Three trends worth befriending for the coming decade

Simon Turner

Wed 5 Feb 2025 5 minutesIt’s easy to get caught up in the day-to-day details of investing, which means it’s also easy to lose sight of the bigger picture trends which are likely to continue driving investment returns.

With long-term outperformance in mind, here are three investment trends worth befriending for the coming decade…

1. The inexorable rise of computing

One trend long-term investors will want to remain on the right side of is the rising quantity and quality of computing power.

Whilst most investors are well aware of this trend thanks to the rise of the Magnificent 7, there’s a noteworthy shift coming as computation capabilities are fast approaching that of the human brain.

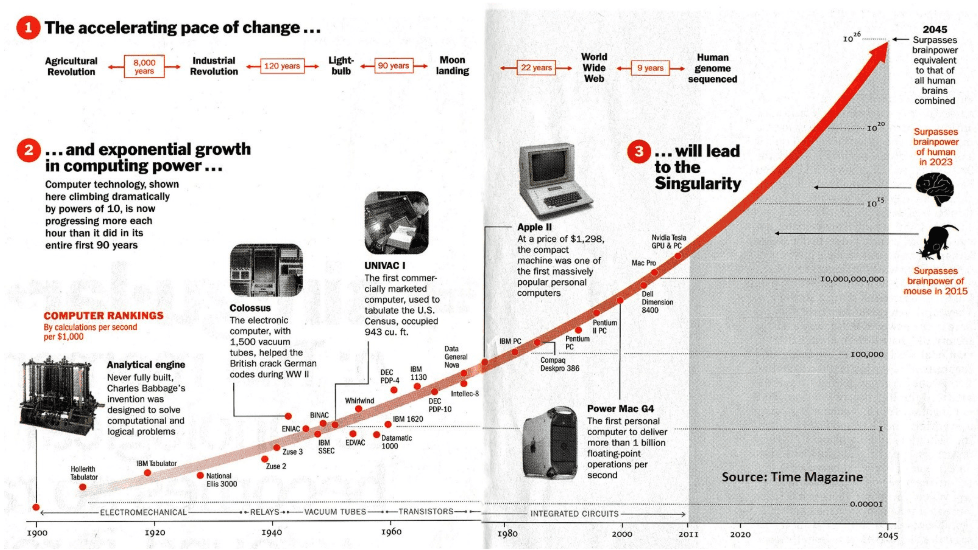

This step-change has long been predicted to occur about now—as shown in Ray Kurzweil’s 2011 forecasts below…

Improving computing capabilities are transforming information search, communication, and creative processes. Moreover, they are enabling increased productivity in most white-collar jobs through automation and AI-assisted tasks.

The rise of mobile computing has also changed information dissemination from a one-to-many model to a more interactive, mass-driven approach, reducing the need for various physical tools and thus saving energy.

As computation power continues to rise exponentially, more white-collar tasks will be automated, allowing for greater efficiency across most professions. It resembles the impact of energy-intensive machinery on agriculture and manufacturing.

This trend is here to stay and is likely to provide a powerful investment tailwind over the coming decade.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. The persistence of network effects

Ever wondered why some companies are able to develop seemingly insurmountable competitive advantages whilst others are susceptible to each and every new competitor who enters the market?

Enter the long term benefits of network effects. These are self-reinforcing advantages that help dominant players maintain their success until a major disruptor emerges.

A positive network effect arises whenever adding users to a system enhances the value of a system for all, drawing in even more users.

Examples include the telephone's early adoption, entrenched communication protocols, and social media platforms, where increased user numbers enhance the network’s value.

While network effects are powerful, they aren't invincible. Challengers generally need to build a substantial advantage, often referred to as a ‘10x advantage’, to disrupt the status quo.

So minor improvements, like a slightly better USB, won't suffice against existing market leaders who possess existing network effects. If you’re picturing Google right now, you’re understanding the immense power of network effects.

For a challenge to succeed, they must be significantly better than the existing leaders, and disruptive in nature.

This is why network effects tend to persist for so long to the benefit of investors. It generally takes many years for major disruptors to emerge and become much better than the market leaders.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

3. Nuclear energy to grow its share of global energy pie

We all know that energy is essential for most industrial processes including raw material extraction, manufacturing, transportation, agriculture, and water purification.

But it’s high-density energy sources that have enabled the survival of 8 billion people at increased overall comfort levels due to the consequential technological advancements.

For the same reason, dense energy solutions which are also low carbon, and thus aligned with the energy transition, are likely to gain greater traction over the coming decade.

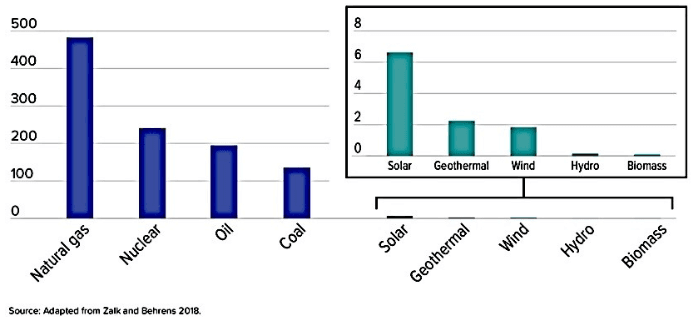

Wind and solar energy both offer potential. Reliance on renewable sources will depend on breakthroughs in energy density and efficiency in batteries which is slowly improving. However, heavy industries require high heat in production processes, which dense energy sources provide more efficiently compared to the electricity derived from renewables.

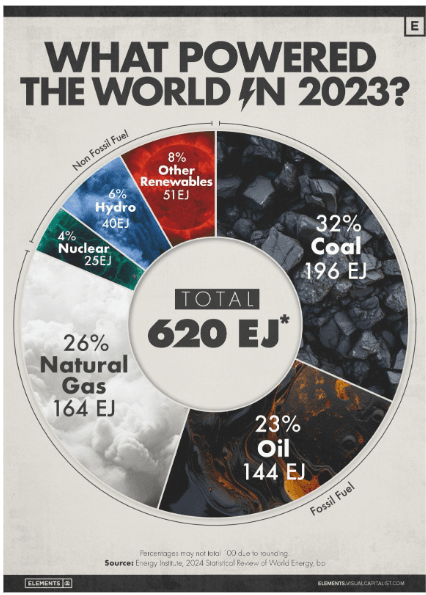

In contrast, nuclear energy ticks all the boxes. It’s a dense, low carbon energy source which is perfect for baseload power, and stands out as well-positioned to grow its share of the global energy pie from its current low base.

That’s likely to form a significant long-term tailwind for the nuclear industry which is emerging as critical for the world’s economic and industrial success during the energy transition.

Implications for investors

We see three main investment implications of the above three trends…

- - Ensure you have sufficient global tech exposure positioned to benefit from the inexorable rise in computing power.

- Ensure you have sufficient exposure to large cap leaders who are likely to keep winning thanks to their enduring network effects.

- Ensure you’re exposed to climate change winning energy investments which are also energy dense such as nuclear and its fuel uranium.

Long term trends tend to be investors’ friends

Investing is a lot easier when you have powerful tailwinds behind you that you can rely on longer term.

The inexorable rise of computing power, the compounding of network effects, and the rise of nuclear energy are shaping up as investment themes positioned to continue driving superior returns over the next decade and beyond.

Long-term investors should arguably position themselves accordingly.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.