, the fintech posted an operating profit of $18.5 million, its first profit since 2019. Revenue increased by 30%.

These improvements are good news for battered investors in the sector. However, sharply higher interest rates continue to challenge the business models of indebted BNPL providers.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A cautionary note...

The uptick in transactions and increased competition brings both good and not-so-great news.

Moody's warns that credit losses for buy now, pay later lenders may increase due to their growing popularity, and increased competition will further drive down margins. With big tech, banks, and card companies enhancing their offerings — Apple, for instance, entering the space with Apple Pay Later — Moody's suggests that only a handful of buy now, pay later companies might 'remain independent or survive’.

The key lies in achieving swift profitability or scaling up with added value for consumers.

BNPL 2.0: Evolving dynamics

Transition is the name of the game. After a period of unchecked expansion, followed by a slump in valuations, the buy now, pay later sector is now transitioning into a more mature phase. Regulatory scrutiny, higher interest rates, and intensified competition are reshaping the industry.

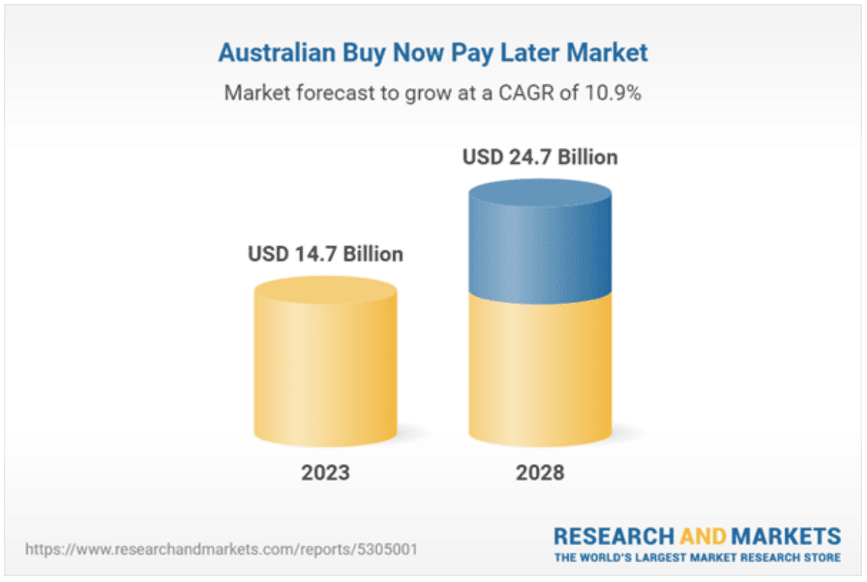

The market opportunity remains robust as consumer interest in alternative credit remains high. The Australian BNPL market is expected to grow at a CAGR of 10.9%, reaching $US24.7 billion by 2028—as shown below.

So growth remains a key theme.

For example, the sector’s new avatar, BNPL 2.0 is poised to drive growth by consolidating the market and implementing standardised regulations, aligning it more closely with traditional consumer credit products. The next phase will see various players, from fintechs and banks to big tech, card networks, and super apps, all stepping into the game, potentially further squeezing the margins.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The sector’s winners will capture the opportunity

For investors, it's crucial to be aware that the capital-intensive nature of buy now, pay later companies means that the future trajectory of the sector’s winners will hinge on factors such as effective debt management and navigating volume growth without sacrificing too much profitability.

The BNPL sector is worth keeping on your watch list.

Key takeaways for Investors

Consumer interest in alternative credit remains high amid the rising cost of living, with BNPL purchases accounting for around US$7.3 billion in online spending during the Black Friday and Cyber Monday sales in the US, marking a 14% increase from last year.

The adoption of BNPL payments is expected to grow steadily in Australia with a projected compound annual growth rate of 10.9%—and the market is anticipated to reach US$24.7 billion by 2028.

The next phase of the BNPL sector’s growth will involve a broader spectrum of providers, ranging from fintechs to banks, big techs, card networks, and super apps, as new regulations align BNPL with legacy consumer credit products.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.