Inflation - It could be worse than you think

If you’re reading this and you’ve already reached the age of 50, then you know a bit about inflation. You’ll remember the 1980s, when inflation peaked at 11.35 per cent, way ahead of wages growth. It took years to bring those spiralling price increases under control.

If you’ve already turned 70, then you lived and probably worked through the inflation crisis of the 1970s, when prices rose around 14 per cent each year. You’ll know that high inflation kills jobs, and wrecks standards of living.

But for relative youngsters (those under 50), inflation doesn’t seem like such a scary concept, because they haven’t experienced it first-hand. That’s right, somebody turning 50 today wasn’t even old enough to vote last time our inflation rate was above 5 per cent.

In fact, an entire generation of adults have experience prices falling, rather than rising. As manufacturing has shifted from developed countries to emerging nations, the cost of most consumer goods has fallen – in some cases hugely.

White goods, clothing, electronics, furniture – even cars – cost less than they did two decades before. Until the impact of Covid, at least.

In the year 2000, an entry-level Volkswagen Golf carried a sticker price of $29,990. By 2020, the Golf had become a far safer, more advanced vehicle. Yet the price had fallen to $25,490.

Today, just three years later, the price has jumped nearly 40 per cent. That’s right, to get behind the wheel of the cheapest VW Golf, you’ll need $35,190.

Okay, there are a range of factors contributing to that $10,000 price rise, including supply chain constraints, labour shortages and semiconductor shortages. But if you’re a buyer, it’s still $10,000 extra you need to find.

Not everybody buys new cars, but the price of cars is included in the Consumer Price Index (CPI). And it’s the CPI that gets quoted every time there’s a discussion about why we’re having to endure rising interest rates.

What is CPI anyway?

The CPI is the price of a hypothetical basket of goods and services that most people buy. It includes everything from petrol, fruit and vegetables, insurance, the cost of new housing, to school fees.

If you read a news article about rising interest rates, it’s almost a guarantee that you’ll find a reference to the CPI (which, incidentally, rose 6.8 per cent in the year to February).

Even the Reserve Bank references the CPI when explaining why it’s been raising rates.

Problem is, the CPI isn’t a perfect measure. For example, alcohol and tobacco make up 9 per cent of the index, but plenty of households neither drink nor smoke.

And households all have different spending patterns. A retiree couple on a modest fixed income won’t be buying the same items as a young family with a mortgage.

The Australian Bureau of Statistics (ABS) explains that the CPI isn’t a measure of ‘average’ household expenditure. Instead, it’s an index including items used by households in total. Which means the actual cost of living for a family may be rising more – or less – than the CPI number might suggest.

Living Cost Indexes (LCIs)

They may not be widely publicised, but the ABS produces another series of indices which break down how rising costs affect different family groups.

There are five LCI categories; pensioner & beneficiary, employee, Age pensioner, other government transfer recipient and self-funded retiree.

In 2022, each of the indices rose between 7.3 per cent and 9.3 per cent – the highest numbers on record.

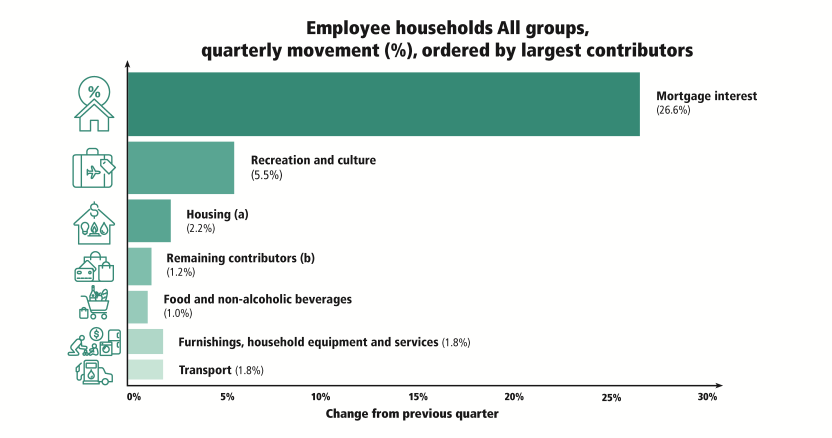

For wage-earning households, the results for the last quarter of 2022 were even more alarming; prices rose 3.2 per cent, well above the CPI rate of 1.9 per cent.1

The chart shows that as you’d expect, higher mortgage interest rates are having the biggest impact. But there’s no doubt that for the typical family, life is getting much more expensive across the board.

Retirees did somewhat better, with prices for Age Pensioners ‘only’ increasing by 1.7 per cent, below the rate of CPI.

But there’s anecdotal evidence that while the rate of inflation as measured by the CPI is slowing, pressure on wage-earning households may be accelerating.

We’ll find out when the next quarterly statistics are released on the 3rd of May.

Disclaimer: This article is prepared by Tom Ellison. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.