The Great Broadening Has Begun

Simon Turner

Thu 22 Jan 2026 6 minutesAre you tired of hearing about the Magnificent Seven being the only investment game in town? That would be understandable since it’s the narrative that’s dominated global equity markets for many years now. It’s been the same outside of the U.S., including here in Australia. The Magnificent Seven have been driving the global equity markets to new highs, and international participation has been rising accordingly.

But already in 2026, we are seeing a trend shift that has significant ramifications for global investors. It appears that The Great Broadening has begun…

A Major Shift is Afoot

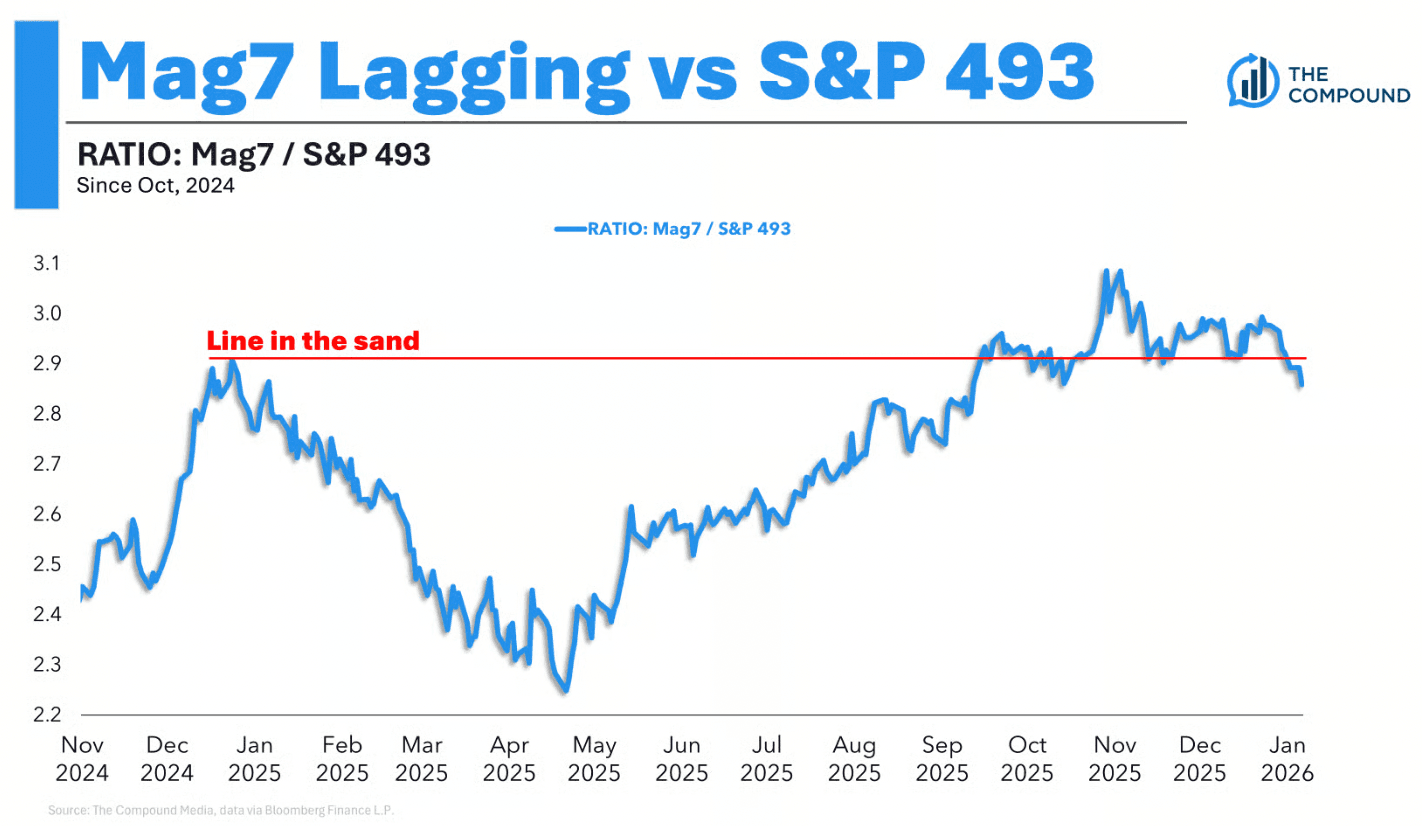

If you examine the ratio of the Magnificent Seven to the remaining 493 stocks in the S&P 500 you’ll notice something striking. That ratio has declined sharply in recent weeks, meaning big tech is no longer outperforming the rest of the market. Your eyesight isn’t letting you down, the Mag7 have indeed started 2026 as underperformers.

This looks like the beginning of The Great Broadening, a market dynamic whereby the sectors and stocks that previously lagged have begun outperforming.

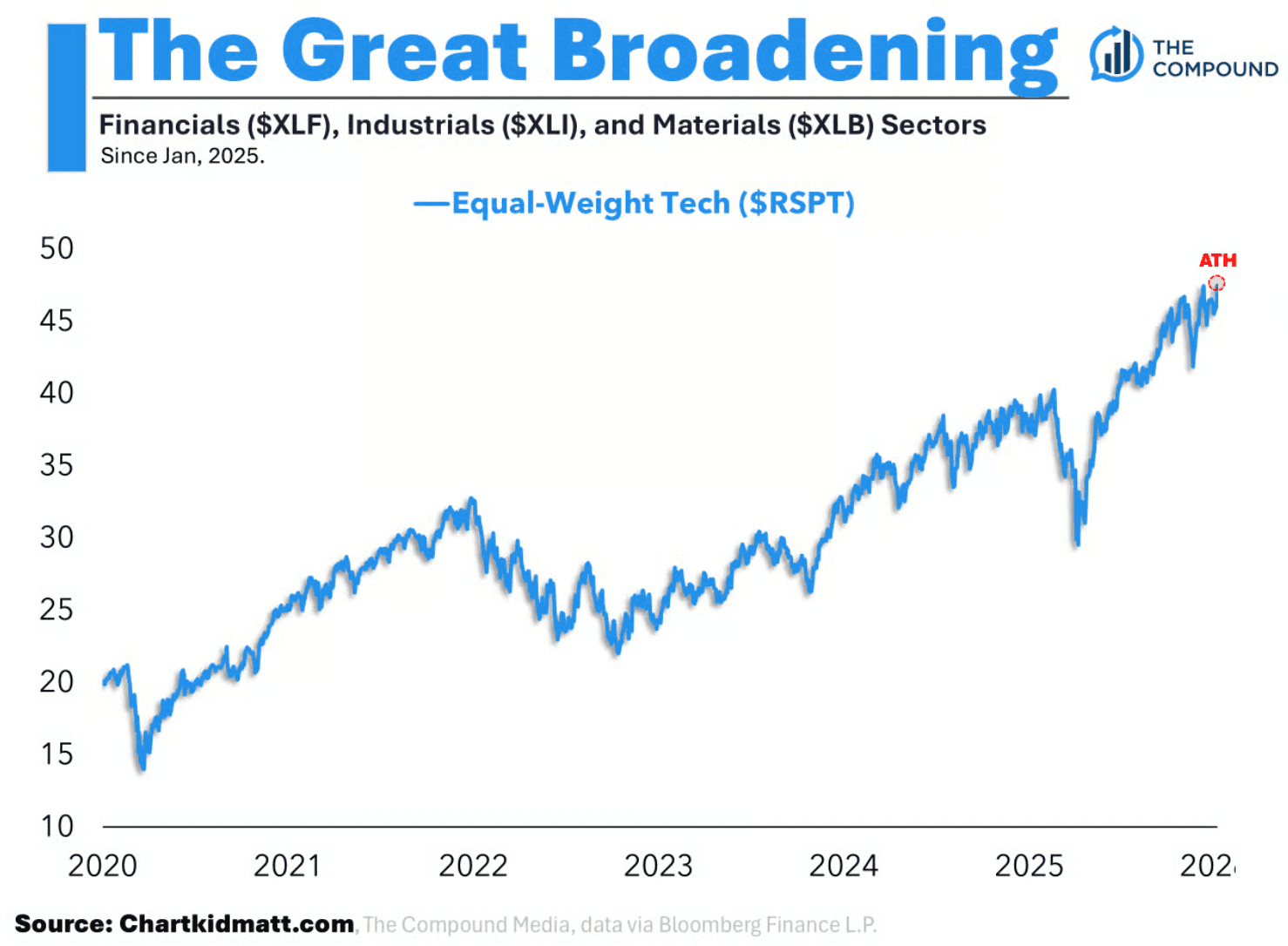

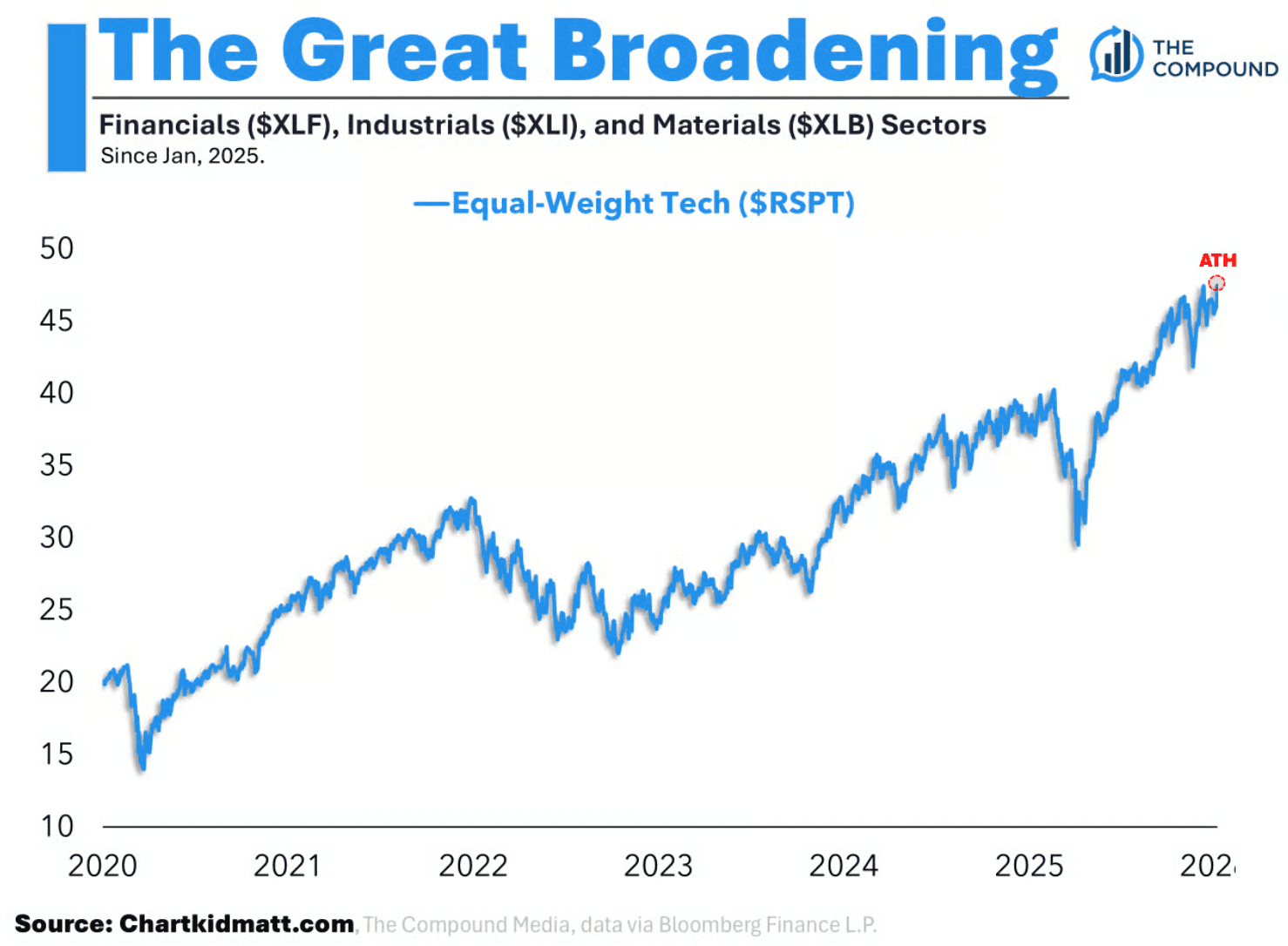

Sticking with the S&P 500 as the measure of this emerging global trend, multiple previously non-participating U.S. sectors have begun outperforming the broader market. For example, Financials, Industrials and Materials, long dormant relative to tech, are making all-time highs in both cap-weighted and equally-weighted terms.

Tech itself recently closed at new highs on an equal-weighted basis, underscoring that this is not one narrow theme carrying markets but a true broadening of participation.

Why it Matters

This trend shift is an important one for investors to be aware of since it implies the U.S. market is healthier than it was.

Technical analysts have long emphasised market breadth as a core measure of underlying strength. Breadth gauges how many stocks are advancing versus declining, how many are trading above key moving averages, and how many are setting new highs versus new lows. Strong breadth suggests broad confidence among investors, whereas narrow breadth is often a warning sign that a market advance is being carried by just a handful of names.

A rally in which only a few stocks participate is like a chorus with only a few voices. It’s fragile and unsustainable. When the chorus broadens to include many voices, the song comes alive for the audience. Market breadth works in much the same way. Increasing participation signals strength, whereas narrow participation warns of potential problems ahead.

Empirical research supports this conclusion. A 2020 study entitled Herding for profits: Market breadth and the cross-section of global equity returns that spanned 64 countries between 1973 and 2018 showed that portfolios with high market breadth significantly outperformed those with low breadth across different styles and conditions. This was true even after accounting for size and volatility.

The upshot is that the apparent arrival of The Great Broadening signals a healthier U.S. (and global) market which has graduated from riding on the coattails of a minor subset.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Implications for Investors

The Great Broadening opens up some noteworthy opportunities and risks for investors:

1. Reassess Concentration Risk.

In recent years most Australian investors have become heavily skewed toward U.S. mega-cap technology and growth names because they’ve dominated global returns for so long.

But as breadth has expanded, avoiding over-concentration to these stocks has evolved into a more prudent strategy.

Broadening participation suggests that exposure to a broader range of global markets and sectors, including cyclical sectors such as commodities and smaller companies, may contribute more meaningfully to returns than they have during much of the past decade.

2. Monitor Breadth Indicators.

It’s time to be aware that The Great Broadening is already a major 2026 investment theme.

That means it’s worthwhile to follow the relevant market data. For example, tracking advance-decline lines, the ratio of stocks above key moving averages, and new high/low differentials can offer early warning signs that The Great Broadening is pausing or reversing.

This data can also provide guidance as to when volatility may be about to return. For example, a classic divergence, whereby breadth weakens while the headline index remains elevated, has historically signalled the onset of heightened volatility.

While no indicator is perfect, breadth measures can enrich your decision-making toolkit beyond simple trend analysis.

3. Time to be Well Diversified by Sector & Geography.

If The Great Broadening reflects the beginning of a more significant rotation into traditionally cyclical areas such as Industrials and Materials, and ex-U.S. global markets, investors are likely to be well served by ensuring their portfolios are well diversified by sector and region.

The arguments in favour of true global diversification have rarely been more compelling. There are plenty of high-quality global funds and ETFs which can provide exposure to this opportunity.

4. Fed Policy is Likely to Support Furthering Broadening.

Trump’s next Fed chairman is more than likely to start their new job with an easing bias. Depending on how dramatic the next cutting cycles is, it’s likely to prove supportive of further market broadening.

The Great Broadening May Be Just Getting Started

The Great Broadening appears to have arrived. There’s already been a measurable shift in U.S. market participation that carries global implications for how we interpret risk, diversification and future return drivers.

In a world where information flows swiftly and markets love following trends, breadth serves as a vital compass. It reminds us that global markets are no longer simply an aggregate of a few U.S. tech stocks, but collective ecosystems of capital, sentiment and economic performance. That surely bullish longer term.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.