The thicker the carpet, the thinner the dividend

Jim Millner wasn’t your typical corporate executive.

Then again, Washington H. Soul Pattinson (WHSP), the family business he ran for nearly three decades is also far from typical.

Over the company’s 120-year history, just five people have held the top job. And the business has remained under the control of the same family since inception.

As the eldest grandchild of founder Lewy Pattinson, Jim Millner was always destined to become involved in the business, which had begun as a modest chain of pharmacies in Sydney.

But his pharmacy studies were interrupted when war broke out. Millner signed up for officer training in 1940 and was promoted to Captain at age 21.

After serving in Malaya, Millner was captured by the Japanese after the fall of Singapore, spending the remaining years of the conflict as a prisoner of war. It’s been argued by some that his legendary thrift was forged by his experiences in a prison camp.

After the war, Millner completed his studies, then as expected, joined the family business.

By 1959 he was general manager, was appointed as a director in 1967, and became Chairman in 1969, a position he held until his retirement in 1998.

Millner was a substantial philanthropic contributor to Australian society, but his approach to business expenditure was very different.

He was fond of saying “the thicker the carpet, the thinner the dividend,” and also said that if a company owned a boat, he would sell the shares.

Whether that frugality was responsible for his success in business is hard to establish. But successful he was.

When Millner took over WHSP, the operation was a chain of profitable pharmacies. Under his leadership, diversification into other industries laid the foundations for today’s $10 billion conglomerate.

Today, WHSP is a very different beast to the operation founded by Lew Pattinson. Investments in TPG Telecom, New Hope Corporation and Brickworks Limited account for nearly half the company’s value.

There’s a portfolio of blue-chip Australian shares worth more than $3 billion. A $650 million private equity portfolio gives exposure to agriculture and water investments. Another $600 million is held in emerging and high-growth companies.

More than $200 million is exposed to property, mainly in the Sydney region.

But the pharmacy operation is no longer part of the portfolio. The last remaining link to WHSP’s traditional business were severed last year, with the sale of Australian Pharmaceutical Industries, owner of the Soul Pattinson pharmacy chain.

Soul Pattinson Chemists, along with Priceline, is now owned by Wesfarmers, operator of Coles supermarkets.

Has the transformation from chemist to conglomerate been a success? If measured by growing returns to shareholders, the answer is yes.

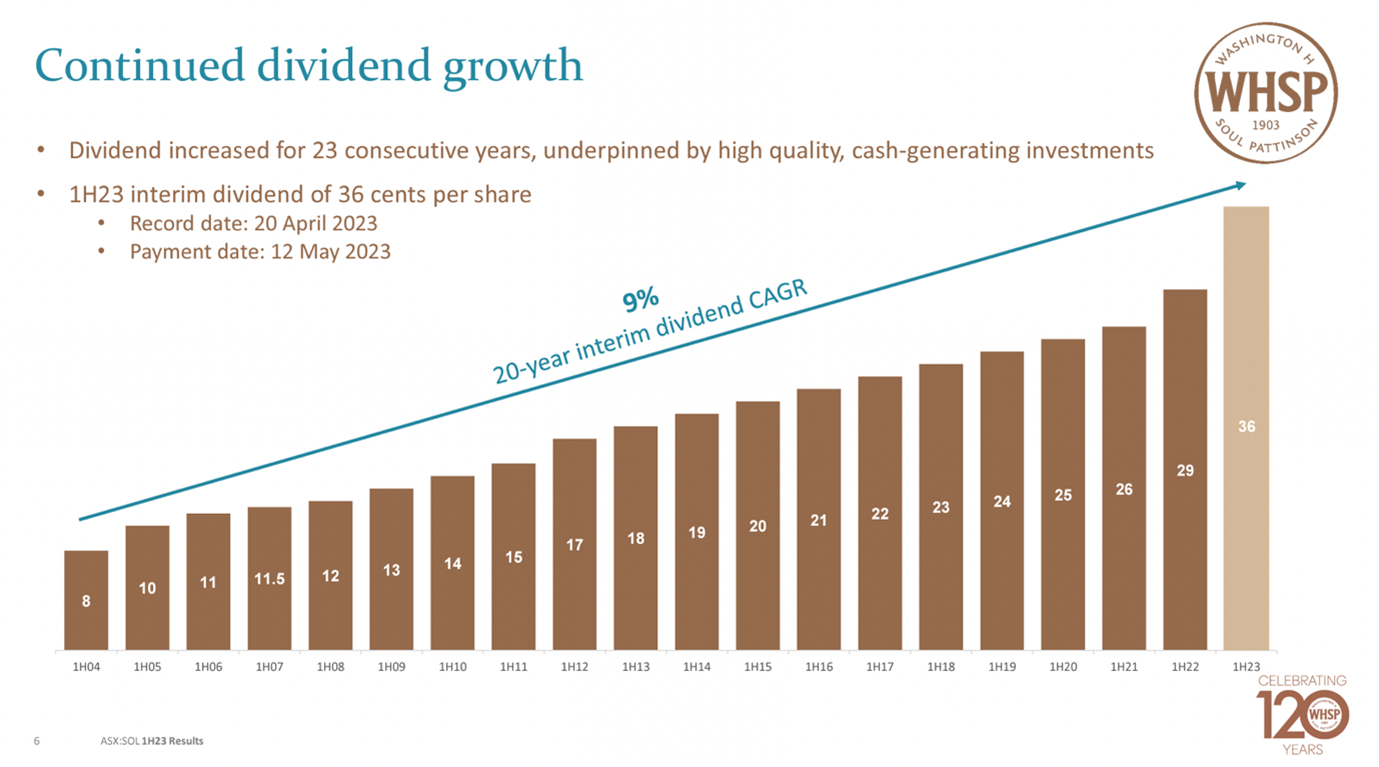

WHSP boasts an unrivalled record of increasing dividends, with payments to shareholders rising each year for 23 years.

Of course, one of the major beneficiaries of that growing dividend stream is the Millner family itself. Robert Millner (the current chair) and his son Thomas (a current director) each own around 22 million shares in WHSP. At the current share price, that combined holding is worth well over a billion dollars.

Robert Millner inherited the chair from his uncle, Jim Millner, in 1998 and he’s held it ever since.

That’s not all he inherited from his uncle Jim though. Since taking control, Robert has also continued the family tradition of frugality.

When Australian Pharmaceutical Industries was still under the WHSP umbrella, Robert Millner was known to have occasionally visited the executive car park. He was looking for expensive European vehicles – in his mind, a clear indication of extravagant spending.

This article contains factual information only and is not intended to be general or personal financial advice, and is for educational purposes only.