Why there’s buzz about the arrival of bitcoin ETFs

Ankita Rai

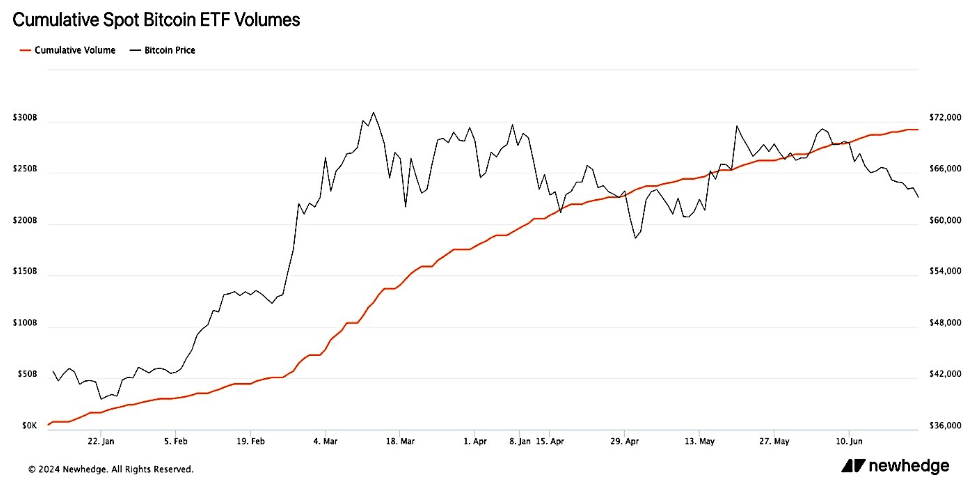

Wed 26 Jun 2024 6 minutesBitcoin is now much easier to own for Aussie investors thanks to the ASX listing of the first such ETF last week. The move follows the lead of the US market, which opened the door to bitcoin ETFs in January this year. Investors have since poured billions of dollars into cryptocurrency ETFs, with US bitcoin ETFs collectively amassing over $57 billion of inflows within three months of launch, including offerings from BlackRock, Fidelity Investments, and VanEck.

In Australia too, the ETF debut saw solid interest, with the ASX-listed VanEck Bitcoin ETF closing its first day of trading with $1.9 million in trading volume. This is the third such offering in the country following similar launches by Global X and Monochrome Asset Management, which both operate on rival exchange Cboe.

The buzz about spot bitcoin ETFs

Spot Bitcoin ETFs are gaining popularity because they address some of the of the inherent risks of digital currency ownership. For example, these ETFs can be purchased through existing brokerage accounts used for buying stocks, eliminating the reliance on crypto exchanges—many of which have poor cybersecurity records and a history of scandals like the collapse of FTX or the legal troubles of Binance.

Additionally, these ETF funds are generally cheaper as they often charge lower fees compared to existing crypto funds or buying Bitcoin directly through traditional crypto platforms. But, most importantly, they allow investors to gain exposure to the digital currency in a format that they understand.

Despite these benefits, investing in a Bitcoin ETF comes with significant risks, the biggest of which is price volatility. This is something an average ETF investor might not be used to.

Since the value of spot Bitcoin ETFs directly mirrors Bitcoin's market value, investors can be exposed to price swings, which can complicate executing trades at desired times and prices. For example, Bitcoin reached a record high of $US74,000 in March due to significant inflows into these ETFs. However, the price has since plummeted to $US61,600 due to uncertainty over monetary policy.

Declining bitcoin volatility: a good sign

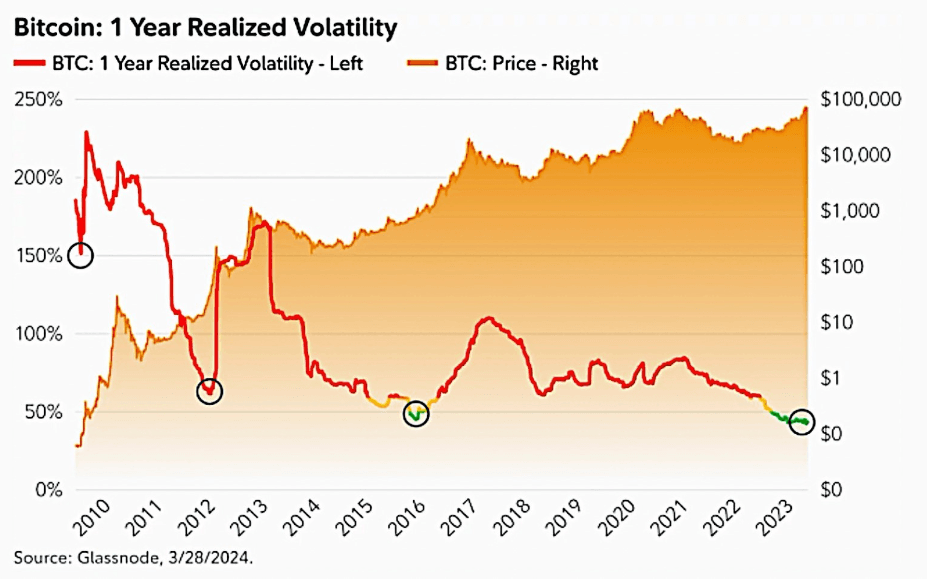

Bitcoin has historically exhibited high volatility, at times exceeding 200% in its early years. This is beginning to decline. In fact, bitcoin’s volatility fell throughout 2023 as its market cap rose, which points towards a growing acceptance of bitcoin as an asset class.

Bitcoin volatility may fall further as the asset class matures. The approval of spot bitcoin exchange-traded products globally further supports this trend.

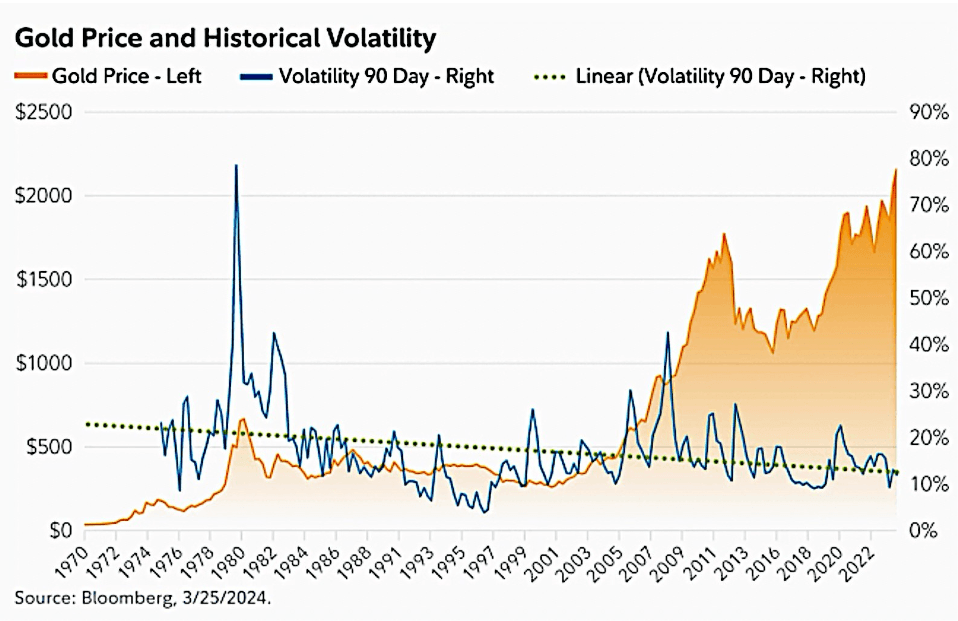

Bitcoin may also be following gold's journey. Gold experienced significant volatility when the US first abandoned the gold standard in the 1970s. Over time, as gold established itself as a mainstream global asset class, volatility gradually declined.

Like gold, as bitcoin settles into lower volatility over time, it is likely to further solidify its place in the global financial landscape.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Bitcoin ETFs in an investment portfolio

The launch of the spot bitcoin ETF has given this emerging asset class more credibility as it is now seen as a viable option for alternative investment strategies alongside equities and bonds.

Thanks to its fixed supply capped at 21 million coins and periodic halving events that reduce supply growth, bitcoin offers investors a store of value that preserves its purchasing power over time. In other words, bitcoin is positioned to be a hedge against inflation.

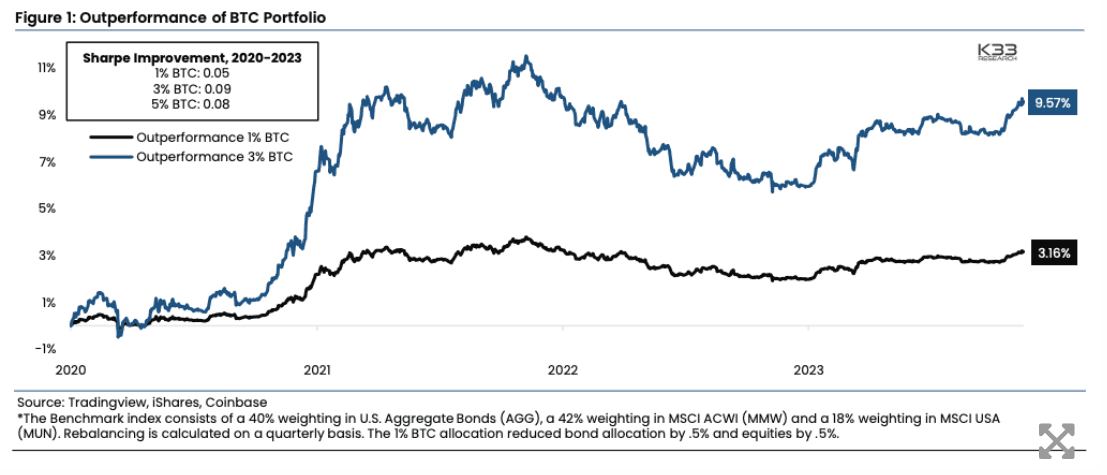

Since early 2020, bitcoin has quadrupled in value and shows low correlation with stocks, which can make it a potential booster for portfolio returns and diversification, with spot bitcoin ETFs making it easy to add to a 60/40 portfolio.

According to K33 Research, a 1% allocation to bitcoin in a 60/40 portfolio outperformed a portfolio without it by 3.2%.

Growing adoption numbers

Cryptocurrencies have surged dramatically over the past year, with bitcoin and ethereum both experiencing substantial price increases of 100% and 80% respectively. This surge indicates growing crypto adoption numbers across global markets.

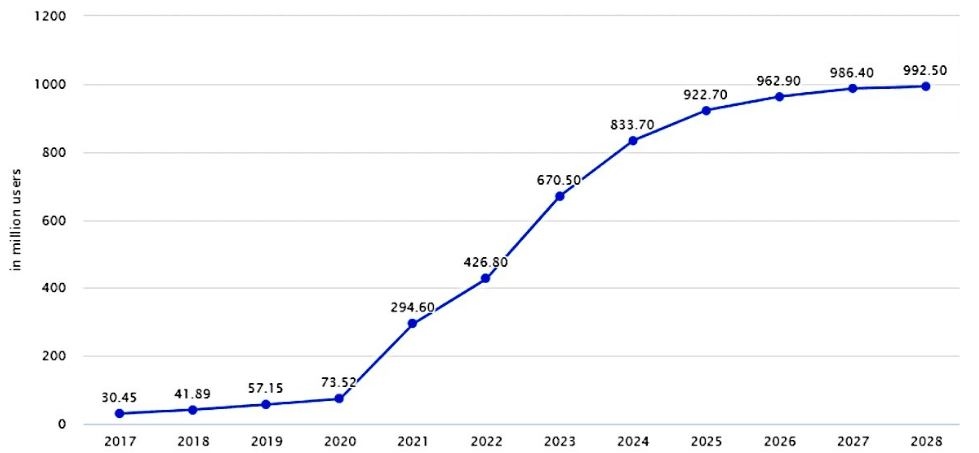

Looking ahead, Statista Market Insights forecasts that global cryptocurrency users could reach 992.5 million by 2028 driven by increasing institutional acceptance, particularly through the introduction of ETFs.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

But regulatory uncertainty remains

Despite the growing popularity of spot Bitcoin ETFs, investors should not lose sight of the fundamental reality that the overall regulatory framework for the crypto industry still remains underdeveloped. Although bitcoin is becoming mainstream, this shift has not been matched by regulatiory developments.

Cryptocurrency remains unregulated in Australia, and no specific legislation exists to protect investors.

The government hopes to address this by introducing legislation later this year that will require cryptocurrency exchanges get an Australian Financial Services License and follow strict financial rules. While these developments are promising, investors should be remain aware of the current regulatory gaps in the crypto industry.

Navigating risks and rewards

With bitcoin ETFs now available, more investors are considering them for potential portfolio diversification and returns. However, there's a crucial caveat: crypto investments are inherently risky and volatile, while the regulatory landscape is still shaky. Despite bitcoin's dominant position in the $1.5 trillion crypto market comprising over 20,000 cryptocurrencies, its supremacy doesn't guarantee price stability.

So, while bitcoin ETFs should be investors’ radars, caution and careful consideration are advisable before making significant investments.

What it means for investors

The approval of Bitcoin ETFs in the US and Australia marks a significant step in bitcoin's journey toward mainstream recognition as a legitimate asset class. These ETFs offer accessible and cost-effective investment options through existing brokerage accounts, reducing reliance on vulnerable crypto exchanges plagued by cybersecurity risks and scandals.

Bitcoin has historically exhibited high volatility but this is beginning to decline, and it could fall even more as the asset class matures. This suggests that bitcoin is stabilising as an investment choice, potentially enhancing portfolio diversification and returns.

Despite these advancements, investing in crypto remains risky due to regulatory uncertainties. While bitcoin shows promise as a store of value, investors should approach it with caution and understand the potential for significant losses in this evolving market landscape.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.