The Megatrends Here to Stay

Simon Turner

Wed 14 Jan 2026 8 minutesMost of the world’s great investors are masters at identifying structural investment trends they can rely to drive their portfolio performance for decades rather than weeks. Whilst predicting the long term future is anything but easy, successfully identifying megatrends is likely to make your life as an investor a lot easier.

The good news is that the most durable megatrends usually announce themselves in plain sight. They show up in public forums like energy grids, corporate capex, public budgets, demographic pyramids, and the maths of physics and biology.

For forward-thinking investors, the goal isn’t to bet on one particular future, but to build portfolios that are resilient to a range of futures, all of which will benefit from megatrends that are evident today.

Let’s delve into some of the most prominent megatrends in plain sight in 2026…

Electrification Continues to Gain Market Share

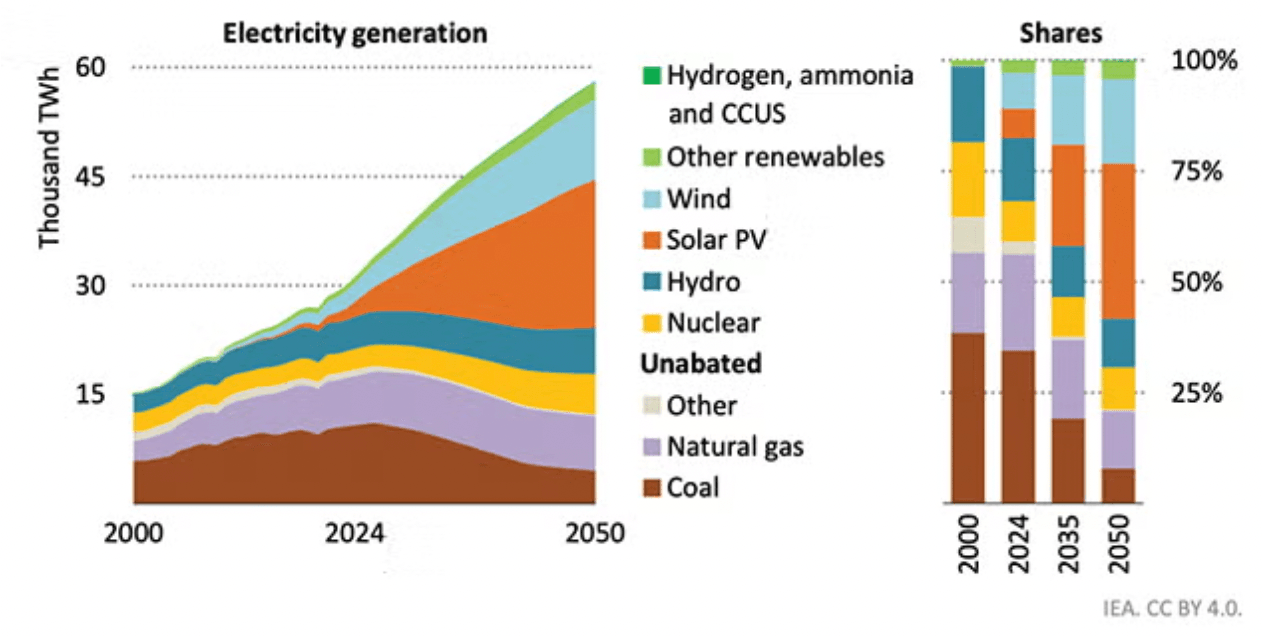

Electrification has evolved into the backbone of modern economic growth. The International Energy Agency expects global electricity demand to keep rising strongly in the coming years, reflecting the pull of electrification across industry, buildings, transport, and data infrastructure.

Solar and wind are expected to carry the lion’s share of the required electricity generation growth over the coming few decades.

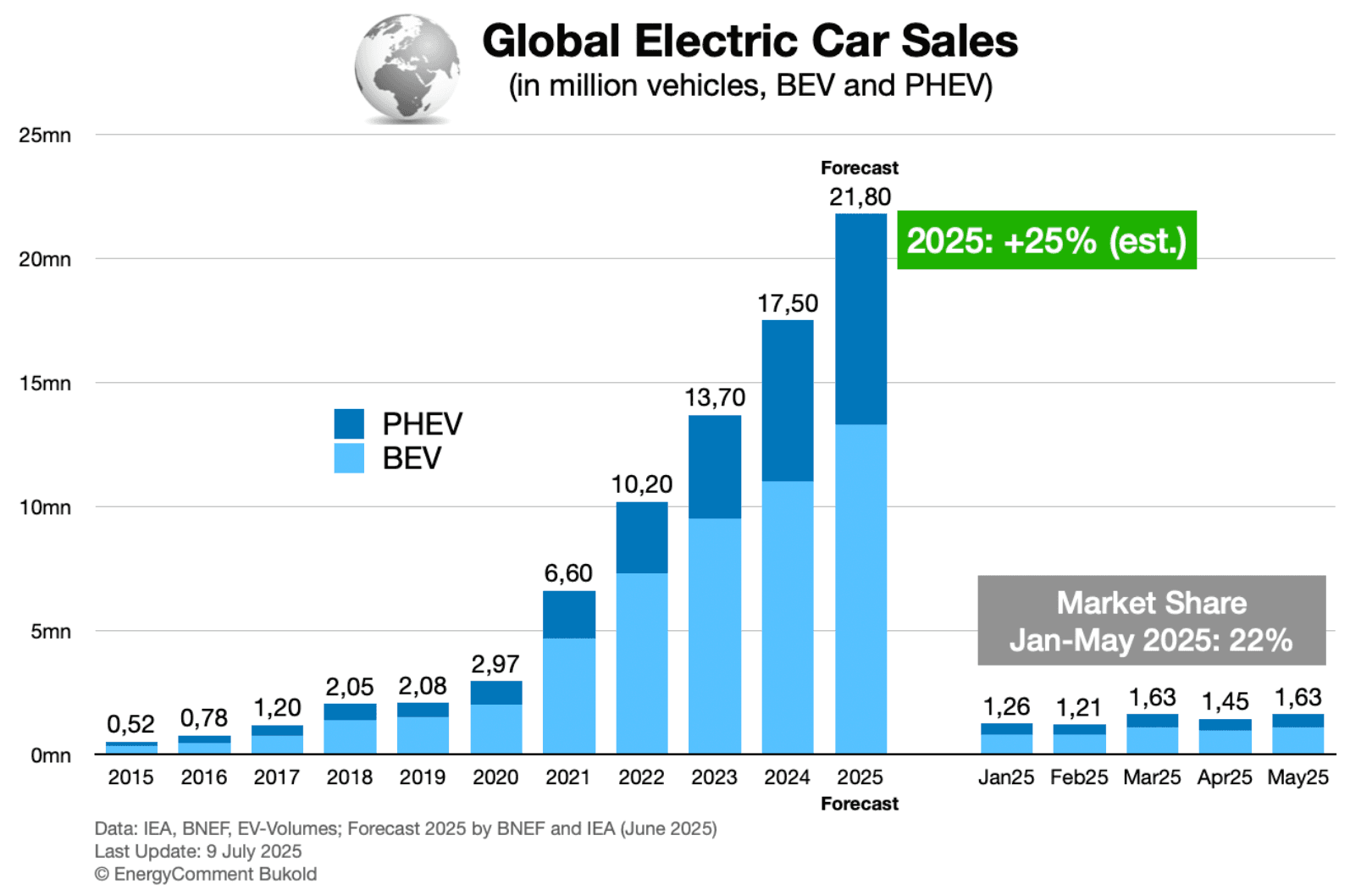

Electric vehicles (EVs) are clear proof of how structural the electricity demand growth outlook is. By the end of 2025, EVs represented around a quarter of global new light vehicle sales, up more than five-fold in five short years. And the future is just as bright as the energy transition gathers pace.

This isn’t just a green story. It’s an industrial retooling trend that’s reshaping demand for a vast array of commodities such as copper, nickel, lithium, grid equipment, batteries, and the software that orchestrates them.

For Australian investors, it also intersects with some the ASX’s biggest sector exposures. Resources, infrastructure, and banks that finance capex will all benefit from this megatrend, while the government’s energy transition policy will create both opportunity and regulatory risk.

Funds Offering Exposure to this Megatrend:

Global X Battery Tech & Lithium ETF (ASX: ACDC) targets companies benefiting from energy storage and EV supply chains.

iShares Core MSCI World Ex Australia ESG ETF (ASX: IWLD) and SPDR® S&P Emerging Mkts Carbon Aware ETF (ASX: WEMG) offer sustainable exposure that tilts toward companies aligned with the electrification that’s core to the energy transition.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

AI Rollout and the Required Data Centre & Semiconductor Growth

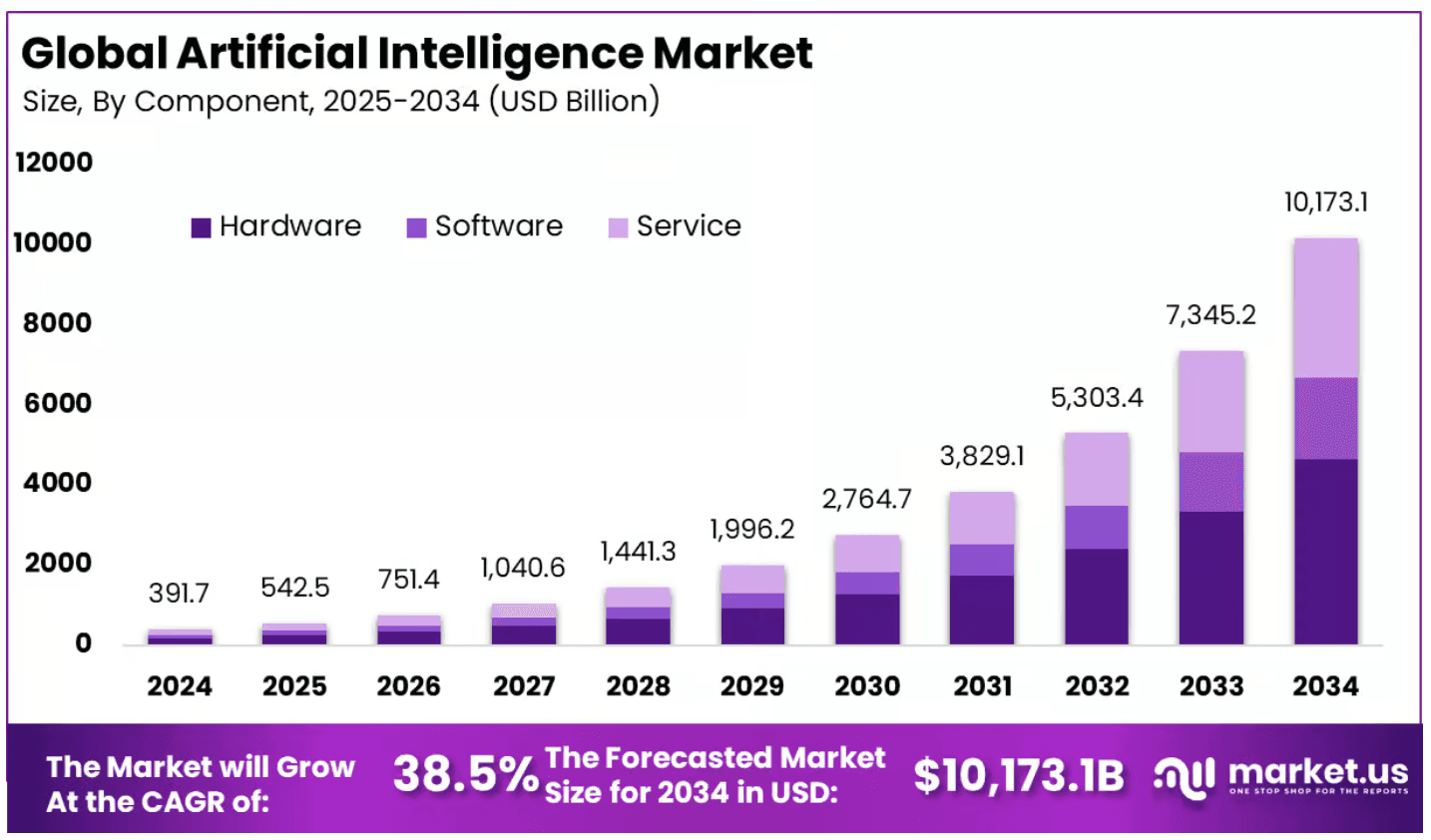

The global AI market offers one of the great growth opportunities in markets today.

As shown below, the AI market is expected to grow at 38.5% p.a. for the coming decade. That won’t surprise many investors. Many have exposure through the Mag 7, or the vast array of US or Asian-based emerging companies in this innovative space.

The associated, but less mainstream, megatrend is in data centres. The AI buildout is turning data centres into an asset class that matters for most investors.

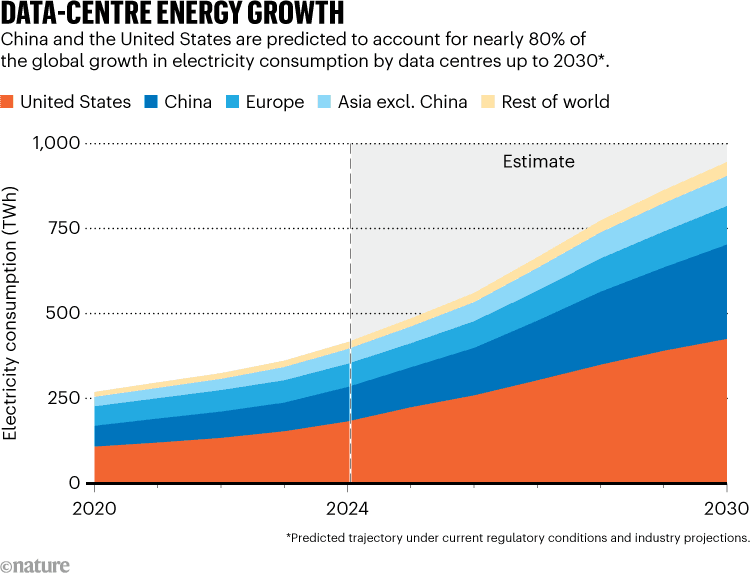

The tell is how fast electricity demand from data centres is rising. The IEA estimates data centres accounted for around 1.5% of global electricity consumption in 2024, about 415 TWh, and projects global data centre electricity use could roughly double to 945 TWh by 2030 in its base case scenario. That’s structural growth in all its glory.

This backdrop also implies persistent demand for power generation, grid upgrades, cooling, semiconductors, and network infrastructure.

Semiconductors, in particular, are increasingly the picks and shovels needed to for the AI rollout. The World Semiconductor Trade Statistics (WSTS) organization recently estimated the global semiconductor market grew 22% in 2025 to $US772 billion and confirmed strong continued momentum is expected through 2026 and beyond.

Whether AI valuations rise or fall in the short run, the physical investment cycle into computing, memory, and power is real.

Funds Offering Exposure to this Megatrend:

Betashares Global Robotics and Artificial Intelligence ETF (ASX: RBTZ) provides diversified exposure to companies leading in automation and AI-related innovation.

Betashares NASDAQ 100 ETF (ASX: NDQ) gives broad exposure to the tech heavyweights driving AI adoption globally.

For niche plays, there’s the Betashares Cloud Computing ETF (ASX: CLDD) and the Betashares Video Games and Esports ETF (ASX: GAME), which provides exposure to digital content and the required software ecosystems.

The Energy Transition is Gathering Pace

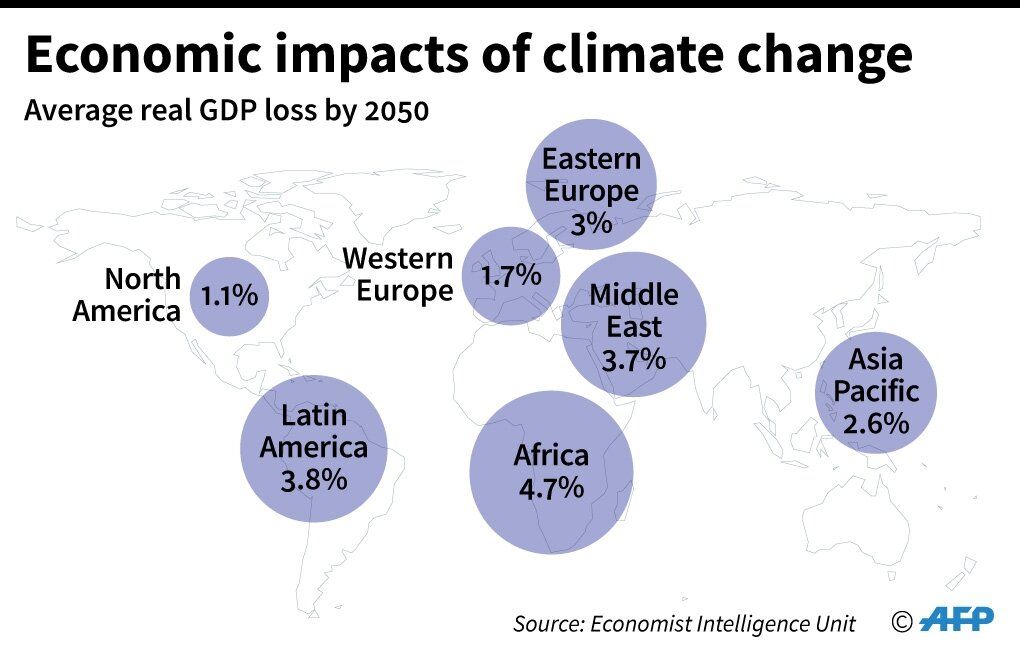

Climate risk is now a balance sheet issue, rather than a corporate values statement.

NASA confirmed 2024 was the warmest year on record and estimates the planet is about 1.5°C warmer than the 1850 to 1900 average.

For investors, this uncomfortable truth is showing up as higher insurance costs, tougher building standards, stranded assets, water constraints, and shifting agricultural productivity.

It’s also reinforcing why mitigation and adaptation strategies matter for governments and corporates alike.

The upshot is portfolios that rely on stable weather, stable insurance premiums, or static regulation are implicitly making a risky forecast.

The more robust approach is diversification across climate winners (efficiency, grid, resilient infrastructure) while avoiding climate losers (assets exposed to physical damage without pricing power).

Funds Offering Exposure to this Megatrend:

iShares Core MSCI Australia ESG ETF (ASX: IESG) and iShares High Growth ESG ETF (ASX: IGRO) screen on sustainability data across Australian and global equities.

Nanuk New World ETF (ASX: NNUK) and Janus Henderson Net Zero Transition Resources ETF (ASX: JZRO) invest in companies contributing to the energy transition and climate resilience.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

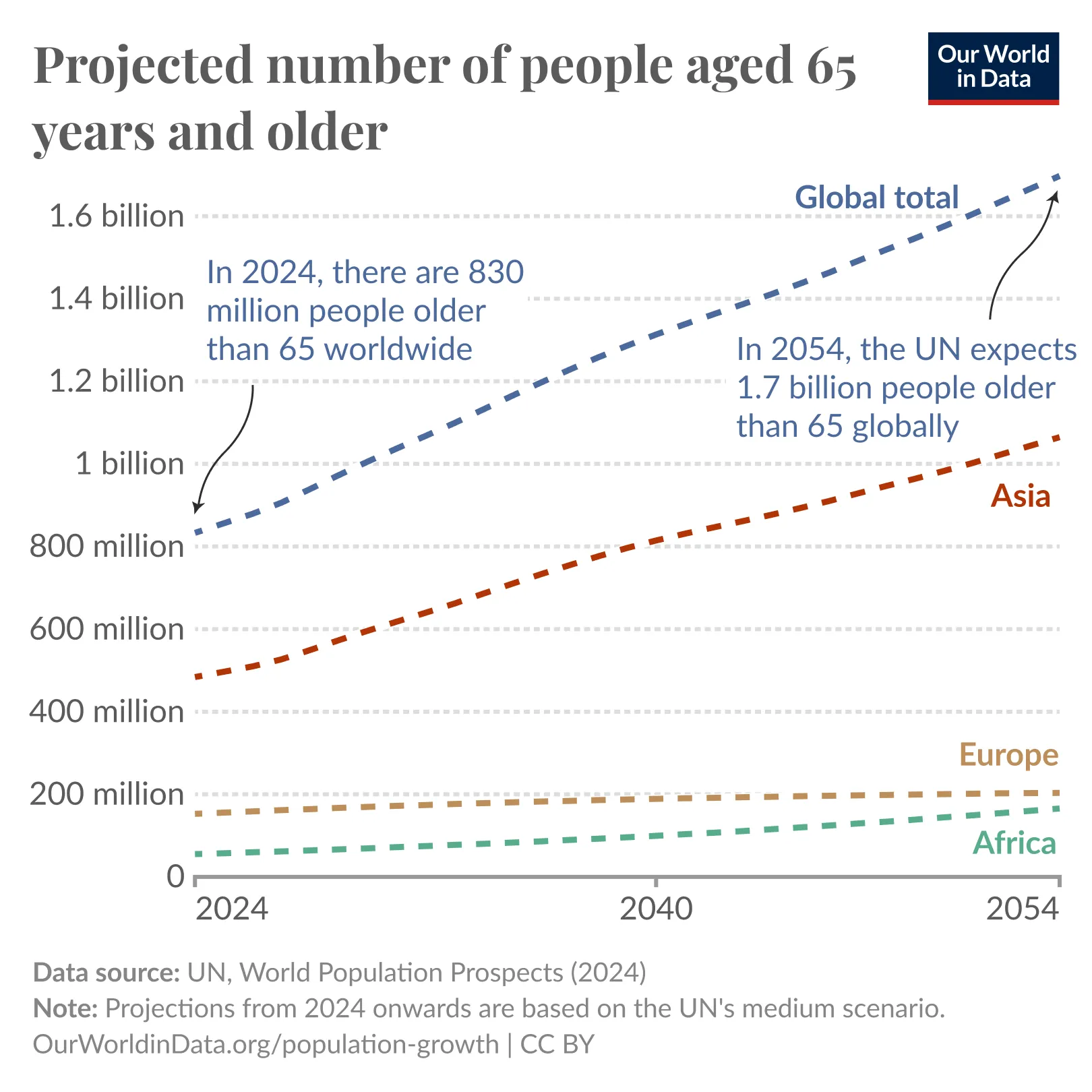

The Ageing Population is Both Predictable and Structural

Demographics remain one of the quietest yet most predictable global megatrends with the number of people aged 65 years and older set to double within the next thirty years

Ageing populations drive demand for healthcare services, diagnostics, pharmaceuticals and longevity technologies. These shifts unfold over decades and generate predictable growth in the healthcare, biotech, and aged care sectors, amongst others.

Case in point: the International Diabetes Federation says nearly one in nine adults worldwide are living with diabetes, about 589 million, with many undiagnosed.

Ageing also tends to intensify the political economy of redistribution and debt, which can influence inflation regimes and real asset performance.

A Fund Offering Exposure to this Megatrend:

- Global X S&P Biotech ETF (ASX: CURE) offers exposure to genomic science and healthcare innovation.

High and Rising Geopolitical Risk

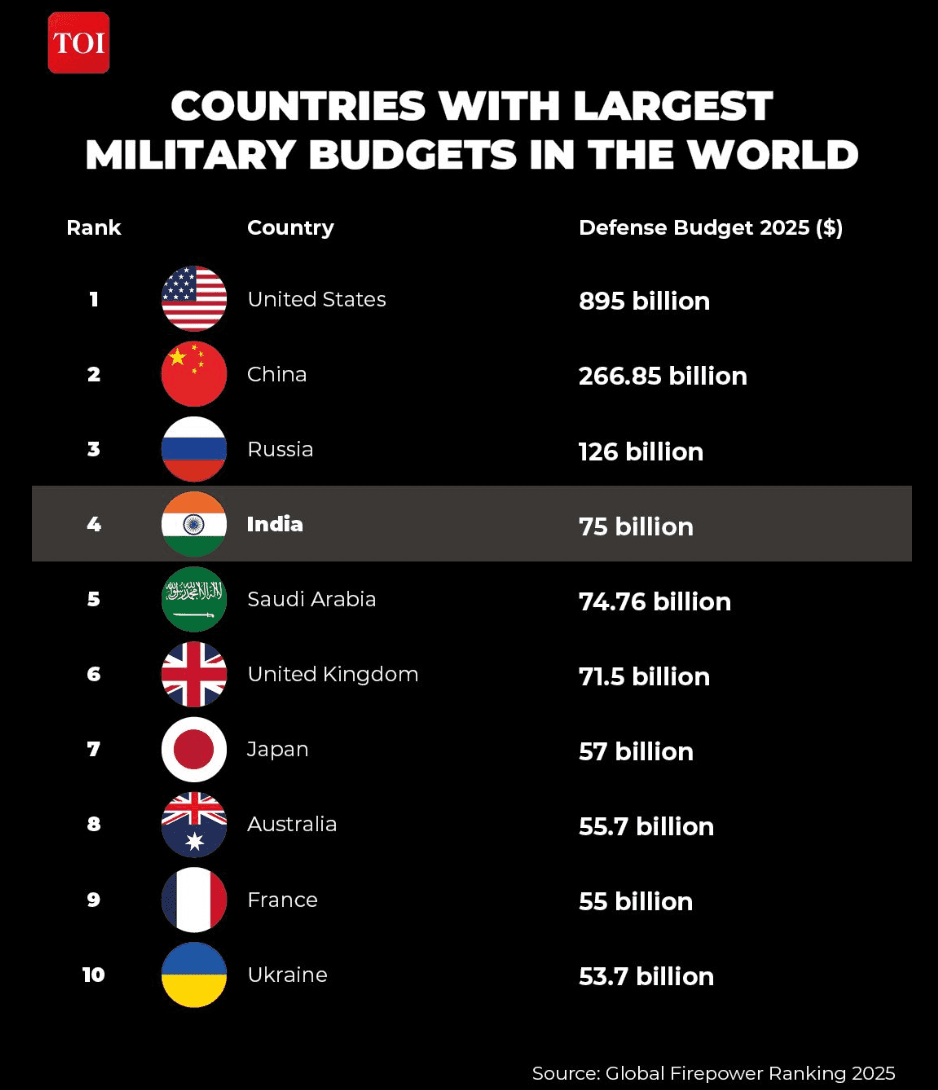

Geopolitical risk is increasingly driving capital allocation as it’s both high and rising.

Defence spending is a blunt but telling indicator. Trump’s talk of raising America’s defence expenditure to $US1.5 trillion defines a new world order in which security issues are a higher priority for the main players.

Alongside defence, economic security is reshaping supply chains, energy strategy, and technology controls. The OECD has highlighted vulnerabilities in international supply chains and the macro costs that can arise from trade and technology fragmentation.

For investors, this can mean more capex duplication, higher strategic inventories, and a premium on trusted supply, as well as periodic shocks when policy changes.

It also increases the value of understanding where portfolio companies sit in critical supply chains, including critical minerals, LNG, agriculture, and trusted services.

A Fund Offering Exposure to this Megatrend:

- Global X Defence Tech ETF (ASX: DTEC) provides investors with access to companies at the forefront of defence innovation.

Growing Demand for Infrastructure & Real Assets

The infrastructure gap remains enormous and investable. The World Bank highlighted the scale of unmet needs across electricity access, water, sanitation, roads, and digital connectivity, and estimates the financing gap in low and middle income countries at around $US1.5 trillion annually.

Add the energy transition, expected data centre growth, defence modernisation, and climate adaptation into the mix, and it’s hard to imagine a world in which long-duration real assets become less relevant.

The practical takeaway is not simply to buy infrastructure, but to be deliberate about inflation protection, regulatory frameworks, duration risk, and the quality of counterparties.

Funds Offering Exposure to this Megatrend:

Resolution Capital Global Listed Infrastructure ETF (ASX: RIIF) provides global infrastructure exposure.

ClearBridge Global Infrastructure ETF (ASX: CIVH) offer exposure to companies owning and operating essential infrastructure assets with inflation-linked cash flows.

Leveraging These Megatrends to Your Long Term Advantage

Megatrends are not fads. They’re slow-moving forces that reshape industries, public policy and consumer behaviour over decades. By linking these forces to your portfolio, you can invest in a way that reflects the world as it truly is, not the world the headlines pretend it to be.

Start by recognising your default exposures. The ASX is concentrated in banks, resources, and a handful of large industrials. A megatrend-aware portfolio doesn’t chase every theme. It emphasises broad diversification, then tilts toward the physical buildouts that are already funded in sectors such as electrification, grids, data centres, semiconductors, resilient infrastructure, and healthcare demand. It also treats geopolitics and climate as regime drivers that can change correlations, especially between equities, bonds, commodities, and currencies.

Most importantly, think about this as a process. Each year, ask yourself: is this trend structural, or cyclical? By spending less time second-guessing news headlines, you’ll have more time to compound your returns based on the world as it really is.

Funds Mentioned

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.