Why lazy investors make more money

Simon Turner

Mon 3 Feb 2025 6 minutesAre you a lazy investor? Or do you watch your portfolio each day like a hawk with a view to trading whenever necessary?

If your long term performance numbers are solid and your stress levels are low, the chances are high that you’re in the lazy camp and proud of it.

Rather than being an insult, being a lazy investor is a great advantage over more emotionally volatile investors who react to short term share price moves.

Moreover, being a lazy investor may be the secret to not only boosting your investment returns, but also to enhancing your mental wellbeing…

What is lazy investment?

So what exactly is lazy investing? In essence, it’s a hassle-free, long-term investment approach aimed at maximising investment returns and minimising stress levels.

Most lazy investors invest in managed equity funds and exchange-traded funds (ETFs) rather than picking individual stocks. They accept that if a large portion of active fund managers can’t beat the market, it’s clearly a challenging goal.

Lazy investors optimise their portfolio structures by diversifying across asset classes, investing in low-cost products, and maintaining a long-term investment outlook.

And most importantly, lazy investors avoid emotional decision-making and reacting to market movements. They accept that listening to their emotions isn’t a helpful guide when investing.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Why lazy investors make more money

Lazy investors are well-positioned to generate solid long term investment returns for the simple reason they don’t fall for the investing pitfalls that cost so many people their financial freedom.

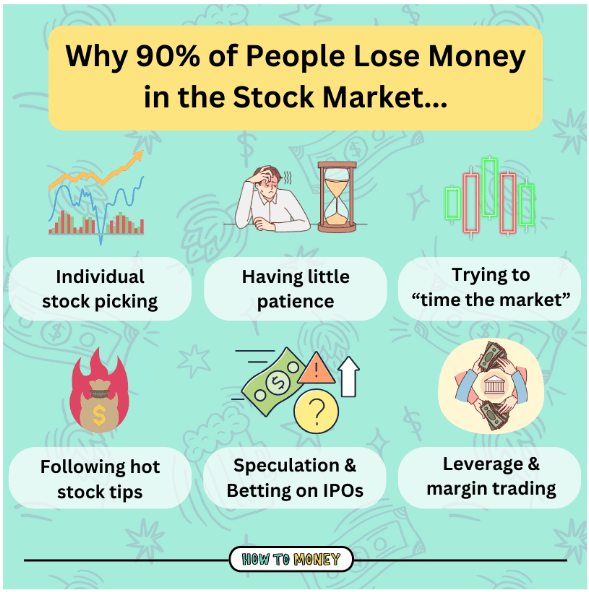

For example, stock picking, being impatient, and trying to time the market are common cardinal sins that many un-lazy investors regularly commit to their own detriment.

Lazy investors’ superpower is their ability to ride out the market’s ups and downs en route to long term investment success. In comparison with a shorter term, more reactive investment strategy, the advantages are hard to overstate.

Why lazy investing is anything but easy

If lazy investing is so effective and good for our mental health, why isn’t everyone doing it?

Of course the answer is different for everyone, so you may need to look into the mirror for your own answer.

Having said that, there’s a common reason why lazy investing is anything but easy … emotional control is challenging for most investors to achieve.

One of the main reasons it’s so hard is that investing requires a very different emotional response than most other parts of life.

For example, when you meet someone new and your gut instinct gives you positive feelings, it’s often a useful signal that an investment in a new friendship may serve both parties well. In contrast, when investors’ gut instincts tell them it’s time to buy a stock, it’s usually after that stock has already rallied. That’s often the worst time to invest.

This is why listening to your emotions as an investor often leads you astray. It also explains why it’s challenging for most investors to adapt their emotional interpretations when investing.

So lazy investing is all about emotional control and understanding the biases which tend to conspire against our investment success.

Lazy investing strategies

You may recognise yourself in this discussion. Have you been too active as an investor for your own good? If you have, you’re in good company. Most investors reach this realisation at some point.

If you want to live your life as a lazy investor looking forward, here are some strategies which may help:

- Create a customised investment plan.

Lazy investors use their investment plan to outline their financial goals, investment parameters, strategy, and timeframe.

- Ensure your asset allocation is balanced.

A typical lazy investor’s portfolio may include up to 70% in growth assets (like shares) and 30% in defensive assets (like bonds).

This balanced approach to asset allocation can help lazy investors sleep at night regardless of short term market movements.

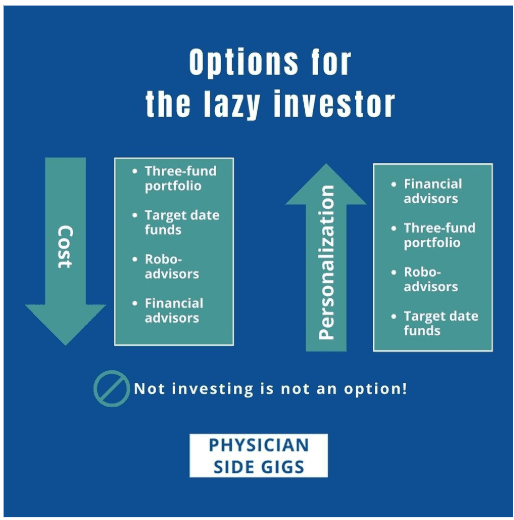

- Utilise ETFs and managed funds to your advantage.

There’s an argument that lazy investors should invest in managed funds in asset classes which are less efficient—such as small caps, private credit, and alternatives.

ETFs also have a valuable role to play for lazy investors in providing exposure to larger, liquid asset classes in which outperformance is harder for most managed funds to achieve.

- Buy at the right price.

Buying into funds and ETFs at the right price is crucial since poor timing can lead to long-term underperformance.

Dollar cost averaging is recommended for lazy investors aiming to mitigate this risk.

- Buy and hold.

Holding onto your investments for the long term allows for better average performance than frequently switching investments, as missing even a few of the best market days can significantly lower your returns.

- Schedule periodic portfolio reviews.

Although lazy investors adopt a hands-off approach, periodic portfolio reviews are essential to ensure alignment with financial goals. Biannual reviews are typically recommended.

- Maintain a degree of flexibility.

Whilst being a lazy investor means buying and holding for the long term, it also involves maintaining a degree of flexibility. Market conditions and business viability can shift over time.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Lazy investing is about optimising your long term success

From now on if anyone calls you a “lazy investor”, take it as a compliment.

Lazy investing is a powerful strategy aimed at optimising long term investment returns and minimising stress levels.

Whilst the word “lazy” sounds easy, lazy investing is arguably harder than a more active approach since it requires greater emotional discipline and investment planning.

The long term benefits are hard to argue with. Long live lazy investing.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.