What the bull-bear spread is telling us

Most of the world’s great investors are experts at using market sentiment to their advantage.

“It is wise for investors to be fearful when others are greedy, and greedy when others are fearful.” Warren Buffet

Whilst it’s tempting for investors to be confident they understand market sentiment based upon market volatility and direction, there’s a simpler, more accurate, and often over-looked way to gauge market sentiment.

It’s time to acquaint yourself with the bull-bear spread and what it’s currently telling us about market sentiment…

What is the bull-bear spread?

American Association of Individual Investors’ (AAII) bull-bear spread represents the percentage of AAII’s member investors who are bullish about the market’s direction over the coming 6 months less the percentage who are bearish. It’s a useful gauge of US market sentiment because it’s a way of reasonably accurately translating market sentiment into numbers. US market sentiment is typically a useful gauge of global market sentiment due to its heavy global weighting and the tendency for most global markets to follow the US.

What the current bull-bear spread is telling us

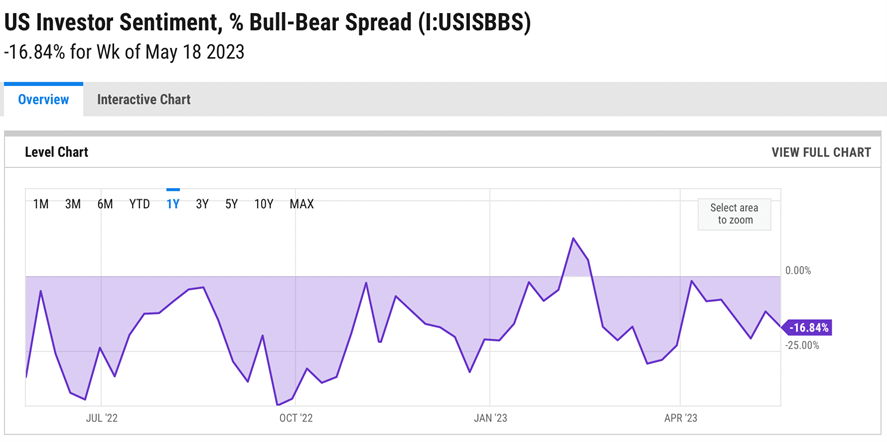

It’s worth highlighting the AAII bull-bear spread’s long term average is 6.4%. In other words, on average there are 6.4% more bullish investors than there are bearish investors. By way of comparison, Investors Intelligence consider the long term market norm to be 45% bulls, 35% bears, and 20% neutral investors. That makes intuitive sense as the long term market direction is up with plenty of corrections along the way. So what is the current bull-bear spread? As shown below, the current bull-bear spread is -16.8%, which is 23.2% below the long term average of +6.4%.

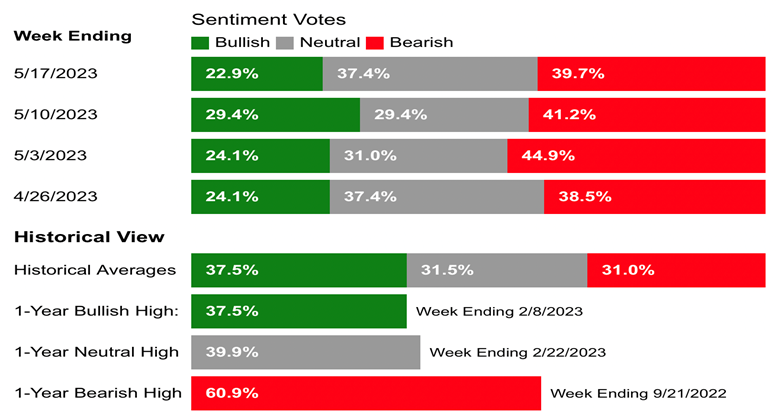

Looking behind the headline number, as shown below 22.9% of investors are currently bullish, 39.7% are bearish and 37.4% are neutral.

With only 23% of investors feeling bullish about short term market direction versus a long term norm of 45%, 22% of the market has swung to a more neutral or bearish stance than is the norm over the longer term. So market sentiment is quite bearish right now. Having said that, we’re not at a market extreme. AAII’s one-year high bearish ratio of 60.9% is a hefty 21% above the current bearish ratio.

Time to be greedy and prudent

The key takeaway for investors is that market sentiment is weak and has the potential to improve significantly looking forward. Equally, market sentiment is not at an extreme at present so being prepared for ongoing volatility remains prudent. Hence, being prudently greedy appears to be the optimal way to benefit from current weak market sentiment.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.